Figuring out the right Canadian tax bracket for your tax calculations can be tricky. Variable tax rates for different provinces only add to the complexity.

This makes it important to understand the federal and provincial tax brackets, so you can track your exact tax liability and ensure a smooth tax filing experience.

In this guide, we discuss all the Canadian tax brackets for your investments including stocks, crypto or any other property, for the tax years 2022 and 2023, helping you navigate the tax season with ease.

What Are Canadian Tax Brackets?

It is the “income range” that decides the tax rate on your taxable income. The federal government and each province or territory have their own tax brackets, which are applied to your taxable income.

Once you have figured out your taxable income (e.g. your income minus all deductions), calculate your federal income tax first and then your provincial tax. Now, add both of these taxes to find your total tax liability.

Types Of Canada Tax Rate 2023

To calculate the income tax, Canadian taxpayers need to know about two tax rates – the federal tax rate and the provincial tax rate. While the federal tax rate is a marginal tax rate constant for all Canadian taxpayers, your provincial tax rate depends on where you live.

Canada Income Tax Allowance

If you are employed and need to pay both federal and provincial tax, you can claim a deduction of up to $14398 of your taxable income, which will increase to $15000 from 2023. This is the allocated personal tax allowance by the CRA known as the basic personal amount (BPA).

When Do You Have To Pay Capital Gains Tax In Canada?

Any profits you make from disposing of your investments including stocks, crypto, or any other property are considered capital gains for individuals. The CRA explains that you do not have to pay taxes on 100% of your profits if you are an individual – you only pay tax on half of your net capital gains for a given tax year.

However, if the disposing of your investment is seen as part of a business by the CRA, the profits you make on the disposition or sale are considered business income and not capital gain.

In this case, you have to pay taxes on 100% of your profits. The business income tax rate remains the same as the federal tax rate and provincial tax rate.

How Does It Apply For Crypto?

You may be subject to crypto capital gains taxes in the following disposal cases:

- Selling your crypto for fiat

- Trading your crypto for another crypto

- Spending your crypto for purchasing goods or services

- Gifting your crypto

Some common taxable business income examples include:

- Mining crypto

- Staking crypto for rewards

- Trading your crypto

Also read: Canada Crypto Tax Guide 2025

The capital gains or business income tax rate is the same as the federal tax rate and provincial and territorial tax rates.

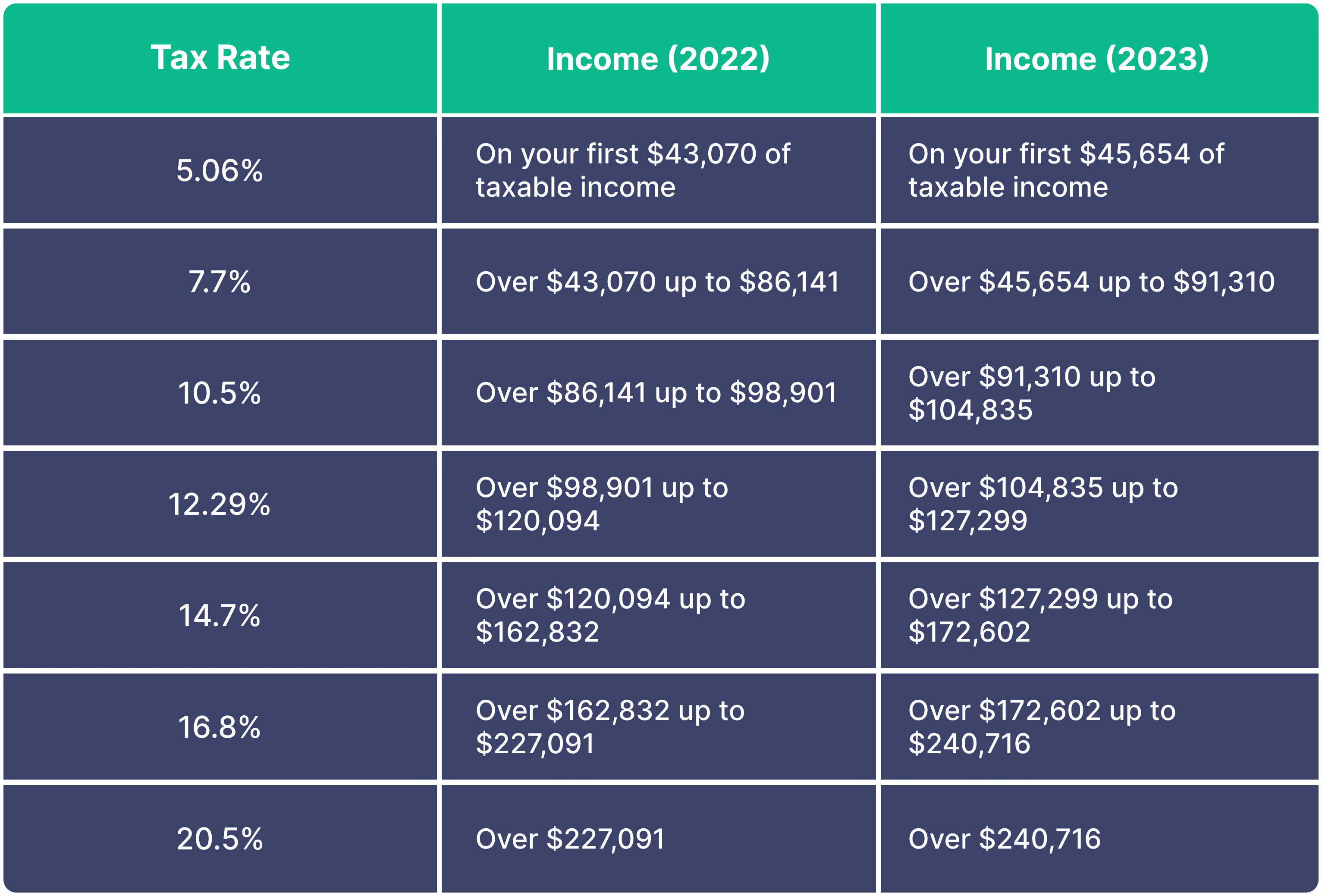

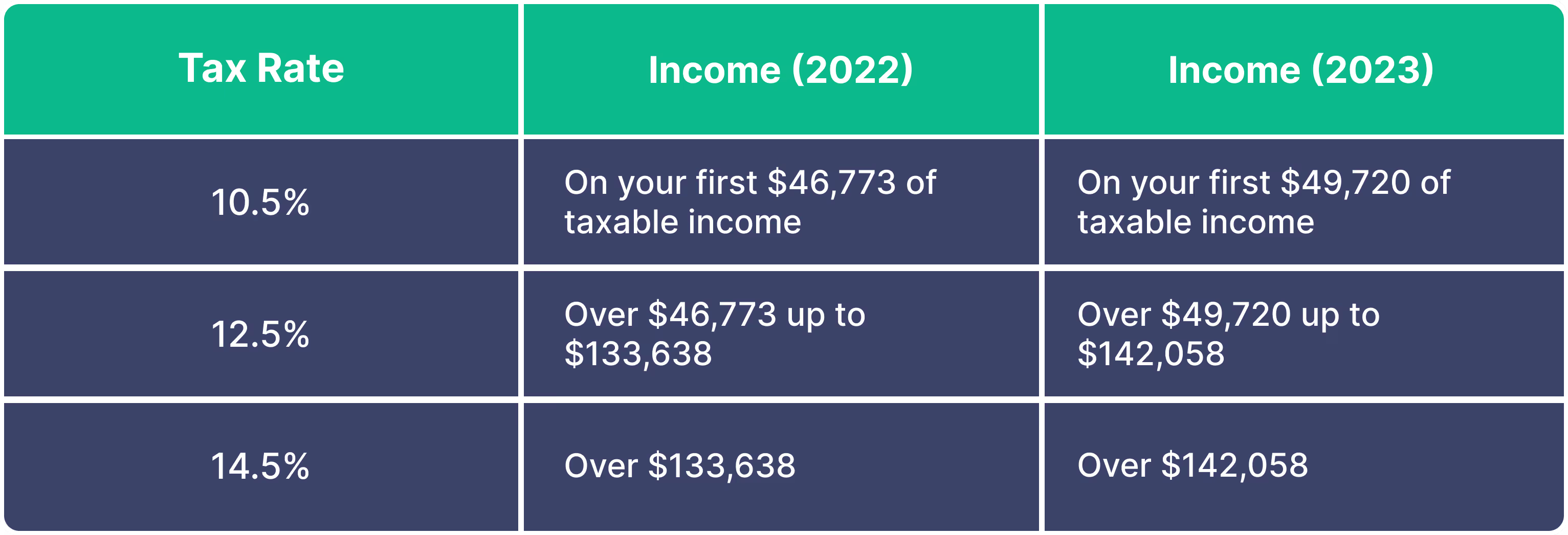

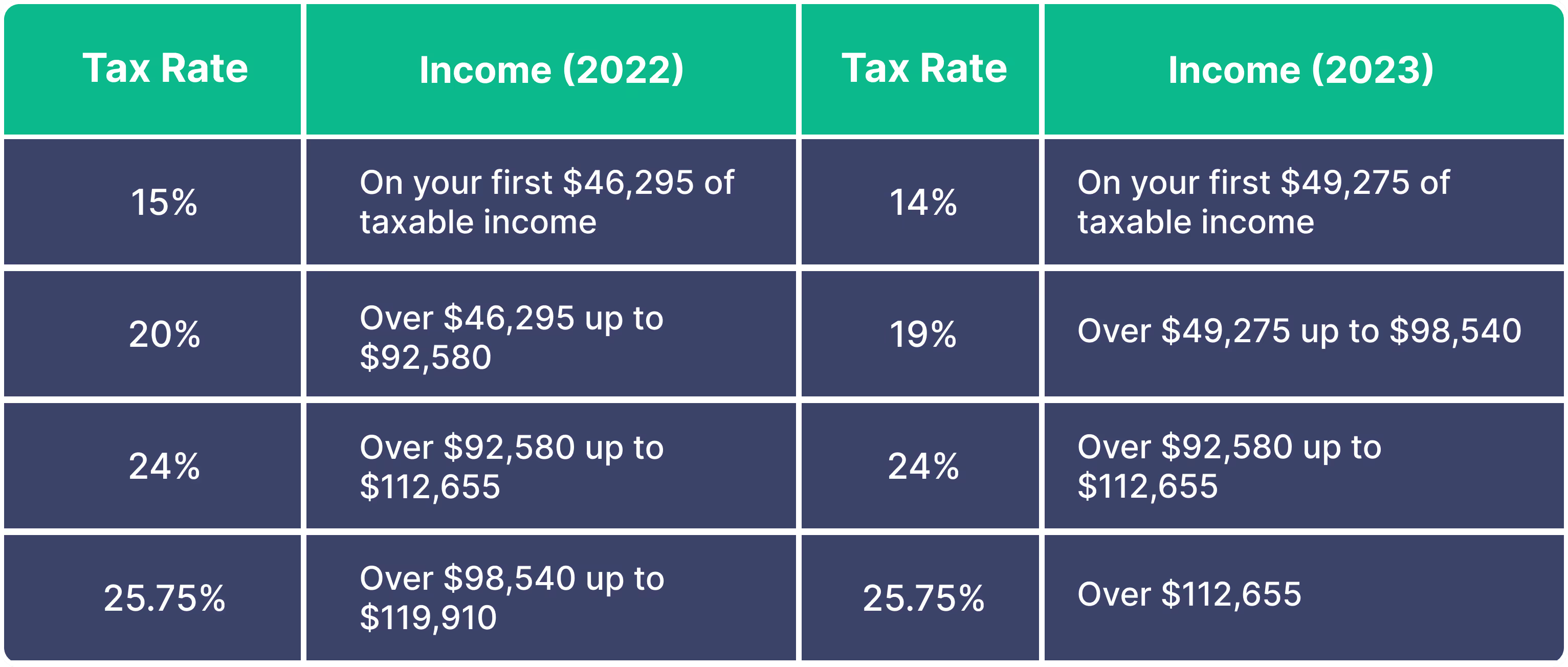

Canadian Federal Tax Brackets 2023

Here are the federal tax rates in Canada for the tax years 2022 and 2023.

.avif)

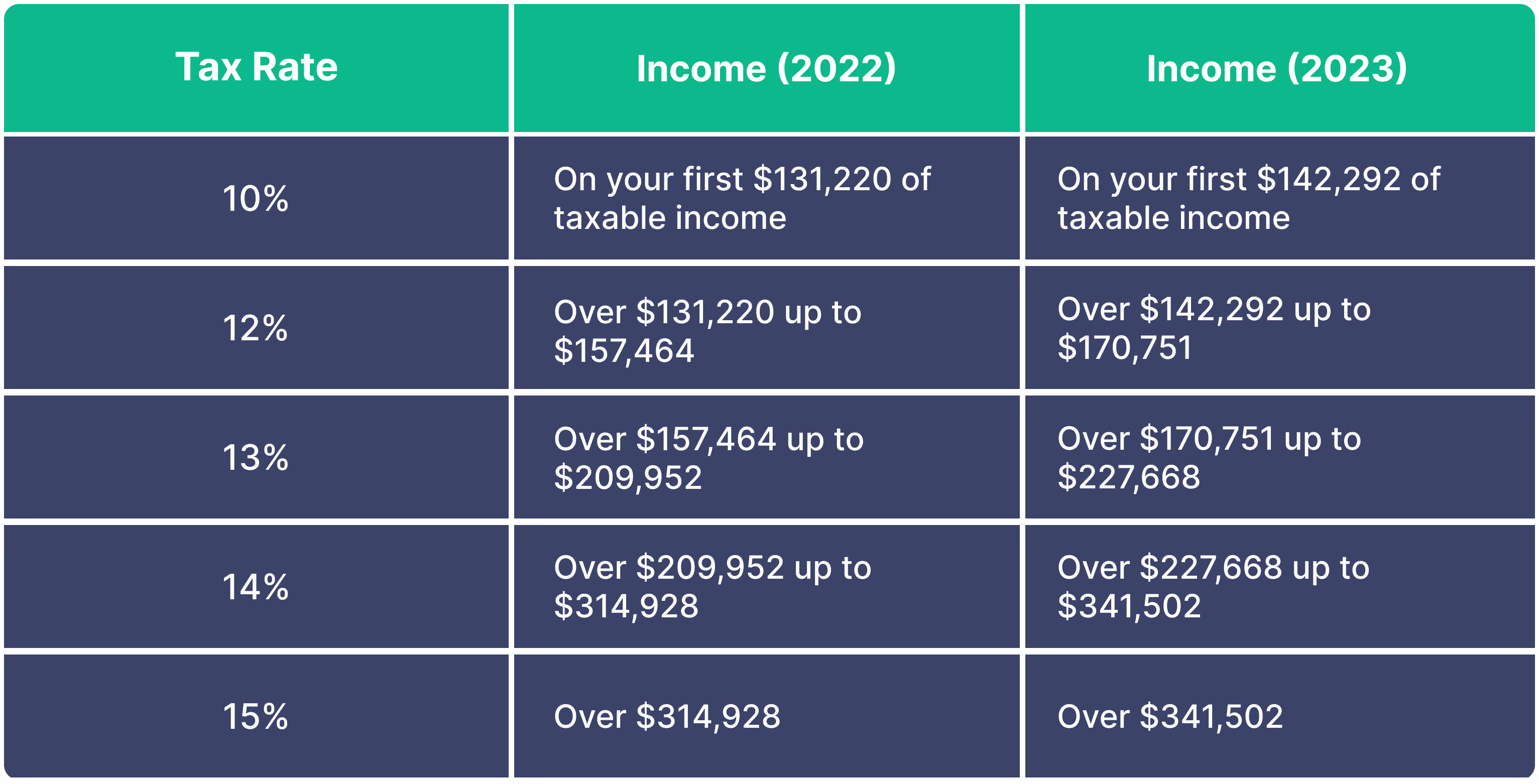

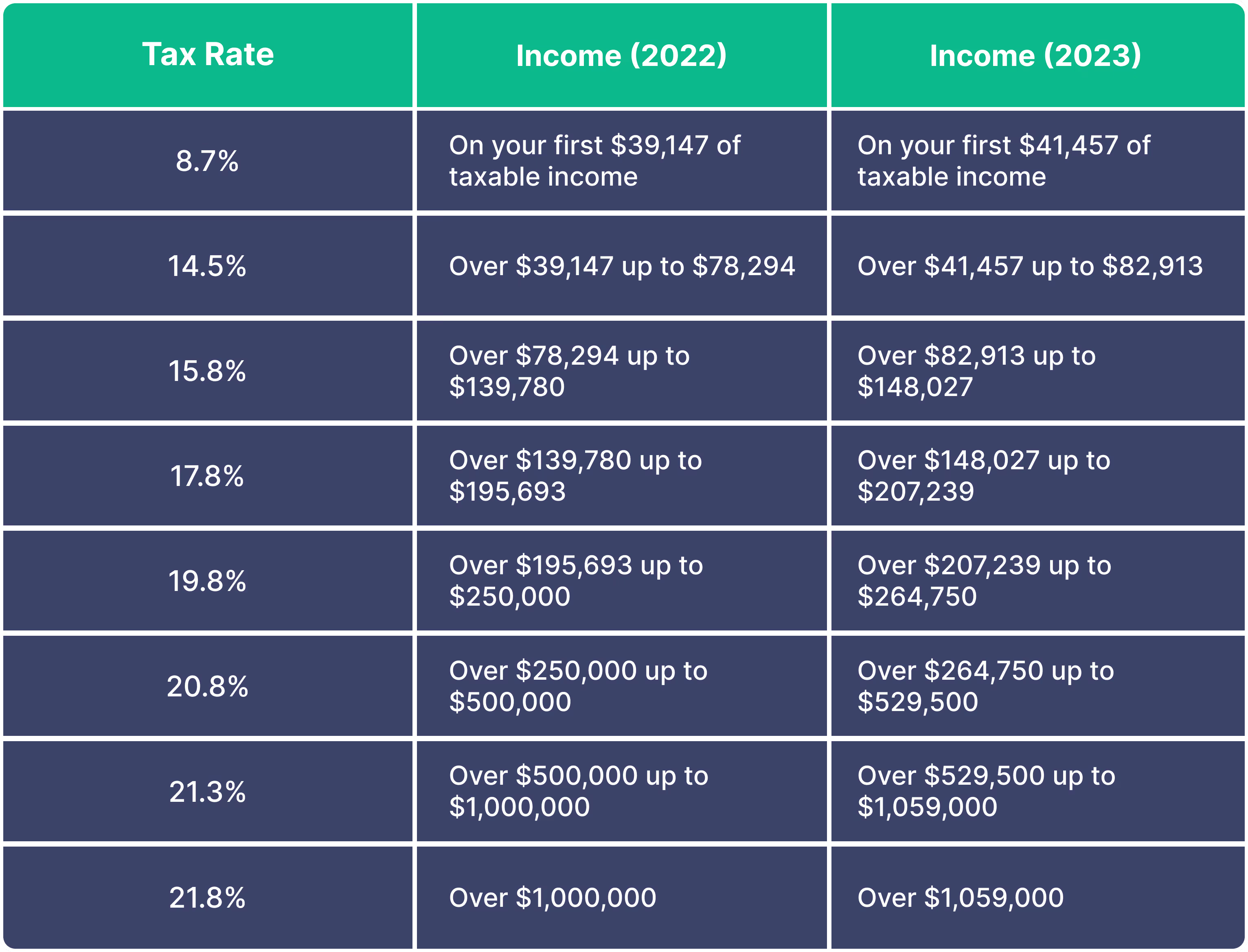

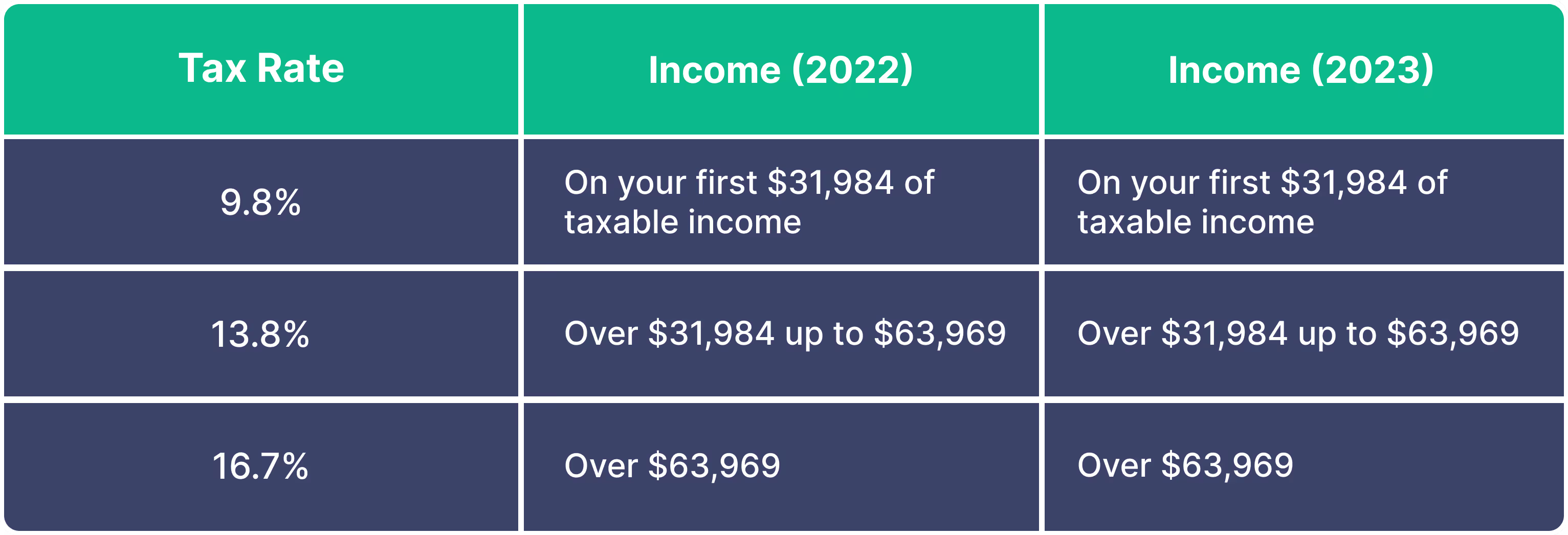

Canadian Provincial Tax Brackets 2023

Each province and territory in Canada has its own tax brackets, which are combined with the federal tax brackets to calculate your overall tax rate.

Let’s look at the tax brackets for each region in detail.

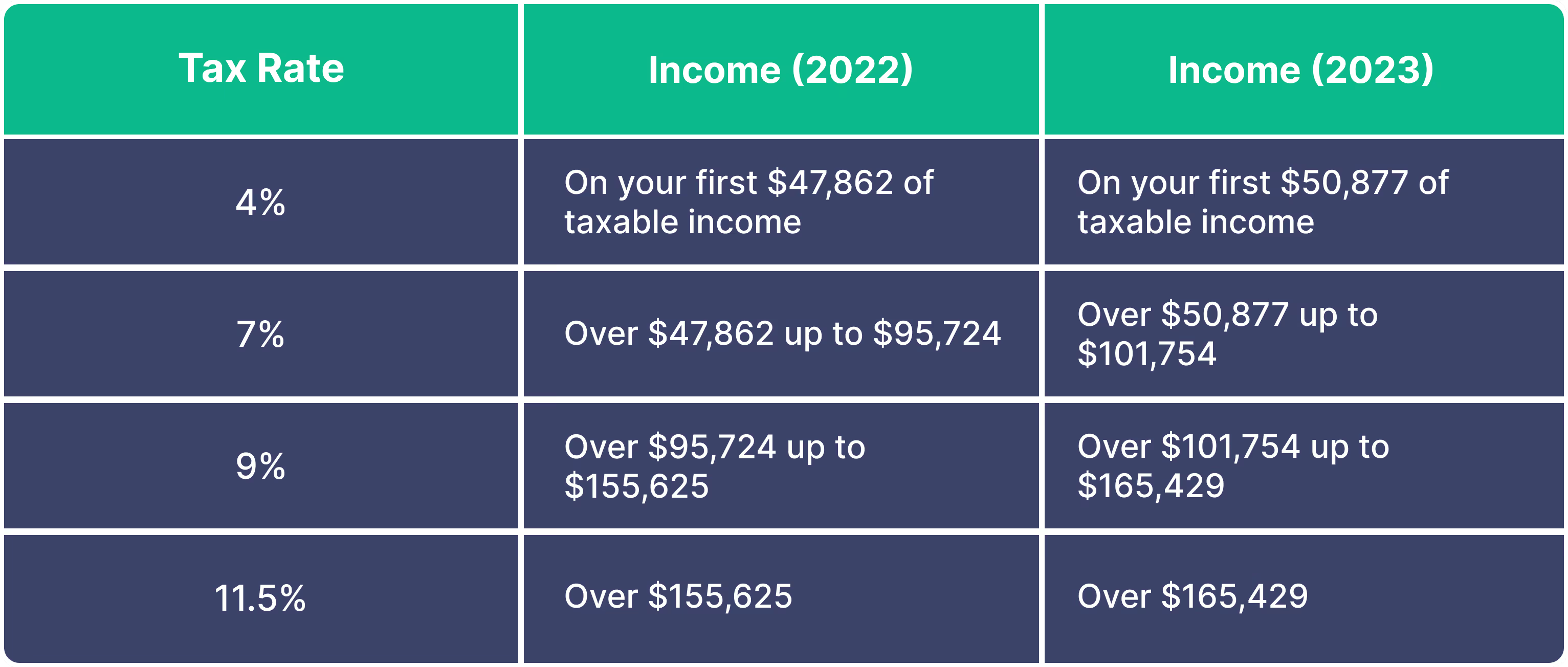

Nova Scotia Tax Brackets 2023

.avif)

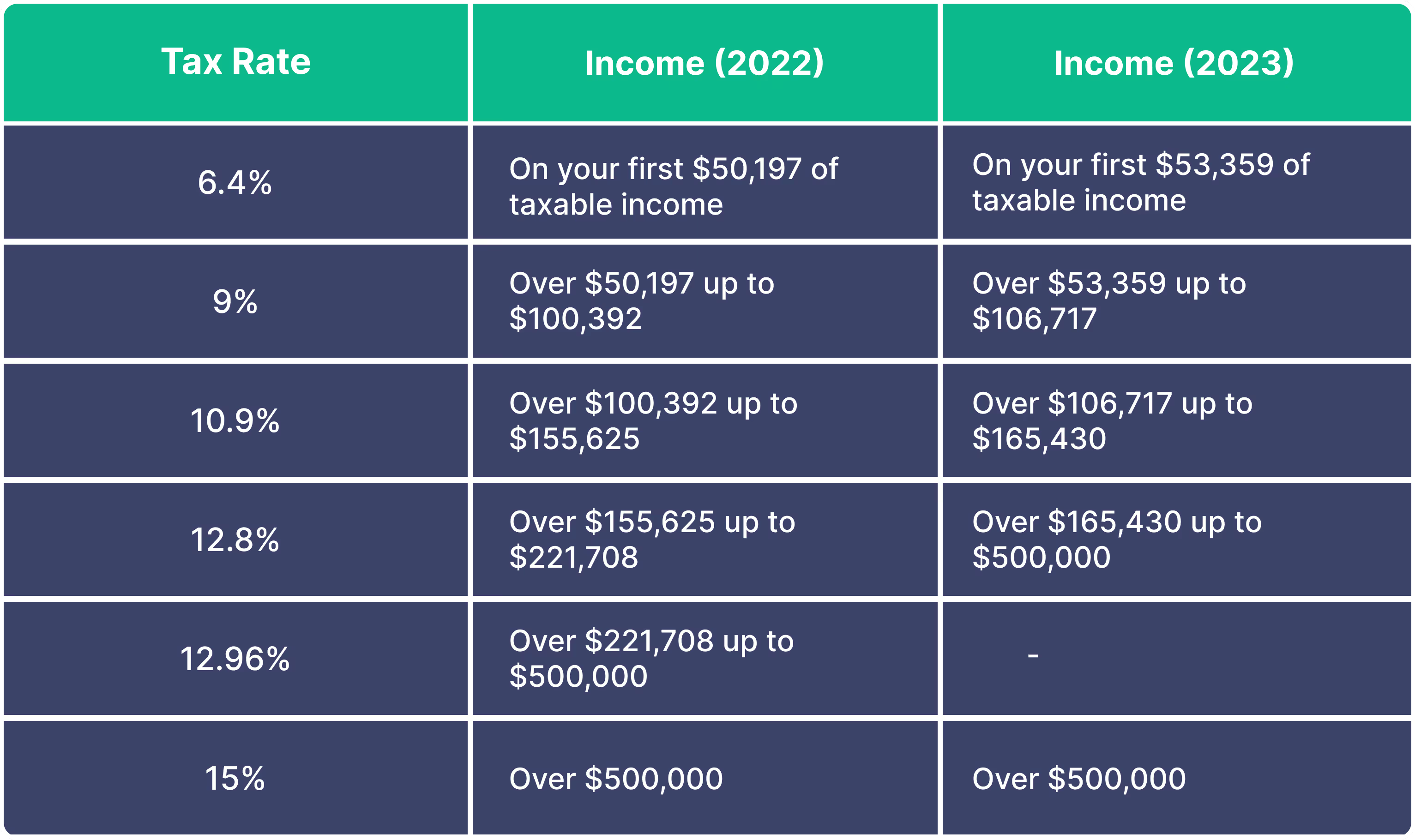

Manitoba Tax Brackets 2023

.avif)

British Columbia BC Tax Brackets 2023

Alberta Tax Brackets 2023

Newfoundland & Labrador Tax Brackets 2023

New Brunswick Tax Brackets 2023

Prince Edward Island Tax Brackets 2023

Saskatchewan Tax Brackets 2023

Nunavut Tax Brackets 2023

Yukon Tax Brackets 2023

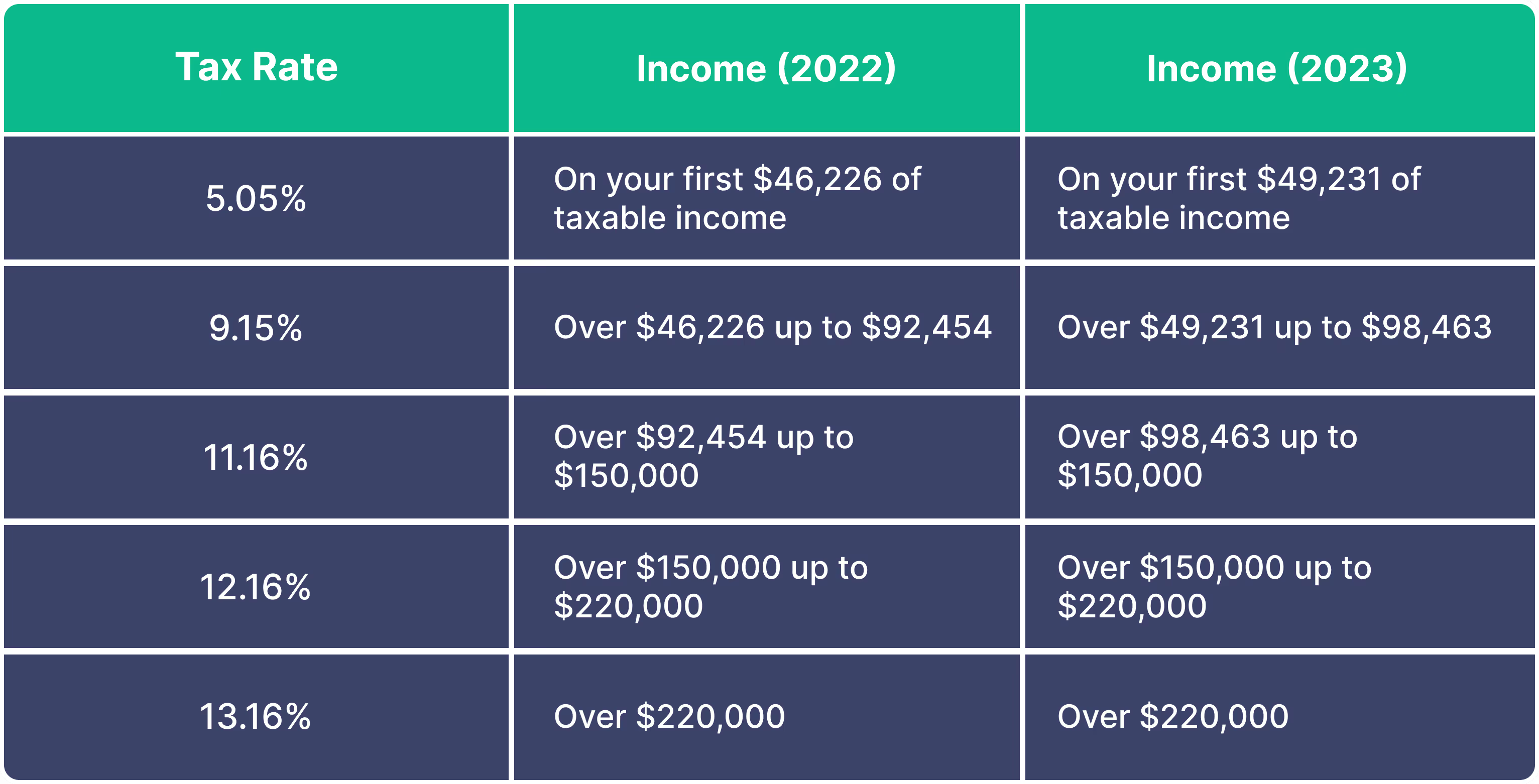

Ontario Tax Brackets 2023

Northwest Territories Tax Brackets 2023

Quebec Tax Brackets 2023

When to file taxes in Canada

In Canada, the tax year aligns with the calendar year, commencing on January 1st and concluding on December 31st. Canadian citizens should be aware that the reporting of cryptocurrency-related income, capital gains, and losses must be conveyed to the CRA by April 30th, 2023.

In the event that the deadline falls on a weekend, taxpayers are granted an extension until May 1st, 2023, to fulfil this obligation. It is highly recommended to avoid delaying this matter, as individuals have the freedom to commence the submission of their tax returns by the end of February.

Please note that your tax payment will be considered timely only if it is received or processed by the CRA on or before May 1st each year.

How to Calculate Crypto Tax in Canada?

Crypto tax for all provinces and territories in Canada (except Quebec) is calculated the same way as the federal tax.

Form 428 is used to calculate your provincial or territorial tax. Provincial or territorial non-refundable tax credits are also calculated on Form 428. You can also easily calculate your crypto taxes using Kryptos in just a few minutes.

All you need to do is connect your wallet to the platform – the app auto-syncs all your transaction history, auto-detecting the taxable events, the tax rates, and even any deductions that you can claim to save taxes. Once done, generate the tax report that you need to file your crypto tax in Canada as per the CRA.

FAQs

1. Do you get taxed on crypto in Canada?

Yes, in Canada, cryptocurrency transactions are subject to taxation. The Canada Revenue Agency (CRA) treats cryptocurrency as a commodity for income tax purposes.

2. How is crypto taxed in Canada?

Here's a brief overview of how cryptocurrency is taxed in Canada:

- Capital Gains: If you sell or "dispose" of cryptocurrency for more than you acquired it for, you may have a taxable capital gain.

- Income from Mining: If you mine cryptocurrency, the CRA may consider it a business activity or a hobby which must be included in your income for tax purposes.

- Income from Trading: If you trade cryptocurrencies frequently, the CRA might consider this activity as running a business, and any profits or losses from this trading would be considered as business income or loss.

- Using Cryptocurrency for Goods/Services: If you use cryptocurrency to purchase goods or services, the CRA considers this a barter transaction. The value of the goods or services obtained must be included in your income.

3. What is the Canada tax bracket?

Canadian tax bracket is the “income range” that decides the tax rate on your taxable income. The federal government and each province or territory have their own tax brackets, which are applied to your taxable income.

4. How do I determine which tax bracket I fall under as a Canadian investor?

To determine your Canadian tax bracket, calculate your total taxable income by adding all sources of income, including your capital gains, and claiming all the deductions. Then, refer to the federal and provincial tax brackets to identify where your taxable income falls within the given ranges.

5. Are there any tax breaks available in Canada?

If you are employed and need to pay both federal and provincial tax, you get a personal tax allowance of up to $14398 of your taxable income, which will increase to $15000 from 2023. You can also offset their capital gains with capital losses incurred during the tax year.

6. What are the different Canadian tax brackets?

The federal tax brackets range from 15% to 33%, and provincial tax brackets vary depending on the province or territory of the crypto trader. These brackets are applied to the capital gains or business income from cryptocurrency trading to calculate the taxes.

All content on Kryptos serves general informational purposes only. It's not intended to replace any professional advice from licensed accountants, attorneys, or certified financial and tax professionals. The information is completed to the best of our knowledge and we at Kryptos do not claim either correctness or accuracy of the same. Before taking any tax position / stance, you should always consider seeking independent legal, financial, taxation or other advice from the professionals. Kryptos is not liable for any loss caused from the use of, or by placing reliance on, the information on this website. Kryptos disclaims any responsibility for the accuracy or adequacy of any positions taken by you in your tax returns. Thank you for being part of our community, and we're excited to continue guiding you on your crypto journey!

| Step | Form | Purpose | Action |

|---|---|---|---|

| 1 | 1099-DA | Reports digital asset sales or exchanges | Use to fill out Form 8949. |

| 2 | Form 1099-MISC | Reports miscellaneous crypto income | Use to fill out Schedule 1 or C. |

| 3 | Form 8949 | Details individual transactions | List each transaction here. |

| 4 | Schedule D | Summarizes capital gains/losses | Transfer totals from Form 8949. |

| 5 | Schedule 1 | Reports miscellaneous income | Include miscellaneous income (if not self-employment). |

| 6 | Schedule C | Reports self-employment income | Include self-employment income and expenses. |

| 7 | Form W-2 | Reports wages (if paid in Bitcoin) | Include wages in total income. |

| 8 | Form 1040 | Primary tax return | Summarize all income, deductions, and tax owed. |

| Date | Event/Requirement |

|---|---|

| January 1, 2025 | Brokers begin tracking and reporting digital asset transactions. |

| February 2026 | Brokers issue Form 1099-DA for the 2025 tax year to taxpayers. |

| April 15, 2026 | Deadline for taxpayers to file their 2025 tax returns with IRS data. |

| Timeline Event | Description |

|---|---|

| Before January 1, 2025 | Taxpayers must identify wallets and accounts containing digital assets and document unused basis. |

| January 1, 2025 | Snapshot date for confirming remaining digital assets in wallets and accounts. |

| March 2025 | Brokers begin issuing Form 1099-DA, reflecting a wallet-specific basis. |

| Before Filing 2025 Tax Returns | Taxpayers must finalize their Safe Harbor Allocation to ensure compliance and avoid penalties. |

| Feature | Use Case Scenario | Technical Details |

|---|---|---|

| Automated Monitoring of Transactions | Alice uses staking on Ethereum 2.0 and yield farming on Uniswap. Kryptos automates tracking of her staking rewards and LP tokens across platforms. | Integrates with Ethereum and Uniswap APIs for real-time tracking and monitoring of transactions. |

| Comprehensive Data Collection | Bob switches between liquidity pools and staking protocols. Kryptos aggregates all transactions, including historical data. | Pulls and consolidates data from multiple sources and supports historical data imports. |

| Advanced Tax Categorization | Carol earns from staking Polkadot and yield farming on Aave. Kryptos categorizes her rewards as ordinary income and investment income. | Uses jurisdiction-specific rules to categorize rewards and guarantee compliance with local tax regulations. |

| Dynamic FMV Calculation | Dave redeems LP tokens for Ethereum and stablecoins. Kryptos calculates the fair market value (FMV) at redemption and during sales. | Updates FMV based on market data and accurately calculates capital gains for transactions. |

| Handling Complex DeFi Transactions | Eve engages in multi-step DeFi transactions. Kryptos tracks value changes and tax implications throughout these processes. | Manages multi-step transactions, including swaps and staking, for comprehensive tax reporting. |

| Real-Time Alerts and Updates | Frank receives alerts on contemporary tax regulations affecting DeFi. Kryptos keeps him updated on relevant changes in tax laws. | Observe regulatory updates and provide real-time alerts about changes in tax regulations. |

| Seamless Tax Reporting Integration | Grace files taxes using TurboTax. Kryptos integrates with TurboTax to import staking and yield farming data easily. | Direct integration with tax software like TurboTax for smooth data import and multi-jurisdictional reporting. |

| Investor Type | Impact of Crypto Tax Updates 2025 |

|---|---|

| Retail Investors | Standardized crypto reporting regulations make tax filing easier, but increased IRS visibility raises the risk of audits. |

| Traders & HFT Users | To ensure crypto tax compliance, the IRS is increasing its scrutiny and requiring precise cost-basis calculations across several exchanges. |

| Defi & Staking Participants | The regulations for reporting crypto transactions for staking rewards, lending, and governance tokens are unclear, and there is a lack of standardization for decentralized platforms. |

| NFT Creators & Buyers | Confusion over crypto capital gains tax in 2025, including the taxation of NFT flips, royalties, and transactions across several blockchains. |

| Crypto Payments & Businesses | Merchants who take Bitcoin, USDC, and other digital assets must track crypto capital gains for each transaction, which increases crypto tax compliance requirements. |

| Event | Consequences | Penalties |

|---|---|---|

| Reporting Failure | The tax authorities can mark uncontrolled revenues and further investigate. | Penalty fines, interest on unpaid taxes and potential fraud fees if they are deliberately occurring. |

| Misreporting CGT | Misreporting CGT Error reporting profits or losses can trigger the IRS audit. | 20% fine on under -ported zodiac signs, as well as tax and interest. |

| Using decentralized exchanges (DEXs) or mixers without records | The IRS can track anonymous transactions and demand documentation. | Possible tax evasion fee and significant fine. |

| Disregarding Bitcoin mining tax liabilities | Mining reward is considered taxable income, and failure of the report can be regarded as tax fraud. | Further tax obligations, punishment and potential legal steps. |

| Foreign crypto holdings: Non-disclosure | Foreign-accepted crypto FATCA may be subject to reporting rules. | Heavy fines (up to $ 10,000 per fracture) or prosecution for intentional non-transport. |