.avif)

Calculate Your Crypto

Taxes in Minutes

Before 2017, cryptocurrencies in the Czech Republic followed EU regulations instead of local laws.

However, in 2017, the Czech government updated its regulations, introducing new obligations for banks, cryptocurrency exchanges, and financial service providers. To avail services, customers are now required to verify their identity.

This legal change has made it easier to prosecute tax evaders and those engaging in illegal cryptocurrency activities in the Czech Republic. Consequently, there is a rising interest in taxing cryptocurrency users. If you're considering investing, it's crucial to understand the implications of crypto taxes in the Czech Republic and how to ensure compliance. Discover more to make informed decisions about your cryptocurrency ventures.

To understand crypto tax laws in detail do check out our complete guide on the Czech Republic Tax laws Guide.

Is Crypto Taxed in the Czech Republic?

One of the fundamental questions surrounding cryptocurrency is its taxability. In the Czech Republic, cryptocurrencies are subject to taxation, but the process is distinct from traditional currencies. Unlike fiat money, cryptocurrencies are not recognized as legal tender. This unique classification has significant implications for how these assets are taxed in the country.

The tax treatment of cryptocurrencies in the Czech Republic is not based on local regulations alone. Instead, the country relies on European guidelines and rules to govern the taxation of crypto assets in the region. The absence of official recognition as legal tender means that cryptocurrencies are not subject to payment system laws. Instead, their taxation falls under the umbrella of income tax.

Is Crypto Regulated in the Czech Republic?

Understanding the regulatory landscape is crucial when delving into the tax implications of cryptocurrency. Cryptocurrencies are mostly unregulated in the Czech Republic. Rather than being treated as a currency, cryptocurrencies are classified as “commodities”. This unique categorization places them outside the traditional framework of monetary regulations.

The Czech National Bank (CNB) has adopted a "light-touch, liberal approach" to cryptocurrency regulation. The Vice-Governor of CNB emphasized that while the country does not actively promote or protect cryptocurrencies, it also refrains from banning or hindering their development. This approach positions the Czech Republic as a jurisdiction where cryptocurrencies can operate without burdensome restrictions.

What Are the Tax Implications of Cryptocurrency in the Czech Republic?

Understanding the tax implications of cryptocurrency transactions is crucial for individuals and businesses operating in the Czech Republic. The taxation of crypto transactions depends on the nature of each transaction.

For individuals engaged in trading cryptocurrencies, gains are subject to a 15% tax rate. On the other hand, businesses face a 19% tax rate on similar gains. This disparity in tax rates for individual and business crypto gains creates a unique landscape, especially considering that cryptocurrencies are not officially recognized as a form of currency.

Individuals receiving compensation in cryptocurrency are required to pay income tax on their earnings, mirroring the taxation of fiat income. The tax base for such transactions is calculated by combining the income from selling cryptocurrencies, the value of the cryptocurrencies in Czech Korunas, and deducting any incurred expenses.

Can the Czech Government Track Crypto?

Transparency in crypto transactions is a priority for the Czech government. As a member of the European Union, the Czech Republic adheres to the Anti-Money Laundering Directive (AMLD-5) enacted in July 2018. This directive requires crypto exchanges and related entities to comply with Know Your Customer (KYC) regulations and maintain detailed customer records.

In addition to following AML regulations, the Czech government has taken steps to directly regulate crypto exchanges and wallets. Any entity offering cryptocurrency services, including buying, selling, storing, managing, or mediating transactions, is subject to Czech AML regulations. Attempting to conceal transaction details to evade taxes can lead to legal consequences, emphasizing the importance of transparency in crypto dealings.

Capital Gains Tax in Czech Republic

Contrary to some jurisdictions, the Czech Republic does not impose a specific capital gains tax on cryptocurrency gains. Instead, gains from trading cryptocurrencies as an individual are taxed at a flat rate of 15%. This aligns with the taxation of other forms of income in the country.

Calculating capital gains in the Czech Republic involves determining the disposal amount and cost basis. The cost basis is the acquisition price of the cryptocurrency, including any additional fees.

Calculating Crypto Capital Gains

The difference between the disposal amount and cost basis represents the capital gain or loss.

Formula: Capital Gains/Loss = Disposal Amount - Cost Basis

Practical Example:

Consider Antonin, who bought 1 ETH for 32,000 CZK and sold it six months later for 40,000 CZK, paying a 1,200 CZK transaction fee. The cost basis are calculated as follows:

Cost Basis = Acquisition Price + Transaction Fee

= 32,000 + 1,200

= 33,200 CZK

Disposal Amount = 40,000 CZK

Capital Gain or Loss = Disposal Amount - Cost Basis

= 40,000 - 33,200

= 6,800 CZK

Crypto Losses and Their Tax Treatment

In the Czech Republic, losses from cryptocurrency transactions can be deducted from other income within the same year or carried forward for up to two years. However, there are limitations on deductions for specific categories, such as trading.

The tax treatment of cryptocurrency losses is an area where clarity is needed, especially regarding the categorization of trading activities. Seeking guidance from tax professionals is recommended to navigate this aspect effectively.

Lost or Stolen Crypto

The tax implications of lost or stolen cryptocurrency remain unclear in the Czech Republic. While there is no specific guidance on this matter, it is likely that the status of such assets will be reviewed on a case-by-case basis. Individuals facing situations of lost or stolen crypto are encouraged to directly contact tax authorities for clarification on the treatment of these assets.

Tax Breaks in Czech Republic

Despite the tax obligations associated with cryptocurrency transactions, the Czech government offers various exemptions to help lower the overall tax burden. These exemptions include:

- General personal tax credit increased from 27,840 CZK to 30,840 CZK this year.

- Child tax credits, providing specific allowances for each child.

- Dependent spouse tax credit for spouses with lower incomes.

- Disability tax credits based on the severity of the disability.

- Student tax credits for eligible students up to a certain age.

Leveraging these tax breaks can significantly impact an individual's or business's overall tax liability.

Crypto Cost Basis Methods in Czech Republic

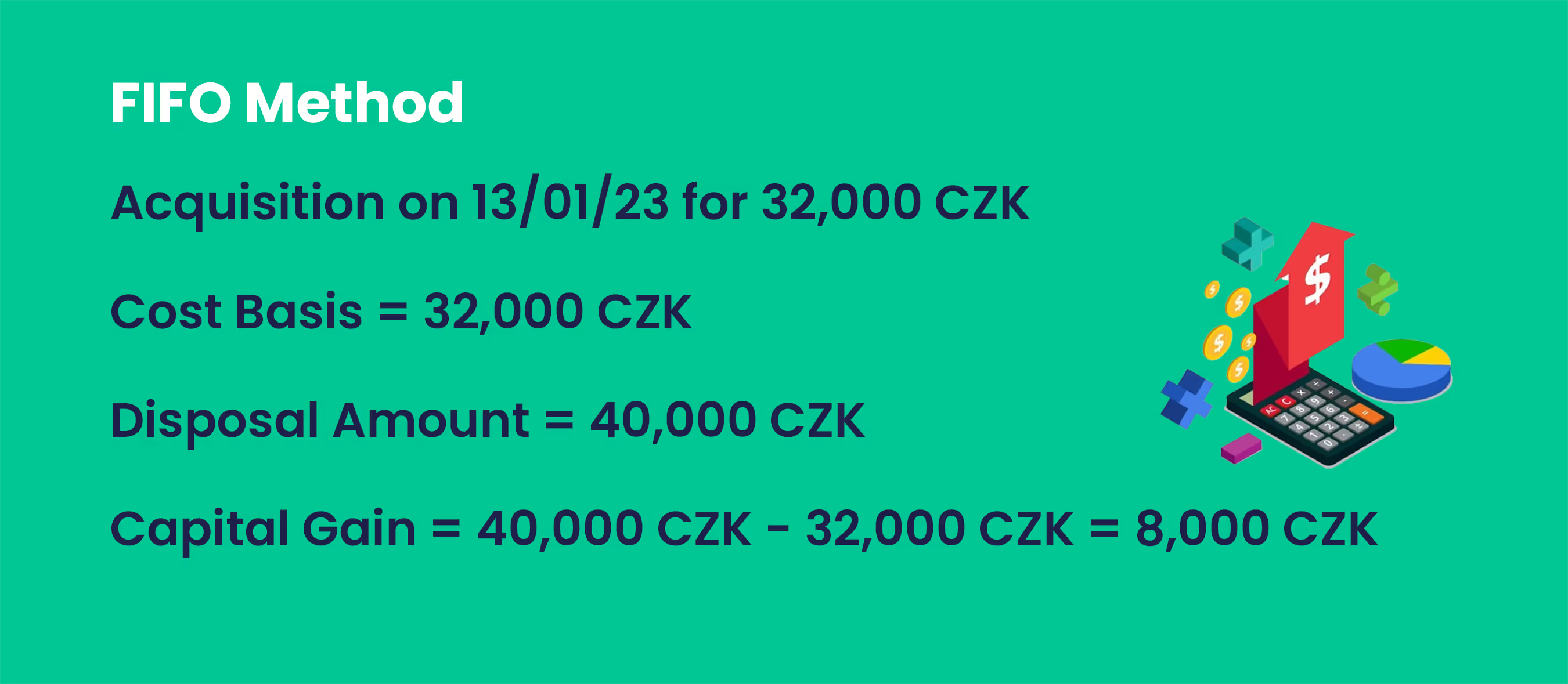

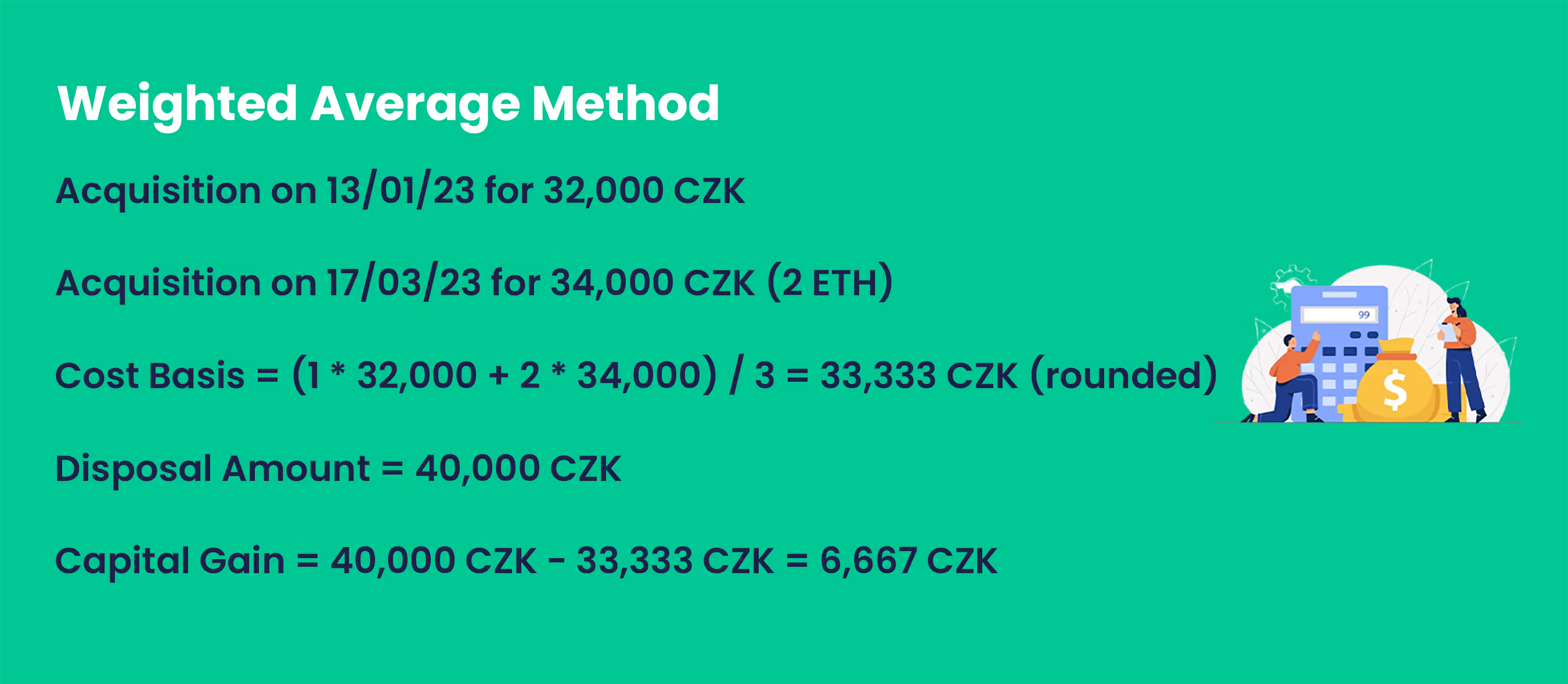

While the Czech Republic does not impose a capital gains tax, calculating gains for tax purposes remains essential. Two accepted accounting methods for determining the cost basis in the Czech Republic are the FIFO (First-In-First-Out) method and the Weighted Arithmetic Average Method.

- FIFO Accounting Method: This method dictates that the first asset acquired is considered the first one sold. The acquisition price of the earliest asset purchased is used as the cost basis for the most recent disposal.

- Weighted Arithmetic Average Method: This method calculates the cost basis as the weighted average of all assets in possession. This approach provides a different perspective on the cost basis, potentially impacting capital gain calculations.

Using a practical example, let's examine two transactions with different accounting methods:

On January 13, 2023, David invested 32,000 CZK to purchase 1 ETH.

Later, on March 17, 2023, he expanded his crypto portfolio by acquiring an additional 2 ETH at a rate of 34,000 CZK each.

Fast forward to May 27, 2023, and David decided to sell 1 ETH for 40,000 CZK.

Now, let's take a closer look at these transactions. By using both FIFO and Weighted Average accounting methods, we aim to determine the cost basis and explore the impact of these accounting techniques on capital gains calculations.

Let’s start with the FIFO accounting method. Considering the initial acquisition on January 13, 2023, where David spent 32,000 CZK, we'll unravel the subsequent computations to gain valuable insights into the implications of using FIFO.

The choice of accounting method can significantly impact capital gains calculations, emphasizing the need for careful consideration, and once selected for a particular asset, it must be consistently applied.

Crypto Income Tax in Czech Republic

Receiving cryptocurrency as compensation for services or product sales incurs income tax in the Czech Republic. Unlike capital gains, crypto income is subject to a progressive tax rate based on the final income tax base.

The tax rate for crypto income is as follows:

- Income below the social security payments cap is taxed at 15%.

- Income above the cap is taxed at a 23% rate.

Calculating crypto income involves summing up the fair market value of all received crypto assets from various sources, such as airdrops, staking, mining, and others.

Tax-Free and Taxed Crypto Transactions

Certain crypto transactions are tax-free, including:

- HODLing crypto assets as individual investors.

- Transferring crypto between personal wallets.

- Buying crypto with fiat.

On the other hand, the following transactions are taxed:

- Selling crypto assets for fiat.

- Trading one crypto asset for another.

- Staking crypto.

- Mining crypto.

- Earning returns from DeFi transactions.

- Receiving tokens from airdrops and forks.

- Buying products or services with crypto.

Each of these transactions has specific tax implications that individuals and businesses must consider.

Tax on Mining and Staking Crypto

Mining rewards in the Czech Republic are considered miscellaneous income and are taxed under existing income tax laws. Individual taxpayers face a flat rate of 15%, while companies engaged in mining activities for profit are subject to a 19% tax rate.

Staking rewards, despite the technological differences from mining, are often treated similarly for tax purposes. While specific guidance on staking rewards in the Czech Republic is limited, aligning with existing regulations on miscellaneous income is recommended.

Tax on Airdrops, Forks, and NFTs

Tokens received from airdrops or forks are treated as additional income and are subject to taxation under existing income tax laws. Soft forks, where no new tokens are generated or distributed, are not considered taxable events.

The tax treatment of NFT transactions in the Czech Republic lacks specific guidance. However, it is likely that any income from trading or swapping NFTs will be viewed as income and taxed at a flat rate of 15% for individuals and 19% for businesses.

Crypto Gifts, Donations, Margin Trades, and ICOs

Gifts and donations in crypto are subject to taxation in the Czech Republic, unlike many other jurisdictions. The integration of inheritance and gift taxes into income tax has implications for the taxation of crypto gifts. However, crypto donations are tax-deductible, offering an avenue for individuals to support causes while benefiting from potential tax relief.

Gains from margin or leverage trades, crypto derivatives, ICOs, and DeFi transactions are taxed similarly to regular crypto trades. The flat tax rates of 15% for individuals and 19% for businesses apply to gains from these activities.

When to Report Crypto Taxes in Czech Republic

Well, in the Czech Republic, the usual deadline for filing and paying crypto taxes falls on April 3rd of the following year after the tax period. If you opt for electronic filing, you automatically get an extension until May 2nd, 2024, and you can request additional extensions if needed. Once your tax return is approved by the authorities, you can expect tax refunds to be processed within 30 days.

How to File Crypto Taxes in Czech Republic

Crypto taxes in the Czech Republic can be filed either offline using traditional tax forms or through various online service providers. Filing online offers the advantage of a deadline extension and increased convenience. Service providers like CzechTaxesOnline and NeoTax facilitate the online filing of crypto taxes. For a seamless approach use Czech Republic Best Crypto tax software like Kryptos.

Maintaining detailed records of all transactions, including dates, times, volumes, and fees, is essential for accurate reporting. While the authorities have not published an official list of required documents, this comprehensive record-keeping ensures compliance with tax regulations.

How to Avoid Crypto Taxes in the Czech Republic

The Czech government provides a number of tax exemptions and allowances that you can use to reduce your tax bill:

- The General personal tax credit will be increased from 27,840 CZK to 30,840 CZK this year.

- In the Czech Republic, you get tax breaks for every child you have.

15,204 CZK for the first child

22,320 CZK for the second child

- Since 2021, there is a special tax bonus if the total tax is less than the child credit, with no maximum limit.

- If your spouse's income is < 68,000 CZK, you get a spouse credit of 24,840 CZK.

- There are exemptions based on the severity of the disability: CZK 2,520, CZK 5,040, or CZK 16,140.

- There is also a student tax credit, with regular students up to the age of 26 and university students up to the age of 28 receiving a 4,020 CZK exemption.

How to File Crypto Taxes using Kryptos?

Now that you know how your cryptocurrency transactions are taxed and what paperwork you need to fill out to complete your tax report, here's a step-by-step overview of how kryptos can simplify your tax process:

- Visit kryptos and sign up using your email or Google/Apple Account

- Choose your country, currency, time zone, and accounting method

- Import all your transactions from wallets and crypto exchanges

- Choose your preferred report and click on the generate report option on the left side of your screen and let kryptos do all the accounting.

- Once your Tax report is ready, you can download it in PDF format.

If you still need clarification regarding the integrations or generating your tax reports, you refer to our video guide.

FAQs

1. Is Crypto Taxed in the Czech Republic?

Yes, cryptocurrencies in the Czech Republic are subject to taxation. However, unlike traditional currencies, cryptocurrencies are not recognized as legal tender. The taxation is based on European guidelines and falls under the umbrella of income tax rather than payment system laws.

2. Is Crypto Regulated in the Czech Republic?

Cryptocurrencies in the Czech Republic are largely unregulated and are classified as commodities rather than currencies. The regulatory approach is described as "light-touch" by the Czech National Bank. While not actively promoted, cryptocurrencies are not banned, allowing them to operate with relative freedom.

3. What Are the Tax Implications of Cryptocurrency in the Czech Republic?

For individuals trading cryptocurrencies, gains are subject to a 15% tax rate, while businesses face a 19% tax rate. Compensation received in cryptocurrency is taxed similar to fiat income. The tax base is calculated by combining income from selling cryptocurrencies, their value in Czech Korunas, and deducting any incurred expenses.

4. Can the Czech Government Track Crypto?

Yes, the Czech Republic, as an EU member, adheres to Anti-Money Laundering Directive (AMLD-5) regulations. Crypto exchanges and related entities must comply with Know Your Customer (KYC) regulations, and any attempt to conceal transaction details can lead to legal consequences.

5. What Are the Tax Breaks in the Czech Republic for Crypto Transactions?

Despite tax obligations, the Czech government offers exemptions, including personal tax credits, child tax credits, dependent spouse tax credits, disability tax credits, and student tax credits. Leveraging these exemptions can significantly reduce the overall tax liability for individuals and businesses.

All content on Kryptos serves general informational purposes only. It's not intended to replace any professional advice from licensed accountants, attorneys, or certified financial and tax professionals. The information is completed to the best of our knowledge and we at Kryptos do not claim either correctness or accuracy of the same. Before taking any tax position / stance, you should always consider seeking independent legal, financial, taxation or other advice from the professionals. Kryptos is not liable for any loss caused from the use of, or by placing reliance on, the information on this website. Kryptos disclaims any responsibility for the accuracy or adequacy of any positions taken by you in your tax returns. Thank you for being part of our community, and we're excited to continue guiding you on your crypto journey!

| Step | Form | Purpose | Action |

|---|---|---|---|

| 1 | 1099-DA | Reports digital asset sales or exchanges | Use to fill out Form 8949. |

| 2 | Form 1099-MISC | Reports miscellaneous crypto income | Use to fill out Schedule 1 or C. |

| 3 | Form 8949 | Details individual transactions | List each transaction here. |

| 4 | Schedule D | Summarizes capital gains/losses | Transfer totals from Form 8949. |

| 5 | Schedule 1 | Reports miscellaneous income | Include miscellaneous income (if not self-employment). |

| 6 | Schedule C | Reports self-employment income | Include self-employment income and expenses. |

| 7 | Form W-2 | Reports wages (if paid in Bitcoin) | Include wages in total income. |

| 8 | Form 1040 | Primary tax return | Summarize all income, deductions, and tax owed. |

| Date | Event/Requirement |

|---|---|

| January 1, 2025 | Brokers begin tracking and reporting digital asset transactions. |

| February 2026 | Brokers issue Form 1099-DA for the 2025 tax year to taxpayers. |

| April 15, 2026 | Deadline for taxpayers to file their 2025 tax returns with IRS data. |

| Timeline Event | Description |

|---|---|

| Before January 1, 2025 | Taxpayers must identify wallets and accounts containing digital assets and document unused basis. |

| January 1, 2025 | Snapshot date for confirming remaining digital assets in wallets and accounts. |

| March 2025 | Brokers begin issuing Form 1099-DA, reflecting a wallet-specific basis. |

| Before Filing 2025 Tax Returns | Taxpayers must finalize their Safe Harbor Allocation to ensure compliance and avoid penalties. |

| Feature | Use Case Scenario | Technical Details |

|---|---|---|

| Automated Monitoring of Transactions | Alice uses staking on Ethereum 2.0 and yield farming on Uniswap. Kryptos automates tracking of her staking rewards and LP tokens across platforms. | Integrates with Ethereum and Uniswap APIs for real-time tracking and monitoring of transactions. |

| Comprehensive Data Collection | Bob switches between liquidity pools and staking protocols. Kryptos aggregates all transactions, including historical data. | Pulls and consolidates data from multiple sources and supports historical data imports. |

| Advanced Tax Categorization | Carol earns from staking Polkadot and yield farming on Aave. Kryptos categorizes her rewards as ordinary income and investment income. | Uses jurisdiction-specific rules to categorize rewards and guarantee compliance with local tax regulations. |

| Dynamic FMV Calculation | Dave redeems LP tokens for Ethereum and stablecoins. Kryptos calculates the fair market value (FMV) at redemption and during sales. | Updates FMV based on market data and accurately calculates capital gains for transactions. |

| Handling Complex DeFi Transactions | Eve engages in multi-step DeFi transactions. Kryptos tracks value changes and tax implications throughout these processes. | Manages multi-step transactions, including swaps and staking, for comprehensive tax reporting. |

| Real-Time Alerts and Updates | Frank receives alerts on contemporary tax regulations affecting DeFi. Kryptos keeps him updated on relevant changes in tax laws. | Observe regulatory updates and provide real-time alerts about changes in tax regulations. |

| Seamless Tax Reporting Integration | Grace files taxes using TurboTax. Kryptos integrates with TurboTax to import staking and yield farming data easily. | Direct integration with tax software like TurboTax for smooth data import and multi-jurisdictional reporting. |

| Investor Type | Impact of Crypto Tax Updates 2025 |

|---|---|

| Retail Investors | Standardized crypto reporting regulations make tax filing easier, but increased IRS visibility raises the risk of audits. |

| Traders & HFT Users | To ensure crypto tax compliance, the IRS is increasing its scrutiny and requiring precise cost-basis calculations across several exchanges. |

| Defi & Staking Participants | The regulations for reporting crypto transactions for staking rewards, lending, and governance tokens are unclear, and there is a lack of standardization for decentralized platforms. |

| NFT Creators & Buyers | Confusion over crypto capital gains tax in 2025, including the taxation of NFT flips, royalties, and transactions across several blockchains. |

| Crypto Payments & Businesses | Merchants who take Bitcoin, USDC, and other digital assets must track crypto capital gains for each transaction, which increases crypto tax compliance requirements. |

| Event | Consequences | Penalties |

|---|---|---|

| Reporting Failure | The tax authorities can mark uncontrolled revenues and further investigate. | Penalty fines, interest on unpaid taxes and potential fraud fees if they are deliberately occurring. |

| Misreporting CGT | Misreporting CGT Error reporting profits or losses can trigger the IRS audit. | 20% fine on under -ported zodiac signs, as well as tax and interest. |

| Using decentralized exchanges (DEXs) or mixers without records | The IRS can track anonymous transactions and demand documentation. | Possible tax evasion fee and significant fine. |

| Disregarding Bitcoin mining tax liabilities | Mining reward is considered taxable income, and failure of the report can be regarded as tax fraud. | Further tax obligations, punishment and potential legal steps. |

| Foreign crypto holdings: Non-disclosure | Foreign-accepted crypto FATCA may be subject to reporting rules. | Heavy fines (up to $ 10,000 per fracture) or prosecution for intentional non-transport. |

File Your Crypto Tax in Minutes