.avif)

Calculate Your Crypto

Taxes in Minutes

If you’ve faced a lot of losses in your crypto portfolio this year, this article might feel like a breath of fresh air to you -

As a cryptocurrency investor, it's imperative to meticulously record each transaction, calculating the overall capital gain or loss for your annual tax obligations. Experiencing a loss is never pleasant, but it doesn't have to be a dead end.

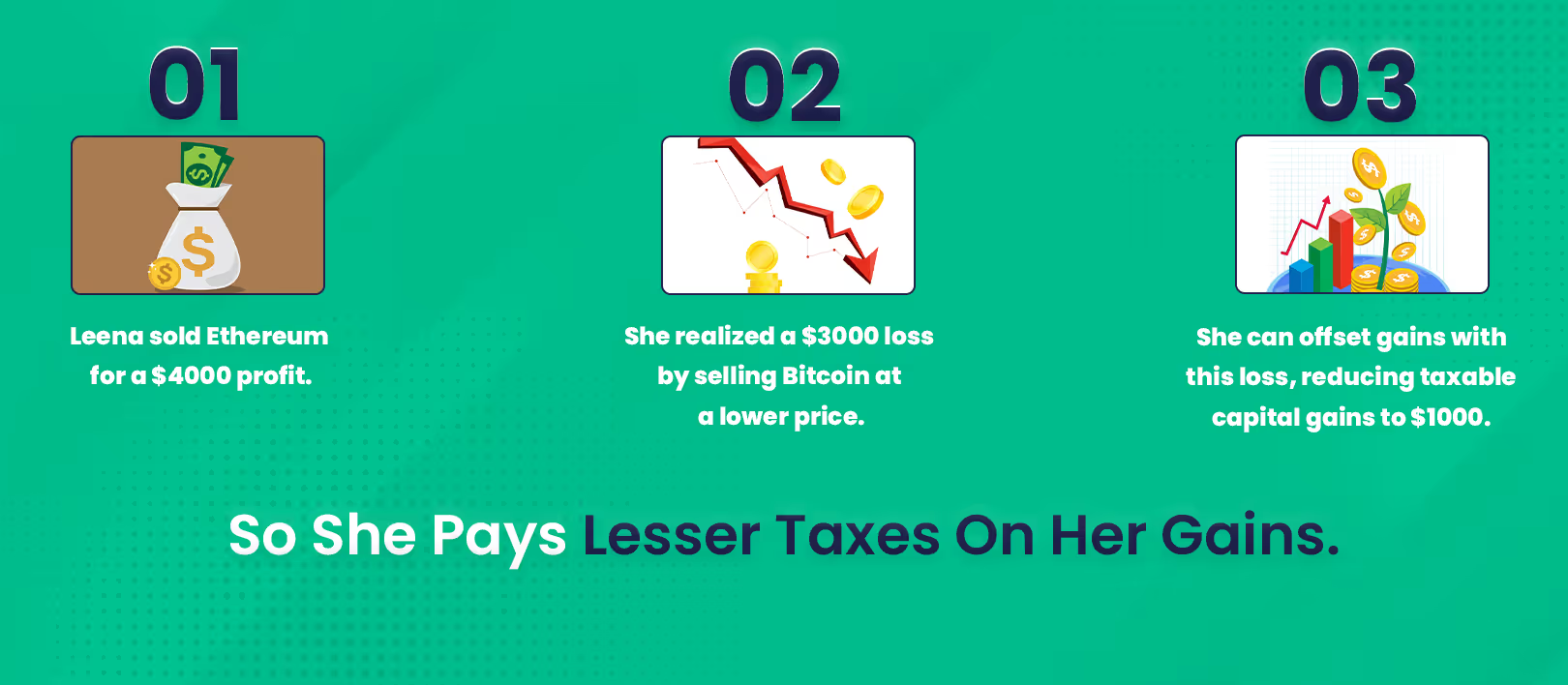

This is where tax-loss harvesting comes into play, a strategy astute investors employ to make the most out of these less favourable situations. By leveraging losses to offset capital gains in other areas of your portfolio, or even reducing your taxable income by up to $3,000, tax-loss harvesting can be a powerful tool in your investment arsenal.

Let's explore how tax-loss harvesting operates specifically for cryptocurrency investors and the distinct rules that apply in this digital financial landscape.

What is Tax-Loss Harvesting?

Crypto tax loss harvesting is a strategic method employed by investors to decrease their net capital gains, ultimately leading to a reduction in their tax liability for the year. This approach involves a few key steps:

- 1. Initiating a Capital Loss: An investor identifies and sells cryptocurrency that is currently at a loss, thereby generating a capital loss.

- 2. Balancing Gains and Losses: This capital loss is then used to offset any capital gains from other investments, effectively reducing the overall tax burden.

- 3. Strategic Repurchase: Post-harvesting, the investor has the option to repurchase the same cryptocurrency at its lower market price, positioning themselves for potential future gains when the market recovers. The wash sale rule in some countries can forbid native traders from creating artificial losses.

Example of Tax Loss Harvesting :

Meet Ava, a crypto investor who purchased 1 BTC for $30,000 and 2 ETH for $500 each during the financial year. Over time, the price of ETH climbs to $2,500, while the price of BTC drops to $28,000. Ava decides to capitalize on her ETH gains and sells her 2 ETH for a total of $5,000.

Without Tax Loss Harvesting:

In this scenario, Ava faces a Capital Gains Tax on her profit from ETH. She bought 2 ETH for a total of $1,000 ($500 each) and sold them for $5,000, realizing a gain of $4,000.

With Crypto Tax Loss Harvesting:

Ava doesn't want to incur a high tax on her gains, so she opts for tax loss harvesting. She sells her 1 BTC for $28,000, realizing a $2,000 capital loss (since she bought it for $30,000). By doing this, she can offset her $2,000 loss against the $4,000 gain from ETH. Now, Ava's taxable gain is reduced to $2,000 ($4,000 gain - $2,000 loss), meaning she'll pay Capital Gains Tax on a significantly lower amount.

Tax Loss Harvesting: How it works?

Tax loss harvesting can be a valuable tool to optimize your tax liabilities and enhance long-term investment returns.

Let's delve into how tax loss harvesting works and the key steps involved:

1. Identify Investments with Losses

The first step in tax loss harvesting is identifying investments in your portfolio that have declined in value. This can be done by reviewing your investment statements, account performance, or consulting with a financial advisor. These "harvestable losses" will be used to offset gains and potentially reduce the tax burden.

2. Consider Capital Gains

It's essential to assess your capital gains for the year. This includes any profits earned from selling investments held for over a year (long-term capital gains) or those held for a shorter duration (short-term capital gains). Understanding your capital gains will help determine the magnitude of losses needed for effective tax optimization.

3. Sell Loss-Making Investments

Once you've identified investments with losses and considered your capital gains, you can strategically sell the investments that have declined in value. It's important to adhere to the applicable tax rules and regulations when executing these sales. This may involve selling individual stocks, mutual funds, or exchange-traded funds (ETFs) that qualify for tax loss harvesting.

4. Offset Capital Gains with Capital Losses

The losses generated from selling investments can be used to offset capital gains. If the capital losses exceed the gains, you can utilize the excess losses to reduce ordinary income up to a certain limit (usually $3,000 per year for individuals in the United States). Any remaining losses can be carried forward to future tax years to offset gains or reduce taxable income.

Benefits and Risks of Tax Loss Harvesting

While tax-loss harvesting is legal, it's important to approach it ethically. Cryptocurrency investors are advised to exercise caution and not exploit this strategy excessively. Transactions that appear to have no significant economic purpose other than tax avoidance might attract scrutiny from the IRS.

Let’s look at both sides of the loss harvesting strategy :

Benefits :

- Reduced Capital Gains Tax: The primary advantage of crypto tax loss harvesting is the reduction of Capital Gains Tax liabilities.

- Offsetting Against Ordinary Income: In the US, you can offset up to $3,000 of capital losses each year against your ordinary income, further reducing your overall tax burden.

- Carrying Forward Losses: If your losses exceed your gains, you can carry these losses forward to future financial years. This allows you to offset future gains, potentially reducing your tax payments in subsequent years.

Risks:

- Regulatory Uncertainty: The IRS may change its stance on the Wash Sale Rule for crypto, impacting future strategies.

- Complexity in Tax Reporting: Tax-loss harvesting adds layers of complexity to your tax filings.

- Transaction Costs: Consider the fees associated with selling and buying crypto, as they can offset the benefits of tax-loss harvesting.

Ideal Time for Tax-Loss Harvesting

Most crypto investors prefer the practice of annual crypto loss harvesting. As the end of the financial year approaches, they review their crypto portfolios, identifying any unrealized losses that could be leveraged to lower their tax liability for the year.

However, seasoned investors don't just wait for the EOFY; they actively engage with the market's inherent volatility all year round. They keep a close eye on their portfolios, identifying unrealized losses and strategically timing their investments to capitalize on market dips.

Utilizing tools like Kryptos can help you continuously monitor both tax obligations and unrealized losses. This proactive approach can help to recognize and seize tax loss harvesting opportunities as they arise throughout the financial year, ensuring better returns for you.

Limits of Crypto Tax Loss Harvesting

During each financial year, there's a cap on how much in capital losses you can use to reduce your net capital gain. The specifics of these limits can vary based on your country of residence.

Let's briefly explore the rules for capital loss limits in different regions :

In the United States, there’s no upper limit for investors. However, if your capital losses are greater than your net capital gains, the maximum amount you can offset against ordinary income is capped at $3,000. Notably, you can carry forward any unused capital losses indefinitely, applying them to future years.

In countries like Australia or the UK, there is no capital loss limit however in Canada, investors can offset upto 50% of their losses.

For detailed information on capital loss limits specific to your country, we recommend exploring our comprehensive crypto tax guides here.

FAQs :

1. How does tax-loss harvesting impact my long-term investment strategy?

While it can provide short-term tax benefits, it's important to align tax-loss harvesting with your long-term investment goals. Avoid making decisions based solely on tax implications.

2. Can I immediately repurchase the crypto I sold for tax-loss harvesting?

Currently, the Wash Sale Rule does not apply to crypto in the US, so you can repurchase it immediately. However, this may change with future regulations or your native regulations.

3. How does the specific identification method work in practice?

This method allows you to select which particular assets to sell for tax-loss harvesting, based on their individual cost basis. It requires detailed record-keeping of each transaction.

4. Can I use my losses in cryptocurrency investments to offset capital gains from other types of investments like stocks?

Absolutely. In the United States, the tax system allows for the offsetting of gains and losses across different types of investments, provided they fall under similar tax categories. This means that if you've experienced losses in your cryptocurrency investments, these losses can be used to offset capital gains you've made from stocks or other assets. Essentially, your capital losses in the crypto market can help reduce the tax burden arising from capital gains in other investment areas, such as the stock market.

All content on Kryptos serves general informational purposes only. It's not intended to replace any professional advice from licensed accountants, attorneys, or certified financial and tax professionals. The information is completed to the best of our knowledge and we at Kryptos do not claim either correctness or accuracy of the same. Before taking any tax position / stance, you should always consider seeking independent legal, financial, taxation or other advice from the professionals. Kryptos is not liable for any loss caused from the use of, or by placing reliance on, the information on this website. Kryptos disclaims any responsibility for the accuracy or adequacy of any positions taken by you in your tax returns. Thank you for being part of our community, and we're excited to continue guiding you on your crypto journey!

| Step | Form | Purpose | Action |

|---|---|---|---|

| 1 | 1099-DA | Reports digital asset sales or exchanges | Use to fill out Form 8949. |

| 2 | Form 1099-MISC | Reports miscellaneous crypto income | Use to fill out Schedule 1 or C. |

| 3 | Form 8949 | Details individual transactions | List each transaction here. |

| 4 | Schedule D | Summarizes capital gains/losses | Transfer totals from Form 8949. |

| 5 | Schedule 1 | Reports miscellaneous income | Include miscellaneous income (if not self-employment). |

| 6 | Schedule C | Reports self-employment income | Include self-employment income and expenses. |

| 7 | Form W-2 | Reports wages (if paid in Bitcoin) | Include wages in total income. |

| 8 | Form 1040 | Primary tax return | Summarize all income, deductions, and tax owed. |

| Date | Event/Requirement |

|---|---|

| January 1, 2025 | Brokers begin tracking and reporting digital asset transactions. |

| February 2026 | Brokers issue Form 1099-DA for the 2025 tax year to taxpayers. |

| April 15, 2026 | Deadline for taxpayers to file their 2025 tax returns with IRS data. |

| Timeline Event | Description |

|---|---|

| Before January 1, 2025 | Taxpayers must identify wallets and accounts containing digital assets and document unused basis. |

| January 1, 2025 | Snapshot date for confirming remaining digital assets in wallets and accounts. |

| March 2025 | Brokers begin issuing Form 1099-DA, reflecting a wallet-specific basis. |

| Before Filing 2025 Tax Returns | Taxpayers must finalize their Safe Harbor Allocation to ensure compliance and avoid penalties. |

| Feature | Use Case Scenario | Technical Details |

|---|---|---|

| Automated Monitoring of Transactions | Alice uses staking on Ethereum 2.0 and yield farming on Uniswap. Kryptos automates tracking of her staking rewards and LP tokens across platforms. | Integrates with Ethereum and Uniswap APIs for real-time tracking and monitoring of transactions. |

| Comprehensive Data Collection | Bob switches between liquidity pools and staking protocols. Kryptos aggregates all transactions, including historical data. | Pulls and consolidates data from multiple sources and supports historical data imports. |

| Advanced Tax Categorization | Carol earns from staking Polkadot and yield farming on Aave. Kryptos categorizes her rewards as ordinary income and investment income. | Uses jurisdiction-specific rules to categorize rewards and guarantee compliance with local tax regulations. |

| Dynamic FMV Calculation | Dave redeems LP tokens for Ethereum and stablecoins. Kryptos calculates the fair market value (FMV) at redemption and during sales. | Updates FMV based on market data and accurately calculates capital gains for transactions. |

| Handling Complex DeFi Transactions | Eve engages in multi-step DeFi transactions. Kryptos tracks value changes and tax implications throughout these processes. | Manages multi-step transactions, including swaps and staking, for comprehensive tax reporting. |

| Real-Time Alerts and Updates | Frank receives alerts on contemporary tax regulations affecting DeFi. Kryptos keeps him updated on relevant changes in tax laws. | Observe regulatory updates and provide real-time alerts about changes in tax regulations. |

| Seamless Tax Reporting Integration | Grace files taxes using TurboTax. Kryptos integrates with TurboTax to import staking and yield farming data easily. | Direct integration with tax software like TurboTax for smooth data import and multi-jurisdictional reporting. |

| Investor Type | Impact of Crypto Tax Updates 2025 |

|---|---|

| Retail Investors | Standardized crypto reporting regulations make tax filing easier, but increased IRS visibility raises the risk of audits. |

| Traders & HFT Users | To ensure crypto tax compliance, the IRS is increasing its scrutiny and requiring precise cost-basis calculations across several exchanges. |

| Defi & Staking Participants | The regulations for reporting crypto transactions for staking rewards, lending, and governance tokens are unclear, and there is a lack of standardization for decentralized platforms. |

| NFT Creators & Buyers | Confusion over crypto capital gains tax in 2025, including the taxation of NFT flips, royalties, and transactions across several blockchains. |

| Crypto Payments & Businesses | Merchants who take Bitcoin, USDC, and other digital assets must track crypto capital gains for each transaction, which increases crypto tax compliance requirements. |

| Event | Consequences | Penalties |

|---|---|---|

| Reporting Failure | The tax authorities can mark uncontrolled revenues and further investigate. | Penalty fines, interest on unpaid taxes and potential fraud fees if they are deliberately occurring. |

| Misreporting CGT | Misreporting CGT Error reporting profits or losses can trigger the IRS audit. | 20% fine on under -ported zodiac signs, as well as tax and interest. |

| Using decentralized exchanges (DEXs) or mixers without records | The IRS can track anonymous transactions and demand documentation. | Possible tax evasion fee and significant fine. |

| Disregarding Bitcoin mining tax liabilities | Mining reward is considered taxable income, and failure of the report can be regarded as tax fraud. | Further tax obligations, punishment and potential legal steps. |

| Foreign crypto holdings: Non-disclosure | Foreign-accepted crypto FATCA may be subject to reporting rules. | Heavy fines (up to $ 10,000 per fracture) or prosecution for intentional non-transport. |

File Your Crypto Tax in Minutes