.avif)

Calculate Your Crypto

Taxes in Minutes

If you have initiated crypto transactions over the past year, you may be subject to income tax or capital gains taxes. It is important to know the different tax implications of your transactions to avoid any last-minute surprises and minimize your tax bill.

In this article, we discuss all the essentials you need to know about crypto taxes and share the right way to report them.

How Are Cryptocurrency Transactions Taxed?

The IRS considers cryptocurrency as property for tax purposes. This means that crypto transactions are subject to capital gains and losses.

Just like stocks or real estate, any profit or loss resulting from the sale or exchange of cryptocurrency must be reported on your tax return. Depending on how long you have held your assets before disposal, you may incur short-term or long-term capital gains tax.

If you earn crypto income through any event, for instance, airdrops or mining – you are subject to ordinary income tax.

When Do You Pay Capital Gains Tax on Crypto?

If you earn a profit by disposing of your crypto, you incur capital gains tax. To calculate your capital gains, you need to find your cost basis. It is the amount you spent to acquire the crypto, including fees, commissions and other acquisition costs in U.S. dollars.

Your capital gain or loss is the difference between the crypto disposal value and your cost basis.

Capital gains are taxed differently depending on the holding period, your income bracket, and your filing status.

- If you sell your crypto in less than 365 days, you are subject to 10-37% short-term capital gains tax.

- In case you hold your crypto for more than a year before its disposal, you incur long-term capital gains tax at a rate of 15% or 20%.

When Do You Pay Income Tax on Crypto?

There are also instances when your crypto is subject to ordinary income tax. This includes events such as:

- Mining cryptocurrencies

- Receiving crypto as payment

- Income from staking crypto

- Yields on crypto accounts

- Airdrops

- Hard forks

The amount of crypto income that you recognize is the fair market value of the crypto asset, in U.S. dollars, when received. It is taxed at the Federal Income Tax rate of 10-37% depending on your income bracket and filing status.

Taxable Events For Crypto Transactions

Now that we know how crypto is taxed, let’s discuss some of the taxable crypto transactions in detail.

Mining Cryptocurrency

As per IRS, when you receive a cryptocurrency reward for successfully mining a new block on the blockchain, it is considered taxable income.

Your income will be the fair market value of the crypto, in U.S. dollars, when you received it. This is subject to ordinary income tax at a rate of 10-37% and has to be reported.

Selling Crypto for Fiat Currency

If you sell your crypto for fiat such as converting Bitcoin to Cash, any profit or loss that you make is your capital gains or capital loss and it is taxable.

To find out your capital gains tax, you have to calculate your cost basis. If the selling price is more than your basis, you incur either short-term capital gains tax or long-term capital gains tax depending on your holding period.

If the selling price is lesser than the cost basis, you realize a capital loss. This can be claimed to offset your capital gains in your returns.

Exchanging Crypto for Other Crypto

This event is triggered when you exchange one crypto for another crypto asset. For example, you buy BTC for $1000 and when it reaches $1500, you exchange it for ETH, the capital gains of $500 on your BTC are considered taxable.

Using Crypto to Pay for Goods and Services

As per IRS, using cryptocurrency for purchasing goods or services is taxable. If you pay for a service using virtual currency that you hold as a capital asset, then you have exchanged it for that service and will realize a capital gain or loss.

Let’s say you buy Bitcoin worth $500 and after 3 years the value of the same reaches $10,000. If you now use this crypto to buy a real property (e.g. a house), you realize long-term capital gains of $9500 which is taxable.

Earning Crypto for Goods or Services

When you receive crypto in exchange for performing services, you realize ordinary income.

The amount of income is the fair market value of the crypto, in U.S. dollars, when received. This is also your cost basis for any future capital gains you make on this asset.

In an on-chain transaction you receive the crypto on the date and at the time the transaction is recorded on the distributed ledger.

Airdrops

If you receive any crypto through airdrops, it is considered as an ordinary income by the IRS which is subject to 10-37% of income tax.

You are taxed on the market value of the crypto asset, in U.S. dollars, when you received it. This should be reported as income at the time of filing your tax forms.

Hard Forks

A hard fork occurs when a crypto protocol is upgraded, resulting in a permanent diversion from the initial blockchain. As a result, a new cryptocurrency is created for the new blockchain in addition to the old crypto asset.

As per IRS, crypto hard forks are considered ordinary income if you receive a new crypto following hard fork. However, if you do not receive any new cryptocurrency, you don’t have any taxable income.

How Are NFTs Taxed?

Just like other cryptocurrencies, NFTs are subject to both income tax and capital gains tax. Some taxable events include:

- Buying NFT with crypto

- Selling an NFT for crypto or fiat

- Exchanging an NFT for another

- Income from the sales of primary or secondary NFTs which is subject to ordinary income tax

If you dispose of your NFTs in less than twelve months, you are subject to short-term capital gains tax at a rate of 10-37%. This rate is also applicable to any income from NFTs.

If you hold your NFTs for more than a year before disposing of them, you are subject to long-term capital gains tax at a rate of 0-20%.

However, IRS released a notice on March 21, 2023, where they described the treatment of some of the NFTs as “collectibles”. As of now, the IRS intends to determine when an NFT is treated as a Section 408(m) collectible by using a "look-through analysis."

Under this analysis, an NFT is treated as a collectible if the NFT's associated right or asset falls under the definition of collectible in the tax code. As per Section 408(m)(2), collectibles include:

- Any work of art

- Any rug or antique

- Any metal or gem

- Any stamp or coin

- Any alcoholic beverage

- Any other tangible personal property specified by the Secretary

Section 408(m)(3) describes that certain coins and bullion are excluded from the

definition of collectible.

If your NFT falls under the “collectible” category, you have to pay a maximum tax of 28% in case you have held your asset for more than a year. It doesn’t apply to the assets sold before twelve months.

Capital Gains Tax Rate For 2023

As per IRS, you are taxed differently on your crypto assets based on how long you have held them.

If you sell your crypto in less than a year, your capital gains taxes are considered short-term. In case you hold your crypto for more than twelve months, your taxes fall under the long-term capital gains taxes.

Both of these types of capital gains taxes have different tax rates depending on the period of holding, filing status, and your income bracket for the year.

Short-term Tax Rate

Your short-term capital gains taxes are based on the Federal Income Tax rates and are the same as the rates on your taxable income. It ranges from 10-37% tax rate depending on your income and filing status.

Here are the tax rates for the financial year 2023 (taxes due in April 2024):

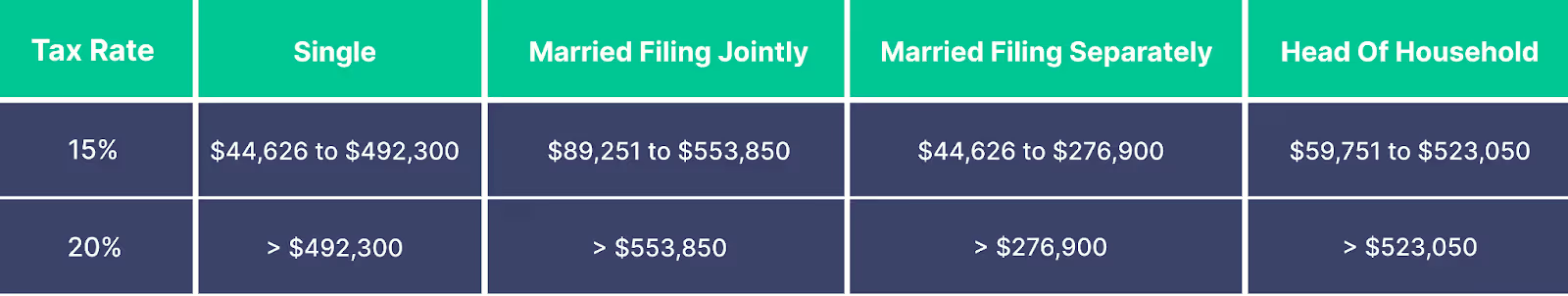

Long-term Tax Rate

If you hold your crypto assets for more than a year, you are taxed under long-term capital gains which is lower for most investors. You don’t have to pay any long-term capital gains tax if your income is $44,625 or less (for single filers) and $89,250 or less for married couples filing jointly.

If you earn more than the mentioned income, you are subject to a tax rate of 15% or 20% depending on your taxable income and filing status.

For the financial year 2023, here’s the tax rate for long-term crypto capital gains

Not sure how to calculate your crypto taxes? Check out our free crypto tax calculator.

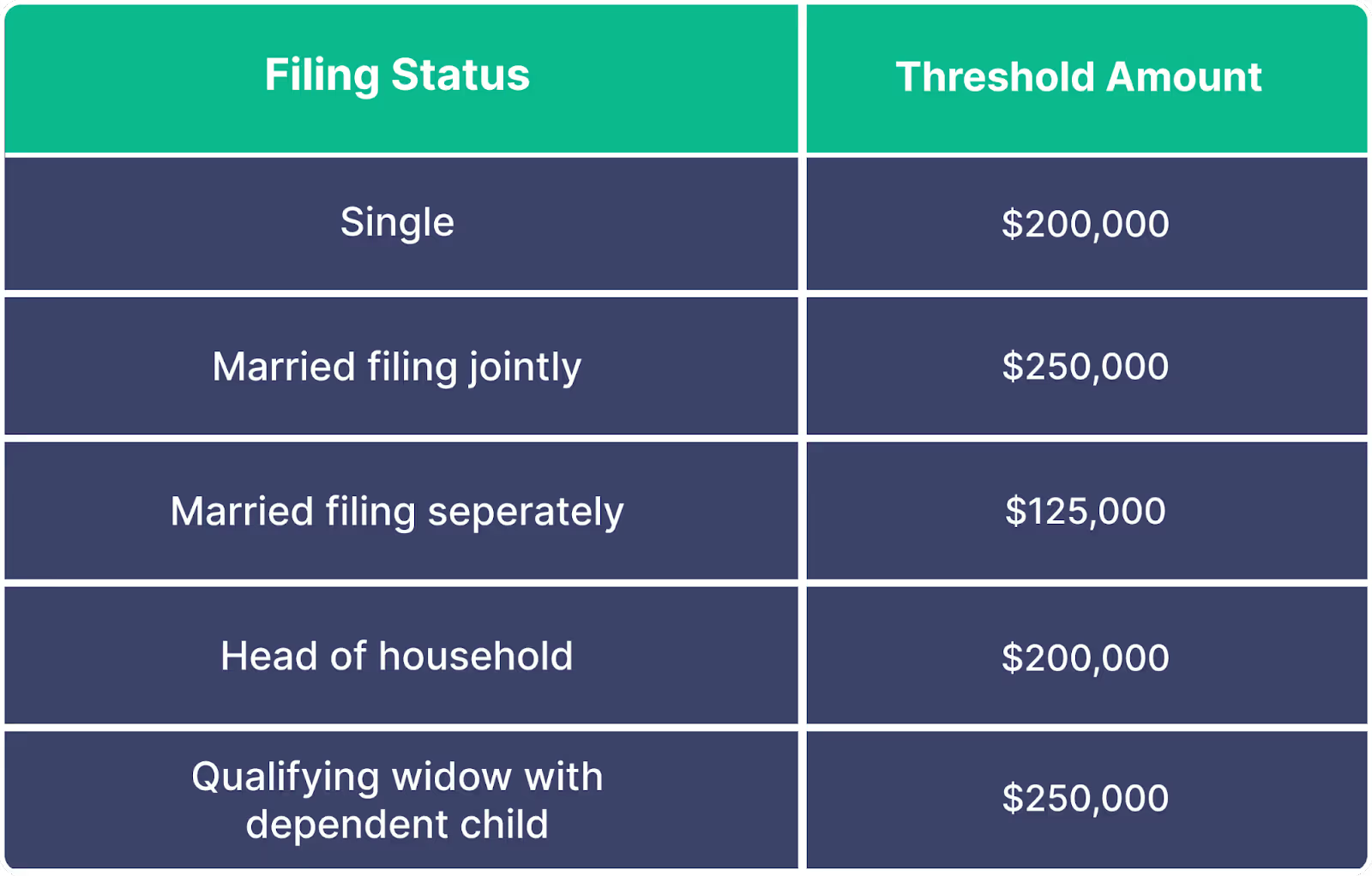

When Do You Have to Pay Net Investment Income Tax (NIIT)?

The Net Investment Income Tax (NIIT) may add a 3.8% tax surcharge to individuals with a net investment income and also modified adjusted gross income of more than the following threshold:

For more details on Net Investment Income Tax, refer to this IRS guide.

How To Report Your Crypto Taxes?

As per IRS, you must:

- Calculate capital gain or loss in accordance with IRS forms and instructions, including Form 8949, Sales and Other Dispositions of Capital Assets

- Summarize capital gains and deductible capital losses on Form 1040, Schedule D, Capital Gains and Losses.

- You must report ordinary income from virtual currency on Form 1040, U.S. Individual Tax Return, Form 1040-SS, Form 1040-NR, or Form 1040, Schedule 1, Additional Income and Adjustments to IncomePDF, as applicable.

If you are looking for an easy way to keep your taxable transactions updated and calculate your crypto taxes, crypto tax software like Kryptos can help.

Simply connect your wallets and the app will calculate your crypto taxes in minutes. It also automatically identifes any tax-saving events so that you save more on taxes.

To learn more, Get started for free today.

FAQs

1. What Cryptocurrency Transactions Can Be Taxed?

The following cryptocurrency transactions are subject to taxation:

- Selling crypto for fiat currency (e.g., USD)

- Exchanging crypto for other crypto

- Using crypto to pay for goods and services

- Receiving crypto as payment for goods or services

- Mining cryptocurrency

- Hard forks and chain splits

- Receiving staking rewards, airdrops, or other income from crypto

2. What's Your Tax Rate for Cryptocurrency Capital Gains?

Your cryptocurrency capital gains tax rate depends on whether the gains are short-term or long-term:

- Short-term capital gains tax: If you held the crypto for one year or less, your gains are considered short-term and are taxed at your ordinary income tax rate.

- Long-term capital gains tax: If you held the crypto for more than one year, your gains are considered long-term and are taxed at a rate of 0%, 15%, or 20%, depending on your income.

3. Do I Pay Taxes on Crypto If I Don't Sell?

Generally, you do not have to pay taxes on crypto holdings that you have not sold or exchanged. However, you may be subject to taxes if you received crypto through mining, staking, or as payment for goods and services.

4. How Can I Avoid Paying Taxes on Crypto?

It is essential to comply with all tax obligations. However, you may minimize your tax liability by:

- Holding crypto for more than one year to qualify for long-term capital gains tax rates, which are generally lower.

- Harvesting tax losses by selling crypto at a loss to offset gains from other transactions.

- Donating crypto to a qualified charity for a potential tax deduction.

- Utilizing tax-advantaged accounts, such as an individual retirement account (IRA), to invest in certain crypto assets.

Please consult a tax professional for personalized advice on minimizing your tax liability.

5. How is crypto taxed?

Crypto is taxed as property by the IRS, which means transactions involving crypto are subject to capital gains and losses. You must report profits or losses exchange on your tax return. Additionally, receiving crypto as payment or mining rewards is considered taxable income.

6. Do you pay tax when transferring crypto?

Transferring crypto between your own wallets or accounts generally does not trigger a taxable event. However, exchanging crypto for other crypto or using crypto to pay for goods and services are considered taxable events, and you must report any capital gains or losses on your tax return.

All content on Kryptos serves general informational purposes only. It's not intended to replace any professional advice from licensed accountants, attorneys, or certified financial and tax professionals. The information is completed to the best of our knowledge and we at Kryptos do not claim either correctness or accuracy of the same. Before taking any tax position / stance, you should always consider seeking independent legal, financial, taxation or other advice from the professionals. Kryptos is not liable for any loss caused from the use of, or by placing reliance on, the information on this website. Kryptos disclaims any responsibility for the accuracy or adequacy of any positions taken by you in your tax returns. Thank you for being part of our community, and we're excited to continue guiding you on your crypto journey!

| Step | Form | Purpose | Action |

|---|---|---|---|

| 1 | 1099-DA | Reports digital asset sales or exchanges | Use to fill out Form 8949. |

| 2 | Form 1099-MISC | Reports miscellaneous crypto income | Use to fill out Schedule 1 or C. |

| 3 | Form 8949 | Details individual transactions | List each transaction here. |

| 4 | Schedule D | Summarizes capital gains/losses | Transfer totals from Form 8949. |

| 5 | Schedule 1 | Reports miscellaneous income | Include miscellaneous income (if not self-employment). |

| 6 | Schedule C | Reports self-employment income | Include self-employment income and expenses. |

| 7 | Form W-2 | Reports wages (if paid in Bitcoin) | Include wages in total income. |

| 8 | Form 1040 | Primary tax return | Summarize all income, deductions, and tax owed. |

| Date | Event/Requirement |

|---|---|

| January 1, 2025 | Brokers begin tracking and reporting digital asset transactions. |

| February 2026 | Brokers issue Form 1099-DA for the 2025 tax year to taxpayers. |

| April 15, 2026 | Deadline for taxpayers to file their 2025 tax returns with IRS data. |

| Timeline Event | Description |

|---|---|

| Before January 1, 2025 | Taxpayers must identify wallets and accounts containing digital assets and document unused basis. |

| January 1, 2025 | Snapshot date for confirming remaining digital assets in wallets and accounts. |

| March 2025 | Brokers begin issuing Form 1099-DA, reflecting a wallet-specific basis. |

| Before Filing 2025 Tax Returns | Taxpayers must finalize their Safe Harbor Allocation to ensure compliance and avoid penalties. |

| Feature | Use Case Scenario | Technical Details |

|---|---|---|

| Automated Monitoring of Transactions | Alice uses staking on Ethereum 2.0 and yield farming on Uniswap. Kryptos automates tracking of her staking rewards and LP tokens across platforms. | Integrates with Ethereum and Uniswap APIs for real-time tracking and monitoring of transactions. |

| Comprehensive Data Collection | Bob switches between liquidity pools and staking protocols. Kryptos aggregates all transactions, including historical data. | Pulls and consolidates data from multiple sources and supports historical data imports. |

| Advanced Tax Categorization | Carol earns from staking Polkadot and yield farming on Aave. Kryptos categorizes her rewards as ordinary income and investment income. | Uses jurisdiction-specific rules to categorize rewards and guarantee compliance with local tax regulations. |

| Dynamic FMV Calculation | Dave redeems LP tokens for Ethereum and stablecoins. Kryptos calculates the fair market value (FMV) at redemption and during sales. | Updates FMV based on market data and accurately calculates capital gains for transactions. |

| Handling Complex DeFi Transactions | Eve engages in multi-step DeFi transactions. Kryptos tracks value changes and tax implications throughout these processes. | Manages multi-step transactions, including swaps and staking, for comprehensive tax reporting. |

| Real-Time Alerts and Updates | Frank receives alerts on contemporary tax regulations affecting DeFi. Kryptos keeps him updated on relevant changes in tax laws. | Observe regulatory updates and provide real-time alerts about changes in tax regulations. |

| Seamless Tax Reporting Integration | Grace files taxes using TurboTax. Kryptos integrates with TurboTax to import staking and yield farming data easily. | Direct integration with tax software like TurboTax for smooth data import and multi-jurisdictional reporting. |

| Investor Type | Impact of Crypto Tax Updates 2025 |

|---|---|

| Retail Investors | Standardized crypto reporting regulations make tax filing easier, but increased IRS visibility raises the risk of audits. |

| Traders & HFT Users | To ensure crypto tax compliance, the IRS is increasing its scrutiny and requiring precise cost-basis calculations across several exchanges. |

| Defi & Staking Participants | The regulations for reporting crypto transactions for staking rewards, lending, and governance tokens are unclear, and there is a lack of standardization for decentralized platforms. |

| NFT Creators & Buyers | Confusion over crypto capital gains tax in 2025, including the taxation of NFT flips, royalties, and transactions across several blockchains. |

| Crypto Payments & Businesses | Merchants who take Bitcoin, USDC, and other digital assets must track crypto capital gains for each transaction, which increases crypto tax compliance requirements. |

| Event | Consequences | Penalties |

|---|---|---|

| Reporting Failure | The tax authorities can mark uncontrolled revenues and further investigate. | Penalty fines, interest on unpaid taxes and potential fraud fees if they are deliberately occurring. |

| Misreporting CGT | Misreporting CGT Error reporting profits or losses can trigger the IRS audit. | 20% fine on under -ported zodiac signs, as well as tax and interest. |

| Using decentralized exchanges (DEXs) or mixers without records | The IRS can track anonymous transactions and demand documentation. | Possible tax evasion fee and significant fine. |

| Disregarding Bitcoin mining tax liabilities | Mining reward is considered taxable income, and failure of the report can be regarded as tax fraud. | Further tax obligations, punishment and potential legal steps. |

| Foreign crypto holdings: Non-disclosure | Foreign-accepted crypto FATCA may be subject to reporting rules. | Heavy fines (up to $ 10,000 per fracture) or prosecution for intentional non-transport. |

File Your Crypto Tax in Minutes