.avif)

Calculate Your Crypto

Taxes in Minutes

Singapore has long been hailed as a haven for both crypto investors and businesses alike owing to its lenient tax regulations and the government’s crypto-friendly approach. It is one of the reasons why major crypto companies like Crypto.com are based out of Singapore. Crypto investors in Singapore enjoy zero taxes on capital gains and long-term investments, and while some clear guidelines and regulations govern the taxation of crypto assets in Singapore, the impetus for interpreting these regulations lies with the investors themselves, which can be overwhelming at times depending on the nature of transactions.

That’s why we have curated this detailed tax guide covering all the crucial aspects of crypto taxation in Singapore. We have answered pivotal questions like “How is crypto taxed in Singapore?” “How to file crypto taxes in Singapore?” “How to avoid paying crypto taxes in Singapore?” “How are Airdrops, ICOs, and forks taxed?”. The objective of this guide is to educate investors on the subject of crypto taxes and help them file their crypto taxes conveniently.

Note that this guide is quite comprehensive and will be updated regularly to accommodate new guidelines and regulations. We suggest revisiting this guide regularly to stay updated on the new tax trends.

In Singapore, cryptocurrency taxation varies depending on the nature of your activities involving digital tokens. When trading cryptocurrencies as a business, gains and losses are considered regular income and are subject to income tax, requiring them to be reported on your annual tax return. However, capital gains from long-term investments in cryptocurrencies are not taxed, setting Singapore apart from countries imposing capital gains tax. Using cryptocurrencies for payments is treated as barter trade, with businesses taxed on the value of goods or services provided in the transaction.

An 8% GST is chargeable on the fees pertaining to crypto transactions in Singapore. Profits gained from professional trading and crypto-related business activities are treated as regular income and subjected to income tax. Short-term and long-term trades, on the other hand, do not trigger immediate tax obligations, given Singapore's lack of capital gains tax.

For regulatory compliance, businesses offering digital payment tokens falling outside the securities token category must disclose non-approval by the Monetary Authority of Singapore (MAS) and outline associated risks. In a cryptocurrency landscape marked by diverse activities, Singapore's taxation approach remains nuanced, favouring long-term investors through its absence of capital gains tax while accounting for income tax implications related to trading and business activities.

Yes, the MAS can track the crypto transactions of investors in Singapore, particularly when these transactions involve digital payment tokens and fall under the regulatory framework set by the MAS. As part of its regulatory efforts to combat money laundering and ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, MAS requires licensed digital payment token service providers to implement customer due diligence measures and monitor transactions.

MAS expects crypto service licensees to conduct proper customer due diligence for all digital payment transactions. This includes assessing customer risk levels and taking enhanced due diligence measures for customers with higher money laundering risks. Additionally, licensees are required to monitor their business relationships with customers on an ongoing basis and ensure that transactions align with customer profiles and risk assessments.

Furthermore, per the value transfer rules, digital or crypto service providers are expected to transmit originator and beneficiary information securely and promptly to beneficiary service providers.

Through these regulatory requirements and measures, MAS can obtain insights into crypto transactions taking place within Singapore's jurisdiction. Therefore, we suggest reporting all your transactions to the MAS judiciously to avoid legal and tax trouble.

There is no dedicated capital gains tax structure in Singapore as such. Capital gains from crypto transactions are not subject to taxation in Singapore. Unlike some other countries, Singapore does not impose taxes on capital gains. Therefore, any profits made from buying and selling cryptocurrencies, when intended as long-term investments, are exempt from taxation.

This policy encourages individuals to engage in the long-term holding of cryptocurrencies without incurring capital gains tax obligations. However, it's important to note that capital gains taxation exemption applies to long-term investments specifically, and other activities involving cryptocurrencies, such as trading as a regular business activity, may still be subject to income tax.

In business settings, the tax treatment of gains and losses depends on the nature of the transaction and the individual's intention at the point of purchase. If the cryptocurrencies were held for trading purposes as part of a business or trade, any gains or losses from their disposal are treated as taxable income or allowed as deductions.

If the cryptocurrencies were not held for trading purposes (e.g., held as personal investments), resulting gains or losses from disposal are generally not taxable or allowed as deductions.

Determining whether gains/losses are considered part of a business or trade involves evaluating factors such as the purpose of holding, frequency of transactions, and holding periods. These factors help determine whether the gains are subject to income tax or treated differently.

As previously mentioned, there is no capital gains tax in Singapore and income from crypto transactions is either exempt from taxation or is taxed as income (when categorised as part of a business or trade). The taxes that do apply to capital gains in Singapore are equal to the income tax rates as mentioned in the later sections of the guide.

Capital gains calculations don’t make much sense for individuals with a long-term investment strategy as they are non-taxable. However, it’s a different story for investors/traders operating in a business or trade setting. Calculating your capital gains or losses is a pretty straightforward process, you can use this formula to do so:

For those who are not aware of the term cost basis, it is simply the price you pay to acquire a certain asset, including any fees paid in the process. Here’s an example:

Suppose you bought 1 BTC for 30,000 SGD and you paid 200 SGD in transaction fees in the process, then your cost basis would then be equal to 30,200 SGD.

Let’s say you decide to sell this BTC for 40,000 SGD and you incur a transaction fee of 200 SGD again. Then your cost basis would change to 30,400 SGD.

For calculating the capital gain, we will use the above-listed formula:

Capital Gain/Loss = Disposal Amount - Cost Basis = 40,000 SGD - 30,400 SGD = 9,600 SGD

Crypto losses can be tax deductible in Singapore under certain circumstances. If an individual engages in buying and selling crypto as part of a business or trade and incurs losses, these losses can be deducted from their overall income for tax purposes.

However, if the losses stem from cryptocurrencies held for investment purposes (e.g., personal investments), they may not be eligible for deduction.

Unfortunately, the MAS is yet to release specific guidance on how lost or stolen crypto is viewed from a tax perspective. However, you can seek legal remedies if you've lost your assets in a crypto scam or rug pull.

Investors who fall victim to crypto scams and frauds in Singapore have recourse to legal remedies for seeking redress within the existing legal framework. Despite the absence of specific legislation directly addressing crypto-related fraud, several potential avenues exist for pursuing justice.

Civil claims based on fraud and misrepresentation are among the primary remedies available. Investors can bring legal action if they can demonstrate intentional deception or false information that led to their investment losses. Similarly, breach of trust and claims of deceit can be explored, especially if the fraudulent scheme involves entrusting wrongdoers with investors' funds.

To safeguard their interests and assets, victims can seek urgent and interim relief from the court. Freezing injunctions can prevent wrongdoers from diminishing the value of stolen crypto-assets, given the swift movement of digital assets. Moreover, proprietary injunctions that directly target the property itself, and Mareva injunctions that prevent the disposal of assets, offer legal tools to preserve the value of stolen crypto-assets during legal proceedings.

Once frozen crypto assets are identified, victims can proceed with the main legal action. This involves seeking proprietary declarations or vesting orders to officially establish ownership and potentially reclaim stolen assets. Victims must collaborate with experienced legal professionals well-versed in handling crypto-related cases, as enforcement can pose challenges, particularly when wrongdoers are situated in different jurisdictions.

There isn’t much you can do to lower your crypto tax bill besides offsetting your gains using your losses. Because the Singaporean authorities don’t offer much when it comes to tax credits and deductions on crypto investments.

The examples we have used so far are fairly simplistic and do not represent real-world transactions. Investors usually buy multiple assets of the same kind at different prices, and that makes cost basis and capital gain calculations very complicated. That’s why one needs to rely on specialised accounting methods to simplify these calculations. Tax authorities in most jurisdictions have clear rules and guidelines regarding the use of specific cost-basis methods.

However, the MAS has yet to declare clear guidelines on which one to use in Singapore. You can likely use one of the mainstream accounting methods that most countries rely on for cost-basis calculations in Singapore.

Listed below are the top 4 most popular accounting methods:

LIFO or Last-In-First-Out accounting method states that the acquisition price of the most recent asset you buy is to be used as the cost basis for capital gains calculations upon disposal.

FIFO or First-In-First-Out accounting method states that the acquisition price of the earliest asset you buy is to be used as the cost basis for capital gains calculations upon disposal.

HIFO or Highest-In-First-Out accounting method simply states that the highest acquisition price for an asset across all acquisition instances is to be used as the cost basis for capital gains calculations upon disposal.

The average cost basis method simply states that the cost basis for an asset is simply equal to the average acquisition price of all tokens that you currently have in your portfolio.

Note that your capital gains change when you use different accounting methods. Here’s an example:

13/01/24- Lucas bought 1 ETH for 3,500 SGD

17/03/24- Lucas bought 1 ETH for 3,800 SGD

21/05/24- Lucas bought 1 ETH for 3,200 SGD

28/06/24- Lucas sold 1 ETH for 4,000 SGD

We shall use each one of the above-mentioned accounting methods to observe how capital gains change when using a specific accounting method:

According to LIFO, the acquisition price of the last asset you buy is the cost basis.

Cost Basis = 3,200 SGD

Disposal Amount = 4,000 SGD

Capital Gain = 4,000 SGD - 3,200 SGD = 800 SGD

According to FIFO, the acquisition price of the first asset you buy is the cost basis.

Cost Basis = 3,500 SGD

Disposal Amount = 4,000 SGD

Capital Gain = 4,000 SGD - 3,500 SGD = 500 SGD

According to HIFO, the highest acquisition price is the cost basis

Cost Basis = 3,800 SGD

Disposal Amount = 4,000 SGD

Capital Gain = 4,000 SGD - 3,800 SGD = 200 SGD

The cost basis is the average of all acquisition prices

Cost Basis = 3,200 SGD + 3,500 SGD +3,800 SGD/3 = 3,500 SGD

Disposal Amount = 4,000 SGD - 3,500 SGD = 500 SGD

Income tax in Singapore applies to specific instances of crypto transactions, primarily on trading conducted as a regular business activity. When individuals engage in trading crypto as part of their business operations, any profits and losses derived from these trades are subject to income tax. Such gains are treated as ordinary income and must be included in the annual tax return. The requirement to record gains and losses from crypto trading on the tax return is stipulated by the Monetary Authority of Singapore (MAS) to ensure accurate income reporting.

Note that capital gains resulting from long-term investments in cryptocurrencies are exempt from taxation. However, for transactions not falling under the category, any gains realised are subject to income tax if the intention is not primarily for long-term investment purposes.

While the use of cryptocurrencies for payments does not directly trigger income tax for the user, businesses accepting crypto payments are taxed based on the transaction value. Individuals engaged in crypto trading should maintain precise records and comply with tax regulations to meet reporting requirements and avoid potential legal issues.

Income tax varies for residents and non-residents in Singapore.

Employment income for non-residents is either taxed at a flat rate of 15% or a progressive resident income tax rate. Income from other sources is taxed at a flat rate of 22%.

Listed below are some of the tax-free crypto transactions:

Listed below are some of the taxed crypto transactions:

In Singapore, crypto mining is categorised as a hobby or a business pursuit and is taxed based on the level of effort and intent behind the mining activities.

For individuals who engage in crypto mining as a hobby, and without a systematic and habitual focus on profit, the gains from selling the mined tokens are considered capital gains. Such capital gains are exempt from taxation. However, it's important to note that mining expenses are non-deductible.

If an individual undertakes crypto mining with a systematic and habitual intention to derive profits, this activity may be categorised as a business pursuit.

Therefore, the gains made from the mining operations are treated as taxable income. Individuals who engage in mining as a business must declare the resulting income as "business income" on their annual tax declarations. These gains are then subject to the applicable income tax rates.

Moreover, companies registered with the Accounting and Corporate Regulatory Authority in Singapore that partake in crypto mining fall under the purview of corporate income tax rates for the profits generated through mining activities.

It's imperative for individuals and businesses involved in crypto mining to identify which category they fall into.

In Singapore, the taxation of crypto staking depends on the income earned from the staking activity. Individuals who stake crypto and generate a yearly income of 300 SGD or more will likely be subject to income tax on their staking gains.

Individuals are responsible for declaring taxes related to their cryptocurrency staking earnings, similar to other types of income tax in Singapore.

The process of crypto staking taxation in Singapore is straightforward. Individuals incorporate their staking income into their total earnings. The combined income, inclusive of staking profits, is then subject to taxation at the applicable marginal tax rate based on their overall income level.

Although there is no clear guidance on how airdrops and forks are viewed from a tax perspective, the income from airdrops and forks will likely be non-taxable similar to the tokens received through mining in an individual capacity.

However, we do suggest seeking guidance from an experienced tax professional to better understand the tax implications of such transactions.

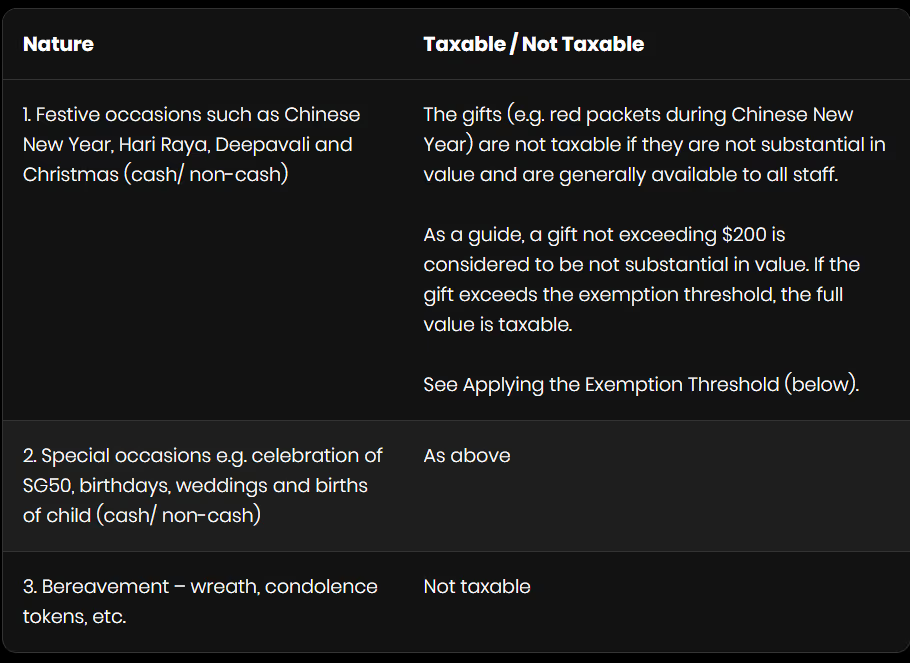

There is no clear guidance regarding crypto gifts and donations and their taxation in Singapore. However, if we consider crypto donations to be the same as cash donations, we can infer a few things about their taxation from existing guidelines.

According to the IRAS website:

“Cash and non-cash gifts relating to festive and special occasions which do not exceed the exemption threshold of $200 are considered to be not substantial in value and are not taxable due to an administrative concession granted. If a gift exceeds the exemption threshold, the full value of the gift is taxable. For example, if the baby gift set is worth $250, the taxable value is $250”

Here’s a summary of gift taxation and exemption.

However, we do suggest seeking guidance from an experienced tax professional to better understand how such transactions are taxed.

The MAS doesn’t differentiate between normal trades and leverage or margin trades. Therefore, the taxation of any income derived from such trades will follow the same trend as regular trades.

ICOs are special events that allow investors to own native tokens from unreleased projects in exchange for mainstream tokens like Bitcoin and Ethereum. They are similar to IPOs in the regular securities market.

Tokens received from ICOs are not clearly defined as income in Singapore's tax rules. The government hasn't given specific instructions on how to tax these tokens yet.

ICOs create tokens that are different from regular money, and they usually don't mean you're buying a share in a company. Saying ICO tokens are like buying shares could cause problems with securities laws.

Right now, we don't know for sure how ICO tokens are taxed in Singapore. The government hasn't explained it yet. So, if you're involved in ICOs, it's important to keep an eye out for any new rules or guidance from the government.

We suggest seeking guidance from an experienced tax accountant to better understand the tax implications of such transactions.

There is no specific guidance on how NFT transactions are taxed in Singapore. However, income from NFTs will likely be non-taxable for individual investors with a long-term investment strategy.

We do suggest seeking guidance from an experienced tax professional to better understand how such transactions are taxed.

DAOs are member-owned communities with a shared vision. All the decisions in a DAO are made by the members in the absence of central leadership. They are new-age institutions that aim to democratise decision-making and allow people to have a say in decisions that directly affect them. DAOs are often called the soul of Web3 and allow members to earn rewards in multiple ways. DAO contributors are rewarded for their contributions to the organization, similar to how centralized organizations pay salaries to their employees. They also pay out bounties for one-time projects and redistribute any profits generated through operations.

Although there is no specific guidance on the taxation of income received from DAOs, it is likely non-taxable. It is advisable to seek guidance from an experienced tax professional or directly contact the MAS to better understand the tax implications of such transactions.

The subject of DeFi transactions is rarely discussed and is a potential grey area in the Singaporean tax framework. We do know that any income from lending or staking on DeFi protocols is taxable and is added to the overall income of an individual and is later taxed at a progressive tax rate based on the tax bracket one falls into.

Other than this, not much is known about DeFi taxation in Singapore. We suggest contacting the MAS directly or seeking the guidance of a tax professional to better understand the taxation of such transactions.

In Singapore, individuals are required to report their crypto taxes based on the calendar year.

Taxpayers must report their taxable income, including any gains from cryptocurrency trading, by April 15 for paper filing and April 18 for e-filing. It's essential to adhere to these deadlines to ensure compliance with Singapore's tax regulations regarding cryptocurrency transactions.

Filing crypto taxes in Singapore is a straightforward process that follows guidelines from the IRAS. Here's how you can do it step by step:

First, gather all the info about your crypto transactions, like buying, selling, and exchanges. Then, sort them into two main groups: ones where you used crypto for money, goods, or services, and those that are investment gains.

Next, you'll need to fill out the right tax forms from IRAS. These forms ask for your personal and financial details, like where your income comes from and the types of digital assets you deal with.

If you made profits by selling cryptocurrencies, it's essential to tell IRAS about it on the forms. This step is really important to make sure everything is correct.

Make sure to send in your tax forms by April 15th. If you're filing online, you have until April 18th. This deadline is important to remember to stay on track.

You can find more information about the tax forms here. It's a good resource to help you get everything right.

Although the MAS has no official record-keeping list, you should maintain the following documents as a precautionary measure to avoid complications while filing crypto taxes:

Now that you’re aware of how your crypto transactions are taxed and what forms you need to fill out to complete your tax report, here’s a step-wise breakdown of how Kryptos can make this task easier for you:

Visit kryptos.io and sign up using your email or Google/Apple Account

Choose your country, currency, time zone, and accounting method

Import all your transactions from wallets and crypto exchanges

Choose your preferred report and click on the generate report option on the left side of your screen, and let Kryptos do all the accounting.

Once your Tax report is ready, you can download it in PDF format.

If you still need clarification regarding the integrations or generating your tax reports, you can refer to our video guide here.

As previously mentioned, Singapore doesn’t levy many taxes on gains from crypto transactions nor does it offer many exemptions or tax credits for such transactions. Crypto losses are non-deductible in Singapore and there’s not much you can do to lower your tax bill.

1. Is Crypto Legal in Singapore?

A better way to ask this question would be “Are crypto investments legal in Singapore?” and the answer is yes. The country has a clear regulatory framework for digital assets, which includes guidelines and regulations for various crypto-related activities. The Monetary Authority of Singapore (MAS) oversees the regulatory aspects of crypto and has categorised different types of tokens to differentiate their treatment. Utility tokens and payment tokens have specific definitions and regulations, while security tokens are subject to securities laws.

Singapore has been proactive in embracing blockchain and crypto technologies while also focusing on investor protection and preventing illicit activities. As long as individuals and businesses comply with the relevant regulations and tax obligations, investing in crypto within the legal framework of Singapore is permissible.

2. How is Crypto Taxed in Singapore?

In Singapore, the taxation of crypto depends on the nature of activities. Trading crypto as a business incurs income tax, while long-term investments are generally not subject to taxation due to the absence of capital gains tax. Using crypto for payments is considered barter trade, and businesses providing goods/services in exchange for crypto are taxed based on the value. Fees in crypto transactions are subject to an 8% goods and services tax.

Mining is assessed based on whether it's a hobby or business activity, with business income being taxable. Staking and lending crypto may lead to income tax if earnings exceed a certain threshold. Reporting accurate crypto-related income is crucial to avoid legal issues.

3. Does Singapore have a capital gains tax?

No, Singapore does not have a capital gains tax. This means that capital gains from investments, including those made in cryptocurrencies, are not subject to taxation in the country. As a result, individuals and businesses can realise profits from their investments without incurring capital gains tax liabilities. However, it's important to note that while capital gains are generally not taxable, other forms of taxation, such as income tax, may apply to specific crypto-related activities based on their nature and purpose.

4. How can Kryptos simplify crypto taxes for you?

We’ve already discussed how to file your crypto taxes in the above sections of the guide, offering a stepwise breakdown of the entire process. However, we agree that it is unreasonably complicated even for someone with a fair amount of prior knowledge. However, there’s an easy way to file your crypto taxes using a crypto tax software called Kryptos.

All you need to do is log in on the platform, add all your trading accounts, wallets, and Defi accounts and sip coffee while Kryptos does all the heavy lifting for you. The platform auto-fetches all your transactions from the tax year and generates a legally compliant tax report within a matter of minutes while also suggesting ways to lower your tax bill. It works like magic, all you need to do is try it once.

All content on Kryptos serves general informational purposes only. It's not intended to replace any professional advice from licensed accountants, attorneys, or certified financial and tax professionals. The information is completed to the best of our knowledge and we at Kryptos do not claim either correctness or accuracy of the same. Before taking any tax position/stance, you should always consider seeking independent legal, financial, taxation or other advice from professionals. Kryptos is not liable for any loss caused by the use of, or by placing reliance on, the information on this website. Kryptos disclaims any responsibility for the accuracy or adequacy of any positions taken by you in your tax returns. Thank you for being part of our community, and we're excited to continue guiding you on your crypto journey!

.avif)