.avif)

Calculate Your Crypto

Taxes in Minutes

Recently, the European Parliament made a significant move by overwhelmingly approving the DAC8, a legislative measure introducing comprehensive tax reporting requirements for cryptocurrency transactions across the EU.

With a staggering 535 votes in favour, 57 against, and 60 abstentions, the proposed rule is now on its way to becoming law. This overwhelming support indicates the EU's dedication to ensuring the crypto sector operates within a regulated framework.

Understanding the DAC8 Rule

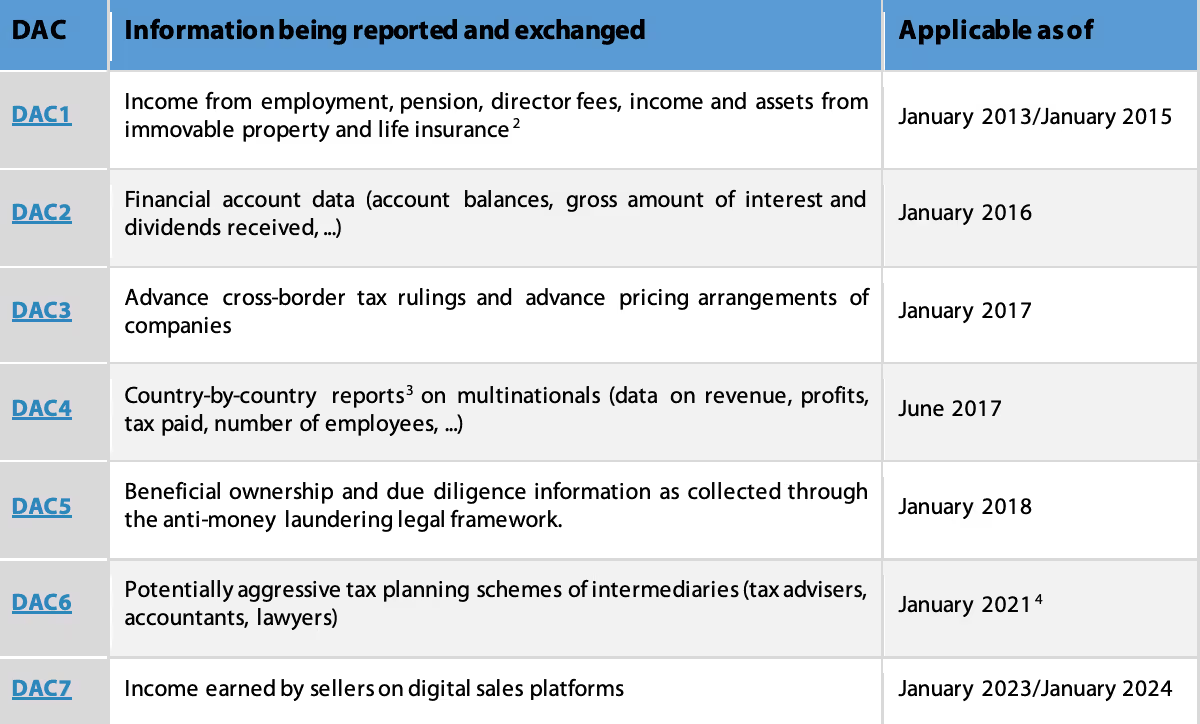

The European Union Directive on Administrative Cooperation (DAC) dates back to 2011. Instead of focusing on the imposition and collection of taxes, this directive emphasises the gathering and streamlined sharing of tax-related data about individuals and businesses among Member States.

As per the EU,

“The DAC has been revised six times in the last decade (DAC1-DAC7), in particular in the light of budgetary constraints following the financial crisis of 2008, the rise of tax scandals (Luxleaks, Panama papers, etc.), and improved cooperation opportunities through digitalisation. These revisions have expanded both the scope of taxpayers and the type of data about which reporting is required. This ranges from individuals' bank account details to the income earned by sellers on digital sales platforms.”

Here’s an overview of DAC rules over the years:

Source: European Parliament

The Proposed DAC8 Directive

The DAC8 directive, proposed on 8 December 2022, mandates crypto-asset service providers to report transactions involving EU clients to the tax authorities of EU member states.

The directive identifies crypto-asset providers and operators as entities obliged to report information to local authorities. It encompasses all crypto-assets usable for investment and payment purposes, including e-money, e-money tokens, and central bank digital currencies.

As the EU states, “The DAC8 proposal focuses on the exchange of information about the gains and profit made from crypto-transactions by EU users.”

This initiative is aimed at facilitating the automatic exchange of crypto asset information among EU tax authorities, ensuring that all transactions are transparent and taxable.

The Role of Tax Identification Numbers (TINs)

TINs play a crucial role in the reporting and monitoring of tax-related data. However, only a small minority of Member States actively collect and share TINs.

The European Parliament Research Service recommends increasing the use of TINs to enhance the efficiency of data exchange and cross-checking of information among Member States.

The Global Perspective on Crypto-Asset Transactions

The European Parliament emphasises the need for an international approach to address the taxation challenges of crypto-assets and e-money.

The OECD has developed a reporting framework (CARF) to help countries track crypto-asset transactions and collect information for tax purposes. The DAC8 proposal aligns with the OECD’s initiatives, integrating both the CARF and the latest changes to the Common Reporting Standard (CRS) into the EU’s legal framework.

Reporting Framework for Crypto-Asset Transactions

The proposed directive follows the provisions of the OECD’s CARF and builds on the definitions used in MiCA for service providers and crypto-assets.

It aims to balance the granularity of the information requested and the administrative burden on crypto-asset providers.

The directive does not oblige Member States to impose taxes on the transactions but focuses on the reporting of information.

Financial Implications of this New Crypto Tax Reporting Rule

The European Commission anticipates that the implementation of this EU-wide crypto-asset reporting framework could generate additional tax revenue ranging from €1 billion to €2.4 billion annually.

This projection is based on an impact assessment report by the European Parliamentary Research Service (EPRS).

Here are some of the key amendments brought forward by the DAC8 for crypto tax reporting:

- Staking and Lending Exclusion: Staking and lending will not be categorised as "Crypto-Asset Services." They will only be relevant for transaction reporting. This change prevents potential regulatory inconsistencies and avoids ambiguities in the term "staking."

- Crypto-Asset Classification: The requirement for CASPs to report the usability of crypto-assets for payment and investment on a case-by-case basis has been removed. This ensures uniformity in crypto-asset classification.

- Penalty Regime: The proposed minimum penalties were eliminated. An interim penalty regime for SMEs has been introduced, with maximum fines capped at 1% of the global turnover of the reporting entity.

- European TIN Consideration: The DAC8 reporting will not rely on the European TIN. The European Parliament has separated the provisions and is reconsidering the introduction of a European TIN.

- Reporting Deadlines: Member States have an extra year for DAC8 transposition. However, data collection starts from 1st January 2026, with CASPs reporting by July 31 of the subsequent year.

- Effective Implementation: Member States must utilise the DAC information effectively. They are mandated to set up systems for data evaluation and risk assessment.

To know all the amendments in detail, refer to the report here.

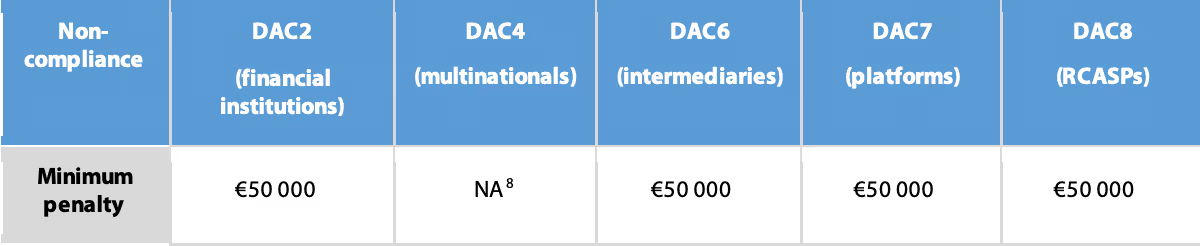

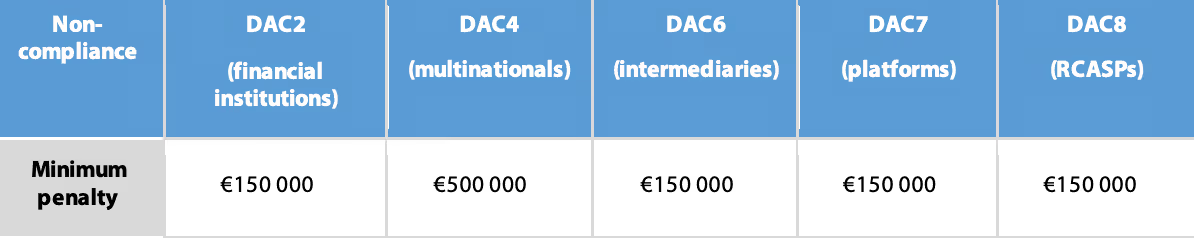

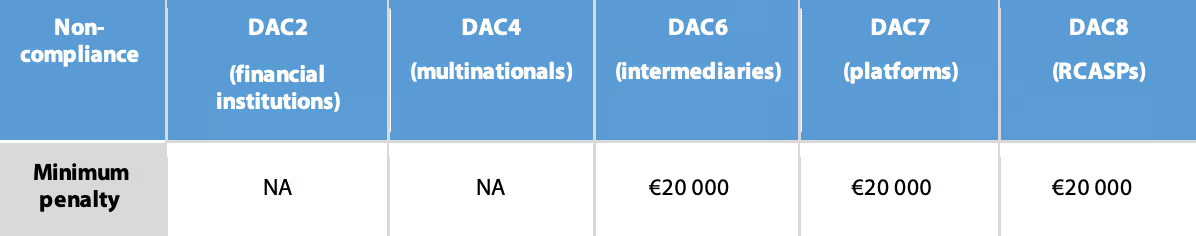

Harmonisation and Coordination on Penalties

The European Union is moving towards a more harmonised approach to penalties associated with crypto-asset transactions.

The OECD and various countries continue to discuss the tax treatment of crypto-trading, aiming for a common understanding and effectiveness in the implementation of penalties.

The European Parliament has also called for more harmonised and effective sanctions to deter non-compliance.

As per EU, “In case more than 25 % of an individual's or entity's report is made up of incomplete, incorrect or false data, or if they fail to file a report at all, including after two administrative reminders, the Commission proposes that Member States put penalties of a minimum financial amount in place.”

Here’s the list of minimum penalties for:

- Legal entity with turnover below €6 million

- Legal entity with turnover above €6 million

- Individual Person

Who are Required to Report?

The directive is in line with the OECD's (Organisation for Economic Co-operation and Development) common reporting standard (CRS). It identifies two categories of entities required to report information to local authorities:

- Crypto-asset providers: this is any legal person or undertaking whose professional activity includes one or more crypto-asset services to third parties.

- Crypto-asset operators: this includes any provider of crypto-asset services other than a crypto-asset service provider. These providers do not fall within the scope of MiCA.

These entities, known as reportable crypto-asset service providers (RCASPs), must adhere to DAC's reporting requirements if they have users within the EU, irrespective of their size or location.

The range of reportable transactions by RCASPs is vast, covering crypto-asset exchanges, transfers involving fiat currencies, and transactions between different crypto assets.

Timeline and Future Implications of the DAC8 Rule

DAC8 is scheduled to take effect on January 1, 2026. This timeline provides ample time for regulatory preparation and the implementation of Markets in Crypto-Assets (MiCA) regulations. MiCA, which laid the groundwork for the approval of DAC in May 2023, represents the eighth iteration, addressing various facets of financial oversight.

In its current form, DAC8 aligns with the Crypto-Asset Reporting Framework (CARF) and MiCA legislation, comprehensively covering all crypto-asset transactions within the EU.

EU member states have to integrate these rules until December 31, 2025, with DAC8's official enactment set for January 1, 2026.

Conclusion

The adoption of DAC8 underscores the EU's commitment to regulating and taxing crypto transactions, positioning the region as a proactive participant in the ever-evolving crypto landscape.

As the cryptocurrency industry continues to grow and evolve, major economic players like the EU must set standards and regulations that ensure the safety and transparency of transactions for all parties involved.

Want to ensure compliance while calculating crypto taxes? Sign Up on Kryptos for free and simplify your tax journey now.

FAQs

1. What is the DAC8 rule?

The DAC8 is a legislative measure introduced by the European Union to enforce comprehensive tax reporting requirements for cryptocurrency transactions across its member states.

2. How does the DAC8 rule differ from previous EU directives on cryptocurrency?

While the EU has had the Directive on Administrative Cooperation (DAC) since 2011, the DAC8 specifically amends this directive to mandate crypto-asset service providers to report transactions involving EU clients, ensuring transparency and regulation in the crypto sector.

3. Which entities are required to report under the DAC8 rule?

The directive identifies crypto-asset providers and crypto-asset operators as the primary entities required to report. These entities, known as reportable crypto-asset service providers (RCASPs), must adhere to the DAC's reporting requirements if they cater to users within the EU.

4. When will the DAC8 rule take effect?

The DAC8 rule is scheduled to be implemented on January 1, 2026. This allows for adequate regulatory preparation and the integration of other related regulations like the Markets in Crypto-Assets (MiCA).

5. How will the DAC8 rule impact the overall crypto landscape in the EU?

The introduction of the DAC8 rule underscores the EU's commitment to regulating and taxing crypto transactions. It aims to position the region as a proactive participant in the evolving crypto world, ensuring safety, transparency, and fiscal responsibility for all involved parties.

All content on Kryptos serves general informational purposes only. It's not intended to replace any professional advice from licensed accountants, attorneys, or certified financial and tax professionals. The information is completed to the best of our knowledge and we at Kryptos do not claim either correctness or accuracy of the same. Before taking any tax position / stance, you should always consider seeking independent legal, financial, taxation or other advice from the professionals. Kryptos is not liable for any loss caused from the use of, or by placing reliance on, the information on this website. Kryptos disclaims any responsibility for the accuracy or adequacy of any positions taken by you in your tax returns. Thank you for being part of our community, and we're excited to continue guiding you on your crypto journey!

| Step | Form | Purpose | Action |

|---|---|---|---|

| 1 | 1099-DA | Reports digital asset sales or exchanges | Use to fill out Form 8949. |

| 2 | Form 1099-MISC | Reports miscellaneous crypto income | Use to fill out Schedule 1 or C. |

| 3 | Form 8949 | Details individual transactions | List each transaction here. |

| 4 | Schedule D | Summarizes capital gains/losses | Transfer totals from Form 8949. |

| 5 | Schedule 1 | Reports miscellaneous income | Include miscellaneous income (if not self-employment). |

| 6 | Schedule C | Reports self-employment income | Include self-employment income and expenses. |

| 7 | Form W-2 | Reports wages (if paid in Bitcoin) | Include wages in total income. |

| 8 | Form 1040 | Primary tax return | Summarize all income, deductions, and tax owed. |

| Date | Event/Requirement |

|---|---|

| January 1, 2025 | Brokers begin tracking and reporting digital asset transactions. |

| February 2026 | Brokers issue Form 1099-DA for the 2025 tax year to taxpayers. |

| April 15, 2026 | Deadline for taxpayers to file their 2025 tax returns with IRS data. |

| Timeline Event | Description |

|---|---|

| Before January 1, 2025 | Taxpayers must identify wallets and accounts containing digital assets and document unused basis. |

| January 1, 2025 | Snapshot date for confirming remaining digital assets in wallets and accounts. |

| March 2025 | Brokers begin issuing Form 1099-DA, reflecting a wallet-specific basis. |

| Before Filing 2025 Tax Returns | Taxpayers must finalize their Safe Harbor Allocation to ensure compliance and avoid penalties. |

| Feature | Use Case Scenario | Technical Details |

|---|---|---|

| Automated Monitoring of Transactions | Alice uses staking on Ethereum 2.0 and yield farming on Uniswap. Kryptos automates tracking of her staking rewards and LP tokens across platforms. | Integrates with Ethereum and Uniswap APIs for real-time tracking and monitoring of transactions. |

| Comprehensive Data Collection | Bob switches between liquidity pools and staking protocols. Kryptos aggregates all transactions, including historical data. | Pulls and consolidates data from multiple sources and supports historical data imports. |

| Advanced Tax Categorization | Carol earns from staking Polkadot and yield farming on Aave. Kryptos categorizes her rewards as ordinary income and investment income. | Uses jurisdiction-specific rules to categorize rewards and guarantee compliance with local tax regulations. |

| Dynamic FMV Calculation | Dave redeems LP tokens for Ethereum and stablecoins. Kryptos calculates the fair market value (FMV) at redemption and during sales. | Updates FMV based on market data and accurately calculates capital gains for transactions. |

| Handling Complex DeFi Transactions | Eve engages in multi-step DeFi transactions. Kryptos tracks value changes and tax implications throughout these processes. | Manages multi-step transactions, including swaps and staking, for comprehensive tax reporting. |

| Real-Time Alerts and Updates | Frank receives alerts on contemporary tax regulations affecting DeFi. Kryptos keeps him updated on relevant changes in tax laws. | Observe regulatory updates and provide real-time alerts about changes in tax regulations. |

| Seamless Tax Reporting Integration | Grace files taxes using TurboTax. Kryptos integrates with TurboTax to import staking and yield farming data easily. | Direct integration with tax software like TurboTax for smooth data import and multi-jurisdictional reporting. |

| Investor Type | Impact of Crypto Tax Updates 2025 |

|---|---|

| Retail Investors | Standardized crypto reporting regulations make tax filing easier, but increased IRS visibility raises the risk of audits. |

| Traders & HFT Users | To ensure crypto tax compliance, the IRS is increasing its scrutiny and requiring precise cost-basis calculations across several exchanges. |

| Defi & Staking Participants | The regulations for reporting crypto transactions for staking rewards, lending, and governance tokens are unclear, and there is a lack of standardization for decentralized platforms. |

| NFT Creators & Buyers | Confusion over crypto capital gains tax in 2025, including the taxation of NFT flips, royalties, and transactions across several blockchains. |

| Crypto Payments & Businesses | Merchants who take Bitcoin, USDC, and other digital assets must track crypto capital gains for each transaction, which increases crypto tax compliance requirements. |

| Event | Consequences | Penalties |

|---|---|---|

| Reporting Failure | The tax authorities can mark uncontrolled revenues and further investigate. | Penalty fines, interest on unpaid taxes and potential fraud fees if they are deliberately occurring. |

| Misreporting CGT | Misreporting CGT Error reporting profits or losses can trigger the IRS audit. | 20% fine on under -ported zodiac signs, as well as tax and interest. |

| Using decentralized exchanges (DEXs) or mixers without records | The IRS can track anonymous transactions and demand documentation. | Possible tax evasion fee and significant fine. |

| Disregarding Bitcoin mining tax liabilities | Mining reward is considered taxable income, and failure of the report can be regarded as tax fraud. | Further tax obligations, punishment and potential legal steps. |

| Foreign crypto holdings: Non-disclosure | Foreign-accepted crypto FATCA may be subject to reporting rules. | Heavy fines (up to $ 10,000 per fracture) or prosecution for intentional non-transport. |

File Your Crypto Tax in Minutes