.avif)

Calculate Your Crypto

Taxes in Minutes

In the USA, whether you live in the sunny side of California or bustling NYC!

You'll have to pay your crypto taxes on your crypto earnings come this April 15th.

Not sure where to start? Worry not, we've got you covered!

Check out our guide for 2024 crypto tax rates in the USA to understand all about crypto taxes in the US, including Capital Gains Tax rates, Federal Income Tax rates, and State Income Tax rates, no matter where you reside.

So, how does crypto tax work in the US?

Well, there are a few key rates to keep in mind:

- Federal Income Tax

- State Income Tax (if applicable)

- Capital Gains Tax.

Your Income Tax is a combination of the Federal and State rates (if your state has one). Meanwhile, your Capital Gains Tax can be either 0%, 15% or 20%, depending on how much you earn annually - including any crypto profits. Capital Gains tax on the amount you'll owe depends on your investments and how long you've held onto them.

If you want a full detailed guide about USA Crypto Tax then check out our Ultimate USA Crypto Tax Guide, but to give you a quick Breakdown:

- If you sell, trade, or use your crypto that you've held for less than a year, you'll pay short-term Capital Gains Tax, along with Federal & State Income Tax.

- Any crypto you earn, whether it's from mining, staking, airdrops, or a hard fork, is subject to Federal & State Income Tax.

- When you sell, trade, or use crypto you've held for more than a year, you'll pay long-term Capital Gains Tax. And if you're dealing with NFTs that are seen as collectibles, you might be looking at a higher 28% rate for long-term Capital Gains Tax.

Now that you've got the basics, let's break it down further and see just how much you'll be paying out in crypto taxes.

Which Crypto Transactions are taxed and which ones aren't?

Here’s a simple breakdown:

- Buying and holding crypto? Tax Free!

- When you trade, sell, or spend crypto, you may be subjected to Capital Gains Tax*.

- Transferring crypto is usually tax-free, but watch out for transfer fees—they might be taxable.

- Got crypto through airdrops, hard forks, mining, or staking? That's considered income and subject to Income tax.

- Gifting crypto is tax-free within certain limits.

- Donating crypto to registered charities? It's tax-deductible.

- If you profit from margin trading, derivatives Capital Gains Tax* applies on the profits acquired.

- Adding/removing liquidity - Subjected to Capital Gains Tax*.

- DeFi investments Income Tax/Capital Gains Tax Applies*.

*Remember, whether you owe short or long-term Capital Gains Tax depends on how long you've held onto your assets.

How much Capital Gains tax do I owe on my crypto?

If you’re curious about the tax rate you'll owe on the money you make from crypto? Well, it depends on how long you've owned it. If it's been less than a year, you'll pay your regular Federal and State Income Tax rate on short-term crypto gains. But if you've held onto your crypto for more than a year, you'll pay a lower tax rate called the long-term Capital Gains Tax rate on your earnings. Just keep in mind that if you're dealing with NFTs which are considered collectibles, you might end up paying a higher 28% long-term Capital Gains Tax rate.

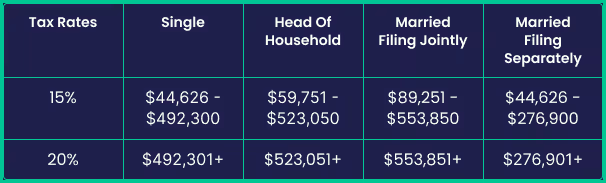

Capital Gains Tax rate for Long-Term Crypto in 2023

In 2023, here are the long-term crypto gains tax rates (applicable for taxes due in April 2024):

2023 Update

President Biden has proposed various tax reforms in the 2023 Federal Budget, potentially affecting crypto investors. One proposed change is increasing the long-term Capital Gains Tax rates for affluent investors from 20% to 39.6% for those earning over $1 million annually. Additionally, crypto may be included in the wash sale rule alongside stocks, limiting tax loss harvesting. However, these proposals are subject to approval. We'll keep you updated on any developments.

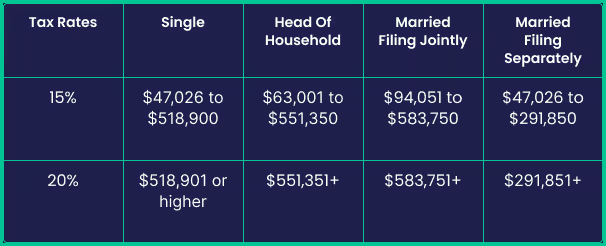

Crypto Capital Gains Tax rate for Long-Term Crypto in 2024

In 2024, the long-term crypto gains tax rates (for taxes due in April 2026) are as follows:

Capital Gains Tax Benefits

If your total income for 2023, including any money you made from crypto, is less than $44,625 (if you're filing as a single taxpayer), you won't have to pay any Capital Gains Tax on long-term gains. For 2024, this amount goes up to $47,026

How much Income Tax do you owe on crypto?

For any short-term gains from selling, swapping, or spending crypto you've owned for less than a year, you'll pay your regular Federal Income Tax rate (plus any applicable state taxes, which we'll talk about in a moment). The same tax rate applies to other types of crypto income, like mining rewards, staking rewards, airdrops, and hard forks.

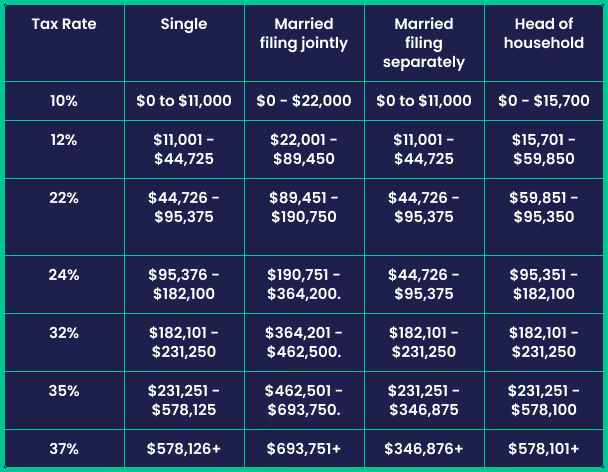

Short-Term Capital Gains Tax & Income Tax for 2023

The Federal Income Tax rates for 2023 (for taxes due in April 2024) are as follows:

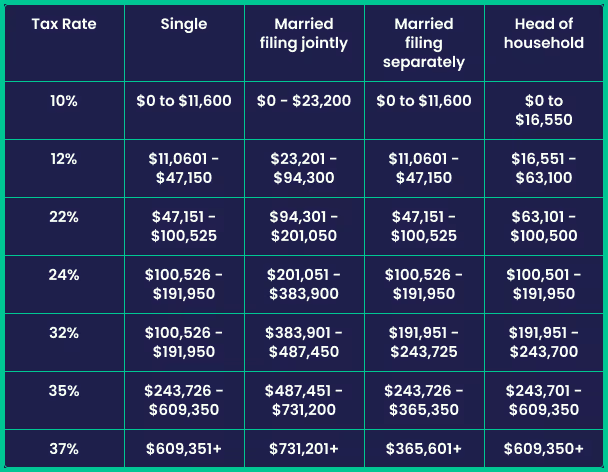

Short-Term Capital Gains Tax & Income Tax for 2024

The Federal Income Tax rates for 2024 (for taxes due in April 2026) are as follows:

USA State Tax Rates on Crypto

When you're dealing with Income Tax on crypto, you might have to pay both federal and state taxes. But here's the thing: most states haven't given clear instructions on how they tax cryptocurrency. So, it's best to talk to a crypto accountant to understand your state tax responsibilities.

Typically, states follow the federal rules for taxing crypto. This means they usually treat crypto as property, and the same tax rules that apply to property transactions will likely apply to crypto transactions too.

In simple terms, if you make short-term gains or earn income from crypto, you might pay State Income Tax.

State taxes can vary. In some states, your tax rate increases as you earn more, similar to how federal Income Tax works. In others, you might pay a flat income tax rate. And in some states, you might not pay any tax at all.

We won't go over every state here. But we'll give you a basic idea and talk about the most popular states for crypto investors.

Which States Have Provided Guidance on Crypto Taxes?

Only a few states have given advice on how cryptocurrency transactions are taxed, mostly focusing on whether sales tax applies rather than Income Tax. Here are the states that have offered guidance:

- California: Considers cryptocurrencies like cash and taxes purchases made with crypto the same as those made with fiat.

- Kentucky: Treats crypto as cash. Sellers accepting crypto payments need to convert them to USD and charge Kentucky sales and use tax.

- Kansas: Also treats cryptocurrencies as cash too. Sellers who accept crypto must convert the payment to USD and charge Kansas sales and use tax.

- Michigan: Michigan doesn't see cryptocurrencies as tangible personal property, so it doesn't impose sales and use tax on crypto purchases.

- New York: New York considers cryptocurrencies like cash and taxes purchases made with crypto just like those made with fiat.

- New Jersey: Similarly, Treats cryptocurrencies like cash and taxes purchases made with crypto just like those made with fiat.

- Pennsylvania: While Pennsylvania's guidance is limited, it suggests that NFTs might be subject to sales tax unless there's an exemption.

- Wisconsin: Wisconsin sees crypto as an intangible right rather than personal property. As a result, the sales price of crypto itself isn't taxed.

- Washington: Washington doesn't tax crypto purchases but treats purchases made with crypto like any other purchase. There's also detailed guidance on NFT taxes, with state sales tax often applicable.

Crypto Taxes in Texas

Texas, known for its thriving crypto mining industry, is becoming increasingly attractive for crypto investors. In addition to this, there's buzz about El Salvador, a big supporter of Bitcoin, considering opening a Bitcoin embassy in Texas. Moreover, a new bill is on the table in the Texas legislature. It suggests making purchases of goods and services with Bitcoin tax-free in the state.

States Without State Income Tax

Eight states in the US don't have an individual state income tax. These states are: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming.

But, it's not all sunshine and roses. Some of these states have higher taxes in other areas. For example, Washington is the first state to include NFTs in its sales tax rules. Now, sellers and retailers must charge a 6.5% state tax on NFTs.

Flat State Income Tax Rates on Crypto

10 states in the USA have a flat income tax rate. Here they are along with their tax rates:

- Colorado: 4.55%

- Illinois: 4.95%

- Indiana: 3.23%

- Kentucky: 5%

- Massachusetts: 5%

- Michigan: 4.25%

- New Hampshire: 5%

- North Carolina: 4.99%

- Pennsylvania: 3.07%

- Utah: 4.95%

It's important to know what counts as income in your state. For instance, in New Hampshire, regular income isn't taxed at the state level, only dividends and interest income.

Now that we've covered the basics, let's take a look at the 2 most popular states for crypto and their tax rates.

California Income Tax Rates

Curious about how much you'll pay in California state income taxes on crypto?

These are the California state income tax rates for 2023 (for taxes due in April 2024):

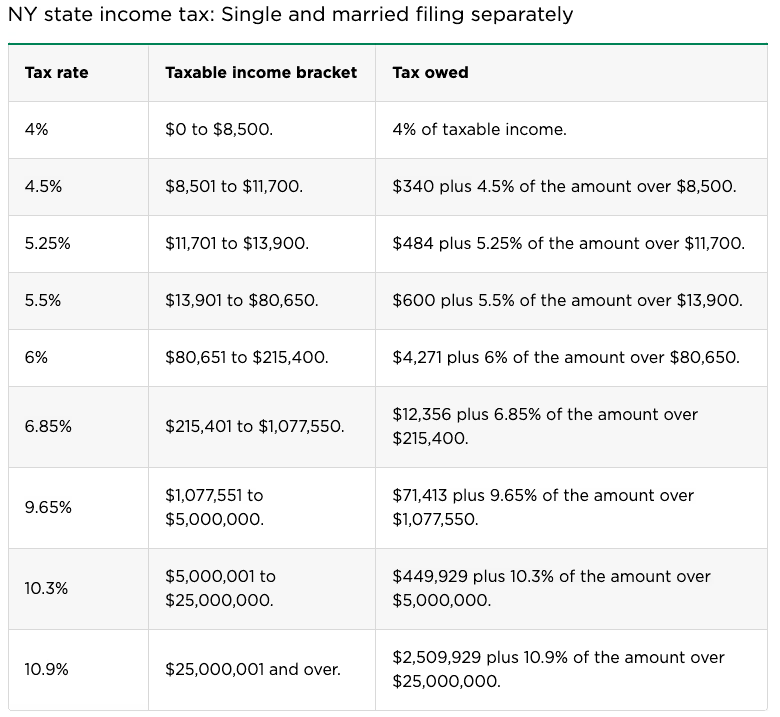

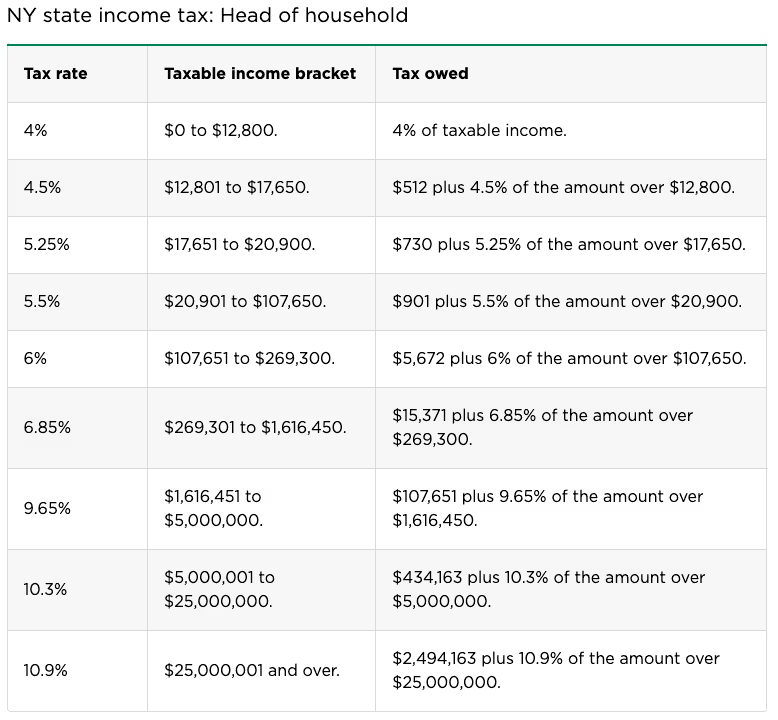

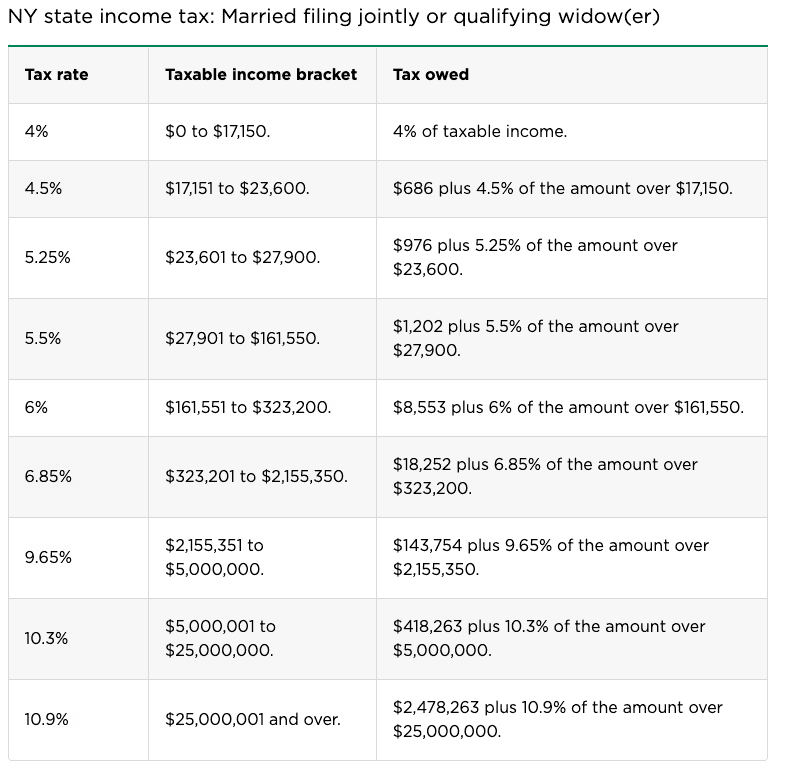

New York Income Tax Rates

Important Note: Along with the above rates, New York State imposes an extra tax on individuals with an adjusted gross income exceeding $107,650. Additionally, residents of New York City AKA (Yonkers) are subject to local income taxes, in addition to the state tax. These rates vary based on income and are 3.078%, 3.762%, 3.819%, and 3.876% respectively.

When to File Taxes for Crypto in USA

For most people, tax filing is part of their yearly routine, typically due by April 15th each year. If April 15th falls on a holiday or weekend, the deadline may be extended to the next business day.

Important Dates for US Taxes in 2023 - 2024

To keep track of your taxes in the USA, here are some key dates to remember:

- January 1st, 2023: The start of the 2023 tax year.

- April 18th, 2023: Deadline for filing your 2022 tax return, as confirmed by the IRS.

- June 15th, 2023: Deadline for US citizens living abroad to file their 2021 tax returns.

- October 16th, 2023: Deadline for taxpayers who got an extension to file their 2022 tax returns.

- December 31st, 2023: End of the 2023 tax year.

- January 1st, 2024: The start of the 2024 tax year.

- April 15th, 2024: Deadline for filing your 2023 tax return.

File Your USA Crypto Taxes with Kryptos

Kryptos is Your Personal Crypto Tax Assistant that simplifies crypto taxes. Not only does it effortlessly calculate your crypto taxes such as capital gains, losses, income, and expenses, but it also provides features to optimize your tax position.

Track your unrealized gains and losses with Kryptos, gaining insights into when to HODL and when to make decisions about your investments.

Kryptos offers support for various cost basis methods, including FIFO, LIFO, and HIFO. You can customize these settings to see how they impact your crypto taxes.

Beyond saving you from hours of spreadsheet work and calculations, Kryptos also cuts down the time spent on form-filling. For US investors, Kryptos generates pre-filled forms ready for submission to the IRS or your tax portal. These include - IRS Form 8949 & Schedule D, TurboTax Report, Tax Act Report, Complete Tax Report.

Make your crypto tax experience more efficient with Kryptos.

FAQs

1. What are the key tax rates to consider for crypto earnings in the USA?

Understanding the tax implications of your crypto earnings involves considering Federal Income Tax, State Income Tax (if applicable), and Capital Gains Tax. Federal Income Tax and State Income Tax rates vary depending on your income bracket, while Capital Gains Tax rates can be either 0%, 15% or 20%, determined by the duration of holding your assets.

2. Which crypto transactions are subject to taxation in the USA?

Crypto transactions such as selling, trading, or spending crypto typically incur Capital Gains Tax. Additionally, income from activities like mining, staking, airdrops, or hard forks is considered taxable income and subject to Federal & State Income Tax. However, buying and holding crypto generally do not trigger tax obligations.

3. How is Capital Gains Tax calculated for crypto earnings?

Capital Gains Tax on crypto earnings depends on the duration of holding the assets. Short-term gains (assets held for less than a year) are taxed at regular income tax rates, while long-term gains (assets held for over a year) are taxed at a lower rate. NFTs, considered collectibles, may incur a higher 28% long-term Capital Gains Tax rate.

4. What is the state of crypto taxation in the USA, particularly concerning different states?

While most states follow federal guidelines on taxing crypto, specific regulations vary. Some states, like California and New York, treat cryptocurrencies similarly to cash, while others have nuanced approaches. Additionally, states like Texas are considering measures to incentivize crypto adoption by exploring tax-free transactions with Bitcoin.

5. When are crypto taxes due in the USA, and how can one streamline the tax filing process?

Crypto taxes in the USA are typically due annually by April 15th, following the end of the tax year. Extensions may be available under certain circumstances. To simplify the tax filing process, platforms like Kryptos offer tools to calculate, track, and optimize crypto taxes, including generating pre-filled forms for IRS submission.

All content on Kryptos serves general informational purposes only. It's not intended to replace any professional advice from licensed accountants, attorneys, or certified financial and tax professionals. The information is completed to the best of our knowledge and we at Kryptos do not claim either correctness or accuracy of the same. Before taking any tax position / stance, you should always consider seeking independent legal, financial, taxation or other advice from the professionals. Kryptos is not liable for any loss caused from the use of, or by placing reliance on, the information on this website. Kryptos disclaims any responsibility for the accuracy or adequacy of any positions taken by you in your tax returns. Thank you for being part of our community, and we're excited to continue guiding you on your crypto journey!

| Step | Form | Purpose | Action |

|---|---|---|---|

| 1 | 1099-DA | Reports digital asset sales or exchanges | Use to fill out Form 8949. |

| 2 | Form 1099-MISC | Reports miscellaneous crypto income | Use to fill out Schedule 1 or C. |

| 3 | Form 8949 | Details individual transactions | List each transaction here. |

| 4 | Schedule D | Summarizes capital gains/losses | Transfer totals from Form 8949. |

| 5 | Schedule 1 | Reports miscellaneous income | Include miscellaneous income (if not self-employment). |

| 6 | Schedule C | Reports self-employment income | Include self-employment income and expenses. |

| 7 | Form W-2 | Reports wages (if paid in Bitcoin) | Include wages in total income. |

| 8 | Form 1040 | Primary tax return | Summarize all income, deductions, and tax owed. |

| Date | Event/Requirement |

|---|---|

| January 1, 2025 | Brokers begin tracking and reporting digital asset transactions. |

| February 2026 | Brokers issue Form 1099-DA for the 2025 tax year to taxpayers. |

| April 15, 2026 | Deadline for taxpayers to file their 2025 tax returns with IRS data. |

| Timeline Event | Description |

|---|---|

| Before January 1, 2025 | Taxpayers must identify wallets and accounts containing digital assets and document unused basis. |

| January 1, 2025 | Snapshot date for confirming remaining digital assets in wallets and accounts. |

| March 2025 | Brokers begin issuing Form 1099-DA, reflecting a wallet-specific basis. |

| Before Filing 2025 Tax Returns | Taxpayers must finalize their Safe Harbor Allocation to ensure compliance and avoid penalties. |

| Feature | Use Case Scenario | Technical Details |

|---|---|---|

| Automated Monitoring of Transactions | Alice uses staking on Ethereum 2.0 and yield farming on Uniswap. Kryptos automates tracking of her staking rewards and LP tokens across platforms. | Integrates with Ethereum and Uniswap APIs for real-time tracking and monitoring of transactions. |

| Comprehensive Data Collection | Bob switches between liquidity pools and staking protocols. Kryptos aggregates all transactions, including historical data. | Pulls and consolidates data from multiple sources and supports historical data imports. |

| Advanced Tax Categorization | Carol earns from staking Polkadot and yield farming on Aave. Kryptos categorizes her rewards as ordinary income and investment income. | Uses jurisdiction-specific rules to categorize rewards and guarantee compliance with local tax regulations. |

| Dynamic FMV Calculation | Dave redeems LP tokens for Ethereum and stablecoins. Kryptos calculates the fair market value (FMV) at redemption and during sales. | Updates FMV based on market data and accurately calculates capital gains for transactions. |

| Handling Complex DeFi Transactions | Eve engages in multi-step DeFi transactions. Kryptos tracks value changes and tax implications throughout these processes. | Manages multi-step transactions, including swaps and staking, for comprehensive tax reporting. |

| Real-Time Alerts and Updates | Frank receives alerts on contemporary tax regulations affecting DeFi. Kryptos keeps him updated on relevant changes in tax laws. | Observe regulatory updates and provide real-time alerts about changes in tax regulations. |

| Seamless Tax Reporting Integration | Grace files taxes using TurboTax. Kryptos integrates with TurboTax to import staking and yield farming data easily. | Direct integration with tax software like TurboTax for smooth data import and multi-jurisdictional reporting. |

| Investor Type | Impact of Crypto Tax Updates 2025 |

|---|---|

| Retail Investors | Standardized crypto reporting regulations make tax filing easier, but increased IRS visibility raises the risk of audits. |

| Traders & HFT Users | To ensure crypto tax compliance, the IRS is increasing its scrutiny and requiring precise cost-basis calculations across several exchanges. |

| Defi & Staking Participants | The regulations for reporting crypto transactions for staking rewards, lending, and governance tokens are unclear, and there is a lack of standardization for decentralized platforms. |

| NFT Creators & Buyers | Confusion over crypto capital gains tax in 2025, including the taxation of NFT flips, royalties, and transactions across several blockchains. |

| Crypto Payments & Businesses | Merchants who take Bitcoin, USDC, and other digital assets must track crypto capital gains for each transaction, which increases crypto tax compliance requirements. |

| Event | Consequences | Penalties |

|---|---|---|

| Reporting Failure | The tax authorities can mark uncontrolled revenues and further investigate. | Penalty fines, interest on unpaid taxes and potential fraud fees if they are deliberately occurring. |

| Misreporting CGT | Misreporting CGT Error reporting profits or losses can trigger the IRS audit. | 20% fine on under -ported zodiac signs, as well as tax and interest. |

| Using decentralized exchanges (DEXs) or mixers without records | The IRS can track anonymous transactions and demand documentation. | Possible tax evasion fee and significant fine. |

| Disregarding Bitcoin mining tax liabilities | Mining reward is considered taxable income, and failure of the report can be regarded as tax fraud. | Further tax obligations, punishment and potential legal steps. |

| Foreign crypto holdings: Non-disclosure | Foreign-accepted crypto FATCA may be subject to reporting rules. | Heavy fines (up to $ 10,000 per fracture) or prosecution for intentional non-transport. |

File Your Crypto Tax in Minutes