.avif)

Calculate Your Crypto

Taxes in Minutes

Are you a Belgian crypto investor wanting to learn more about crypto taxes? Well, you’re not alone. Crypto taxes are complicated, and the fact that tax authorities keep rolling up new guidelines makes it even tougher to navigate the space.

That’s why we created a comprehensive tax guide so that you don’t have to wander the web every time you make a crypto transaction. In this guide, we dive deep into the world of crypto taxes covering topics like capital gains tax, income tax, crypto gifts and donations tax, tax deadlines, crypto mining tax, crypto staking tax, DeFi taxes, NFT taxes and more.

Once you’re done reading this guide, you will have enough information to file your crypto taxes yourself.

So, Let’s dive in….

In Belgium, the primary tax on profits is Capital Gain Tax (CGT), which applies to gains from selling crypto assets. To calculate capital gains, subtract the acquisition cost and any additional charges from the disposal amount. The profits from the sale are then subject to CGT.

The following transactions will attract a CGT in Belgium:

The SPF – Service Public Fédéral Finances or the Belgian General Administration of Taxes also taxes crypto gains as income. Still, income taxes are a bit more complicated than CGT in Belgium.

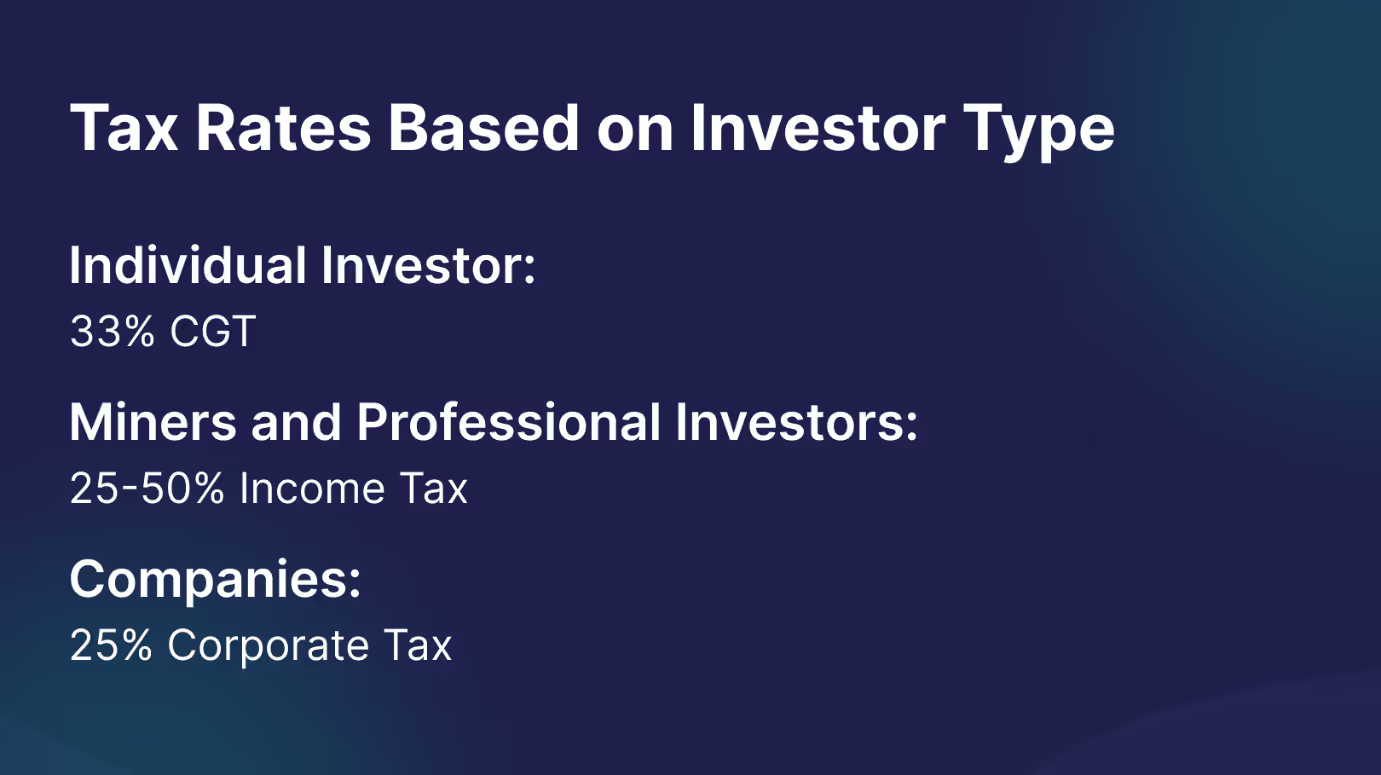

Investors are taxed differently based on specific circumstances and the nature of transactions. There are three different scenarios when it comes to the taxation of individual investors.

If crypto transactions are considered the standard management of private assets and the investor does not have a speculative intent, then these transactions are regarded as non-speculative and exempt from taxation. However, what constitutes "normal management" may vary for each investor based on the nature of their transactions.

Investors are typically classified as long-term investors without speculative intent if only a portion of their funds is allocated to crypto assets and a long-term strategy is implemented to oversee those investments.

Crypto traders, known for engaging in frequent trades with higher risk levels, are often perceived as individuals who make a living by speculating on asset prices and capitalizing on price movements through scalping. Since their focus is purely speculative and lacks a long-term perspective, they are regarded as speculative investors.

If a trader is not operating within a professional environment, their transactions are deemed speculative and subject to a flat tax rate of 33%, along with any applicable municipal surcharge. It's important to note that losses incurred can be deducted from taxable income, thereby reducing the overall tax liability.

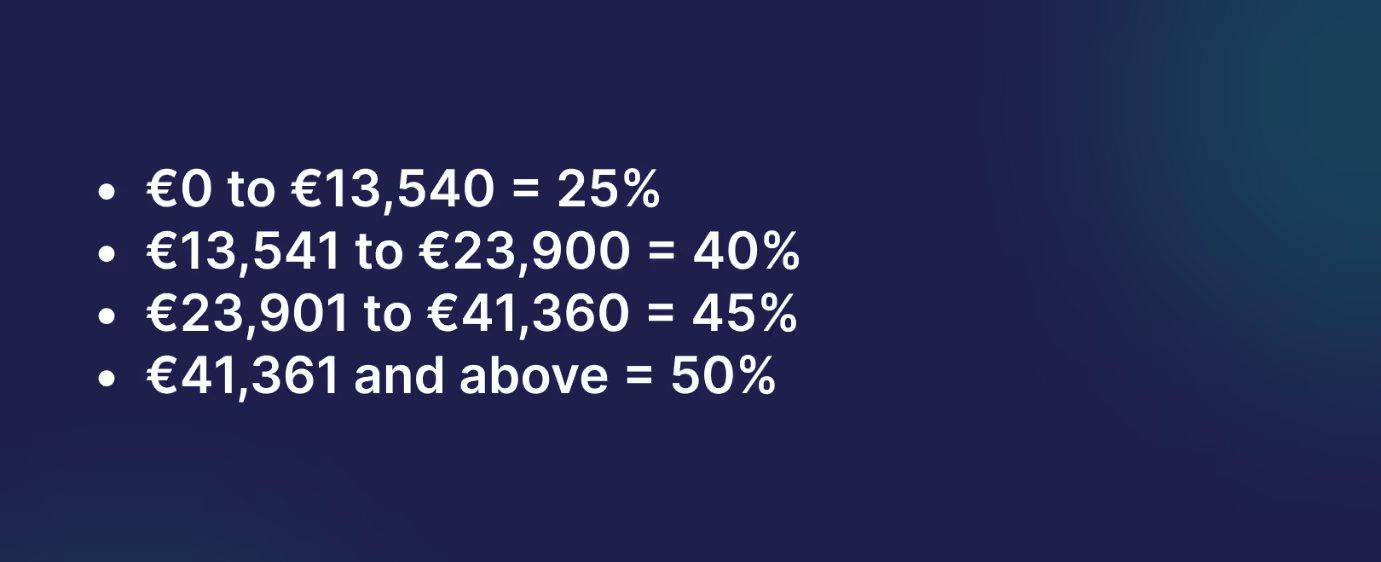

Professional traders, who frequently engage in high-risk trades and heavily speculate with a short-term perspective, face taxation on their income at a progressive rate ranging from 25% to 50%, depending on their tax bracket. It's important to note that this progressive tax rate does not include any municipal surcharges applicable to your gains.

In certain cases, income generated from crypto assets, such as mining, receiving assets through ICOs or airdrops, and other transactions, may be classified as professional income and taxed under income tax laws. The tax brackets for such cases align with those of professional traders, ranging from 25% to 50% based on the individual taxpayer's income.

There seems to be some confusion about how progressive tax rates work. So here’s an example to better understand that.

Let’s say a country has 3 tax brackets:

€0 - 10,000 taxed at 10%

€10,001 - 20,000 taxed at 20%

€20,001 and above taxed at 30%

And let’s assume you make a gain of €30,000.

Now the first €10,000 will be taxed at 10%

The next €10,000 will be taxed at 20%

And the remaining sum will be taxed at 30% since it falls into the third tax bracket.

Since there are three categories of investors in Belgium, one must decide which category they fall in before filing their crypto taxes.

But who decides this category?

The SPF does of course!

There’s an official list of questions that one needs to answer to identify which category they fall in, what kind of taxes will be levied on their transactions, and how much taxes they owe to the tax authorities.

Recent actions taken by the Belgian Special Tax Inspectorate (STI), as reported by Cointelegraph, indicate that the authorities have means to track crypto investor activity. The STI is specifically targeting Belgian residents with holdings in foreign tax exchanges, leveraging double tax agreements with countries like the U.S. to obtain information about Belgian taxpayers with assets in major exchanges such as Coinbase.

Instances have been reported where Belgian residents have received letters from the SPF requesting a comprehensive account of their crypto holdings dating back several years.

Moreover, starting from January 2026, an EU-wide directive known as DAC-8 will require all crypto exchanges and service providers to share investor details with EU member states, promoting better compliance and reporting.

To ensure compliance and avoid legal complications, it is advisable to maintain detailed transaction records and accurately report gains and losses to the SPF.

As mentioned earlier, Capital Gains Tax (CGT) is the prevalent tax applied to cryptocurrencies in Belgium. CGT is imposed on any profits realized from selling cryptocurrencies for fiat or exchanging one cryptocurrency for another.

Unlike many other countries, Belgium does not have a distinct tax framework that distinguishes between long-term and short-term capital gains. Instead, it levies a uniform flat rate of 33% on all capital gains.

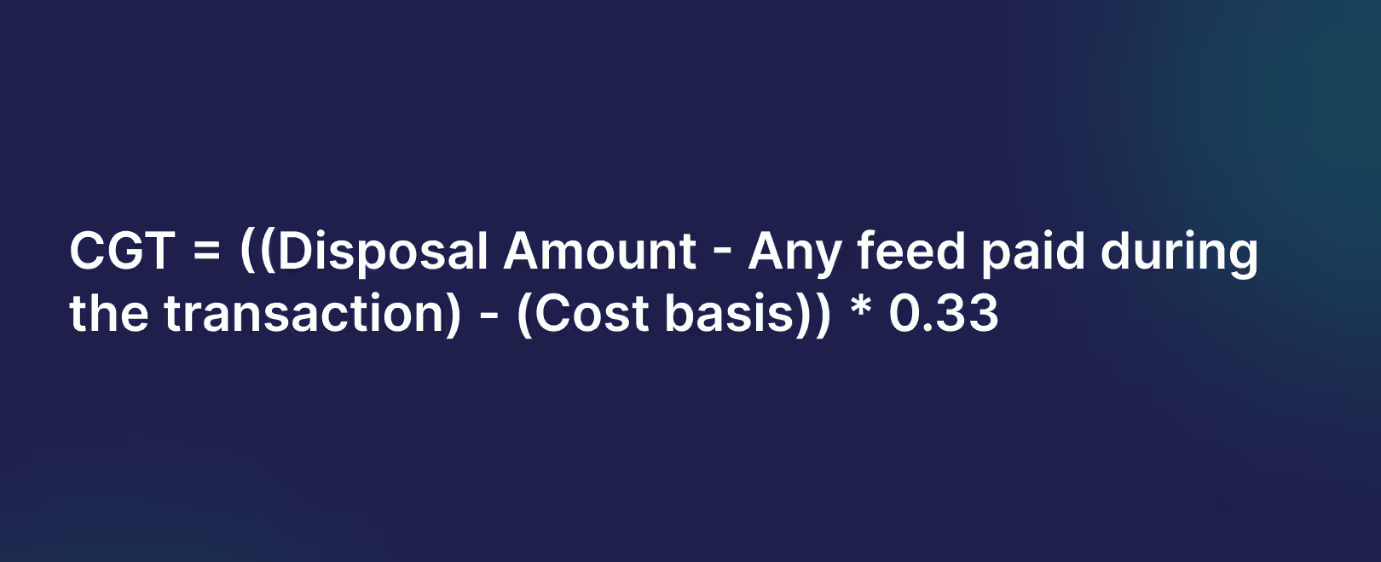

The formula to calculate CGT on your gains is pretty straightforward:

This can be better understood via an example:

Let’s calculate the capital gain on this transaction:

Disposal Amount = €21,000

Acquisition price = €17,000

Fees paid = €137

CGT = ((21,000 - 137) - 17,000) * 0.33 = (20,863 - 17,000) *0.33 = 3,863 *0.33 = €1274.79

In Belgium, there is no specific capital gains tax law that distinguishes between long-term and short-term gains for cryptocurrencies. Instead, tax authorities apply a flat tax rate of 33% to all gains derived from crypto transactions.

Calculating your crypto gains and losses is simple. Just deduct the acquisition amount from the disposal amount and you will have your gain or loss. If the difference is positive, it’s a gain, otherwise, it’s a loss.

Capital gain/loss = Disposal amount - Acquisition amount

Consider the following transactions:

Capital Gain/loss = €17,000 - €15,000 = €2,000 (It’s gain)

Capital Gain/loss = €800 - €1,200 = - €400 (It’s a loss)

Crypto losses are not taxable in Belgium. However, you can use your losses to lower your tax bill by deducting your losses. This is a common way to lower your tax liabilities and pay fewer taxes.

Therefore, it is prudent to record all your losses along with your gains and report them to SPF.

The SPF has not issued any guidance on how lost or stolen cryptocurrencies are treated from a tax standpoint. The determination of the status of such assets is likely to be made on a case-by-case basis. Therefore, it is advisable to reach out to the SPF directly for specific information and guidance regarding this matter.

The Belgian tax authorities do offer a few ways to reduce your tax bill.

You can offset your losses against gains and lower your taxable surplus capital. This method is called tax-loss harvesting and is one of the most popular methods used by crypto investors to lower their tax bills.

Gains are taxable only upon the sale of the assets. When you possess an asset that has increased in value since its acquisition, it represents an unrealized gain until the asset is disposed of. Once you sell the asset, the gains become realized, and you are required to pay taxes on those gains. Holding assets for the long term is an effective approach to potentially minimize tax liabilities.

In Belgium, non-speculative investors who adopt a long-term investment strategy are exempt from taxation on crypto transactions. If you allocate a portion of your capital to cryptocurrencies and your investment approach does not heavily rely on speculating on short-term price movements of crypto assets, any gains you earn from crypto transactions will not be subject to taxation.

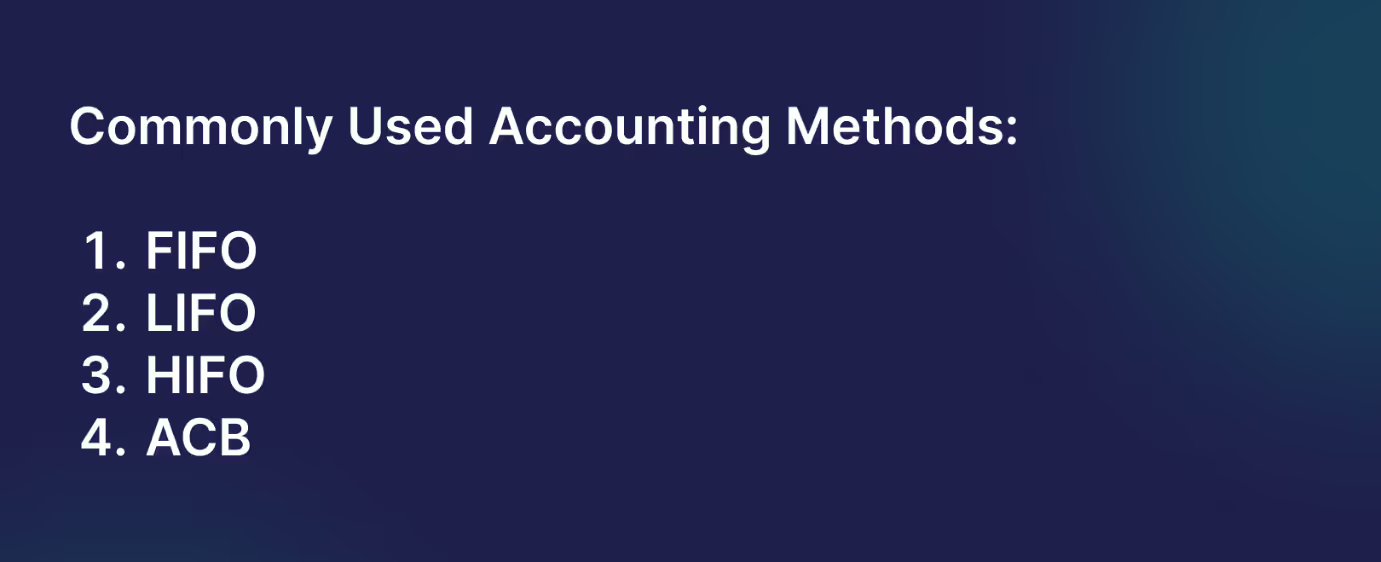

The SPF is yet to release specific guidance on which inventory method to use for cost-basis calculations and investors are free to pick any inventory method. There are numerous inventory methods used by investors globally, we will discuss some of the mainstream methods here.

The FIFO or First-In-First-Out accounting method is one of the most popular ones used by investors. It states that the first asset you buy is the first one you sell. It means that the cost basis of the oldest asset is used to calculate gains, losses, or income when disposal is made.

The LIFO or Last-In-First-Out accounting method is the opposite of the FIFO and states that the last asset you purchase is the first one you sell. This means that the cost basis of the newest asset is used for calculating the gains, losses, or income generated through subsequent disposals.

The HIFO or Highest-In-First-Out accounting method is slightly different in its approach compared to LIFO or FIFO. It states that the asset with the highest acquisition price is the first one to be sold. This means that when you dispose of an asset, you consider the cost highest acquisition price as the cost basis.

The Average Cost Base method simply considers the average acquisition price of an asset across all acquisitions as the individual cost basis. Note that when you use the ACB accounting method, the cost basis of all transactions remains the same regardless of when it was acquired.

Consider the following example:

13/01/24 - Louis bought 1 BTC for €12,000

15/02/24 - Louis bought 1 BTC for €18,000

14/03/24 - Louis bought 1 BTC for €16,500

18/06/24 - Louis sold 1 BTC for €22,000

Now we will calculate the capital gain using all the accounting methods discussed above.

Since we’re using the FIFO accounting method, the cost basis for the disposal will be equal to the acquisition price of the first BTC.

Cost Basis = €12,000 (as seen on 13/01/24)

Disposal Amount = €22,000

Capital Gain/loss = €22,000 - €12,000 = €10,000

In LIFO, the cost basis will be equal to the acquisition price of the BTC purchased last.

Cost Basis = €16,500

Disposal Amount = €22,000

Capital Gain/Loss = €22,000 - €16,500 = €5,500

In HIFO, the asset with the highest acquisition is the first one to be sold.

Cost Basis = €18,000

Disposal Amount = €22,000

Capital Gain/Loss = €22,000 - €18,000 = €4,000

The Average Cost Basis method considers the average acquisition price of the asset to be the cost basis.

Cost Basis = (€12,000 + €16,500 + €22,000)/3 = €15,500

Disposal Amount = €22,000

Capital Gain/Loss = €22,000 - €15,500 = €6,500

In certain cases, income generated from crypto assets can be classified as professional income and is subject to taxation under income tax laws in Belgium. Activities such as mining, staking, and receiving tokens from airdrops may attract income tax liabilities.

It's important to note that income tax in Belgium differs from capital gains tax. While a flat tax rate applies when it comes to capital gains tax, income tax rates are progressive and vary based on the individual's income level.

As previously mentioned, income tax in Belgium is progressive and varies between 25 and 50% based on the income level. Below is the breakdown of tax brackets for crypto income tax in Belgium.

Calculating Crypto Income is easier than calculating capital gains or losses. You just need to record the fair market value of all assets you receive through income-bearing transactions and add them together. The sum you end up with is your taxable income base.

Listed below are some of the tax-free transactions in Belgium:

Listed below are transactions that attract tax liabilities in Belgium:

The SPF is yet to provide specific guidance on how income from crypto mining is taxed in Belgium. Since crypto mining involves securing a network by validating transactions, the mining rewards can be perceived either as self-produced assets or as compensation for services rendered to the network. The interpretation of tax authorities regarding this matter may impact the tax implications.

To gain clarity on the tax implications of income generated from mining activities, it is advisable to directly contact the SPF and seek their guidance on the subject.

Mining and staking are both processes for validating transactions on a network. Mining is typically used in Proof-of-Work networks like Bitcoin, while staking is the preferred method for validating transactions in Proof-of-Stake networks.

In mining, participants receive new tokens as rewards for validating transaction blocks. On the other hand, Proof-of-Stake networks do not distribute new tokens as mining rewards. Instead, stakers can earn network fees as their reward for staking tokens.

There have been instances where legal professionals have presented arguments in court, stating that staking rewards should be considered similar to interest income and treated as movable assets, thereby subject to a tax rate of 30%.

Nevertheless, there is no definitive guidance available on how staking rewards are specifically viewed for tax purposes. Therefore, we recommend reaching out to the SPF for an individual assessment and further clarification regarding the tax treatment of staking rewards.

According to a ruling dated 03.05.2022, any gains incurred from crypto transactions inclusive of airdrops will be treated as miscellaneous income and taxed at a flat rate of 33%. Forks on the other hand are a bit more complicated since there is no clear guidance or ruling regarding the same.

We suggest seeking guidance from a professional tax consultant or contacting the SPF for a personal assessment to better understand the tax implications.

The SPF is yet to release specific guidance on how crypto gifts and donations are treated from a tax perspective in Belgium. However, if we consider crypto donations to be similar to other forms of donations, it is reasonable to assume that crypto gifts and donations will be subject to gift taxes.

In Belgium, inheritance tax is imposed on heirs or legatees who receive assets from the estate of a deceased Belgian resident. Moreover, a specific type of inheritance tax applies when a non-resident passes away but holds tangible assets within the country. In this case, the tax is calculated based on the gross value of the assets, rather than the net value received by individuals. The amount of inheritance tax varies depending on the region in which the deceased had their physical residence.

Gifting in Belgium should be done through a notary deed to meet the requirements. Since all notary deeds need to be registered, Belgian gift taxes are applicable. However, manual and indirect gifts are exempt from these taxes.

The gift tax rates differ depending on the region where the gift is registered. In the Flemish, and Brussels capital regions, registered gifts of movables are subject to a reduced flat registration rate:

As per Article 7 of the Inheritance Taxation Codes (IHTC) in every region, gifts made within three years before the donor's death, which were not subjected to Belgian gift taxes, are considered part of the donor's estate and subject to inheritance taxes. These gifts need to be reported in the inheritance tax return at the time of the donor's death.

Recently, there has been a significant reform of the inheritance tax law at the federal level, with the new rules coming into effect on September 1, 2018. Consequently, many changes have been implemented in regional inheritance taxes, therefore it is advisable to seek specific advice in this regard.

There is no specific guidance on how crypto margin trades, futures, and CFDs are taxed in Belgium. However, any income made from crypto margin trades, futures, and CFDs will be taxed as miscellaneous income.

However, we do suggest seeking guidance from an experienced tax professional or directly contacting the SPF for a personal assessment to better understand the tax implications.

ICOs are special events that allow investors to own native tokens from an unreleased project in exchange for mainstream tokens like Bitcoin and Ethereum. ICOs are similar to IPOs in the traditional securities market.

Although there is no clear guidance on how such transactions are viewed from a tax perspective, ICOs are usually treated as crypto-to-crypto trades in most tax jurisdictions and the SPF would likely treat them the same way.

However, a prudent approach would be to contact SPF directly and seek clarification on the same.

There is no specific guidance from SPF regarding the taxation of NFT-related transactions, we are constantly on the lookout for guidelines on the subject and will add all relevant details here as soon as the guidelines hit our radar.

DAOs are member-owned communities with a shared vision. All the decisions in a DAO are made by the members in the absence of central leadership. They are new-age institutions that aim to democratise decision-making and allow people to have a say in decisions that directly affect them. DAOs are often called the soul of Web3 and allow members to earn rewards in multiple ways. Contributors are rewarded for their contributions to the organization, similar to how centralized organizations pay salaries to their employees. They also pay out bounties for one-time projects and redistribute any profits generated through operations.

The subject of DAO taxation is another grey area in the Belgian tax regime and the SPF is yet to release any specific guidelines on the subject. Although any income from DAOs will likely be taxed as miscellaneous income, we suggest seeking help from an experienced tax professional to better understand the tax implications.

A legal precedent set by the European Court of Justice (ECJ) during Skatteverket v David Hedqvist Case C-264/14 clarifies that cryptocurrencies are contract-based payment avenues and that any transaction made with them constitutes a financial transaction.

And since there is no specific guidance issued by the SPF on the matter, there’s likely no VAT on crypto transactions in Belgium. However, we do suggest seeking guidance from an experienced tax consultant for clarity.

DeFi transactions are much more complicated and their taxation is yet to be discussed by the SPF. Staking on DeFi protocols will likely be viewed as general staking activities and therefore taxed accordingly.

For more complicated transactions like yield farming, and liquidity mining, you might have to consult an experienced tax professional to better understand the associated tax implications.

If you’re using paper forms to submit your tax return, you must submit your tax report by June 30, 2026. If you’re submitting your tax return using the MyMinFin online portal you have until July 15 2026 to submit your tax return.

If you have specific income or if you’re filing your crypto taxes through an accountant, you have an extended deadline till mid-October 2026.

Crypto investors in Belgium are required to disclose taxable profits from their crypto investments by submitting an annual tax return to the tax authorities.

When reporting for the financial year 2024, you should include the net gain or loss from your transactions, as well as any income generated.

In certain cases, the tax authorities may request a detailed list of all transactions, including purchase and sale dates, proceeds, cryptocurrency costs, and any associated expenses.

In Belgium, you have the option to file your crypto tax return either online or through a paper form. Filing online is generally faster and more convenient, as your return comes pre-filled with information provided by your employer.

To file online, you will need either a Belgian electronic ID card or Itsme authentication.

Like most tax authorities, the SPF mandates detailed record-keeping for investors when it comes to crypto transactions. As a Belgian investor, you should maintain the following records:

Now that you’re aware of how your crypto transactions are taxed and what forms you need to fill out to complete your tax report, here’s a step-wise breakdown of how Kryptos can make this task easier for you:

If you still need clarification regarding the integrations or generating your tax reports, you refer to our video guide here.

Although you cannot avoid paying crypto taxes entirely, there are some strategies you can employ to lower your tax bill significantly. Some of them are mentioned below:

Losses are tax-deductible in Belgium and you can use them to offset your gains and lower your taxable income base.

Your assets are only taxable when you dispose of them and make a gain. You can hold on to your assets and avoid paying taxes on your unrealised gains.

Investors who have a part of their capital invested in crypto assets and have a long-term investment strategy that is not dependent on speculation are exempt from any taxes in Belgium.

All content on Kryptos serves general informational purposes only. It's not intended to replace any professional advice from licensed accountants, attorneys, or certified financial and tax professionals. The information is completed to the best of our knowledge and we at Kryptos do not claim either correctness or accuracy of the same. Before taking any tax position/stance, you should always consider seeking independent legal, financial, taxation or other advice from professionals. Kryptos is not liable for any loss caused by the use of, or by placing reliance on, the information on this website. Kryptos disclaims any responsibility for the accuracy or adequacy of any positions taken by you in your tax returns. Thank you for being part of our community, and we're excited to continue guiding you on your crypto journey!

.avif)