.png)

Thailand Crypto Tax Guide 2024

Curious about crypto taxes in Thailand? Explore the comprehensive guide, from legalities to tracking transactions. Discover how to navigate the evolving tax landscape.

.png)

Curious about crypto taxes in Thailand? Explore the comprehensive guide, from legalities to tracking transactions. Discover how to navigate the evolving tax landscape.

Still, wondering how much taxes you will pay this year? The Agenzia Entrate has issued new guidelines around crypto taxation to accommodate the new crypto tax bill passed by the parliament in December 2022. So taxes this year will be different from what you’re used to. And since we don’t want you to get confused between the old and the new tax rules, we curated a comprehensive crypto tax guide, to garner all the relevant details of the new tax system in one place.

This guide is structured in a way that makes it skimmable and easy to understand. Note that this guide is dynamic and will be updated regularly to accommodate any new rules or notifications issued by the authorities. So we suggest you keep revisiting the guide to stay updated on the new taxation trends.

So now that we’ve got that out of the way, let’s hop straight into the guide.

09/06/23 - Updated to accommodate DAO, gifts and donation taxes

09/06/23 - Updated to accommodate ICO taxes

Agenzia Entrate has multiple ways to obtain data related to crypto transactions and ensure compliance with tax regulations. Although crypto transactions may seem anonymous and decentralised, most investors use centralised crypto exchanges to buy, sell, and trade crypto. These exchanges are directed by the European Union to implement "Know Your Customer" or KYC identification processes and collect customer data to ensure tax compliance and prevent money laundering.

Furthermore, the proposed update to the EU directive on administrative cooperation, DAC8, aims to extend EU tax transparency rules to cover crypto assets. As such, it is essential to adhere to tax regulations and seek guidance from a tax professional with expertise in cryptocurrency taxation in Italy to ensure compliance.

Before 2023, any gains derived from the disposal of crypto assets weren't taxable as crypto assets were considered non-speculative in nature. However, if the total value of your assets exceeded €51,645.69 for seven consecutive days within a tax year, then they would be viewed as capital gains and taxed at a flat rate of 26%. This was based on Resolution No. 72/E/2016.

The absence of a concrete regulatory framework for crypto assets and clear guidelines around their taxation was the biggest roadblock to crypto adoption in Italy up until 2023. In December 2022, the Italian Senate introduced new tax regulations for crypto gains within the framework of the 2023 budget legislation. Under these rules, any crypto gains exceeding €2,000 will be subject to a 26% tax rate.

Part of the new tax legislation approved by the Italian Senate in December 2022 includes a provision called the "substitute value tax." This option allows taxpayers like you to declare their digital asset holdings as of January 1st every year and pay a reduced tax rate of 14%. The aim is to incentivize taxpayers to report their crypto holdings in their tax returns by offering a significantly lower tax rate.

Example:

Consider the following transactions:

03/01/2022 - Alessandro buys 2 BTC for €18,000 each

05/02/2022 - Alessandro buys 13 BTC for €15,000 each

15/04/2022 - Alessandro buys 30 ETH tokens for €1,500 each

17/06/2022 - Alessandro sells 13 BTC for €20,000

23/08/2022 - Alessandro sells 30 ETH for €2,000 each

01/01/2023 - Alessandro sells 1 BTC for €23,000

As evident from above, a total of 3 disposals were made. So let’s see how these disposals will be taxed one at a time.

1st Disposal

13 BTC sold for €20,000 each on 17/06/2022

Note that this transaction was made before the Italian senate approved the new set of taxation rules, so it will only be taxable if the gain exceeds €51,645.69.

Since the LIFO accounting method is used in Italy for capital gain/loss calculations, these BTC tokens are the same ones acquired on 05/02/2022 for €15,000 each

Cost Basis = €15,000

Disposal Amount = €20,000

Capital Gain/loss (for 1 BTC token) = Disposal Amount - Cost Basis = €20,000 - €15,000 = €5,000

Total Gain for 13 BTC tokens = 13*5,000 = €65,000

Now since the gain is more than €51,645.69, it will attract a 26% flat tax.

2nd Disposal

30 ETH sold for €2,000 each on 23/08/2022

This disposal was also made before the new guidelines were approved by the Senate and will follow the same rules as the first disposal.

These ETH tokens are the ones acquired on 15/04/2022 for €1,500 each

Cost Basis = €1,500

Disposal Amount = €2,000

Capital Gain/Loss = €2,000 - €1,500 = €500 (for 1 ETH token)

Total Gain = 30*500 = €15,000

Since the total gain is less than €51,645.69, this transaction is not taxable

3rd Disposal

1 BTC sold for €23,000 on 01/01/2023

Now, since the disposal was made after the new tax laws came into force, any gains exceeding €2,000 will be taxed.

This token is the same one acquired on 03/01/2022 for €18,000

Cost Basis = €18,000

Disposal Amount = €23,000

Capital Gain/loss = €23,000 - €18,000 = €5,000

Total gain exceeds €2,000 and will be taxed at 26% under the new tax laws.

Before December 2022, Agenzia Entrate didn’t have a thought-out taxation model and crypto taxation was governed by a small set of regulations issued by the authority, that didn’t consider crypto to be a speculative asset and ruled crypto gains to be tax-free. However, if the total value of your portfolio exceeded €51,645 for seven consecutive days in a tax year, all your gains would be taxable at a flat rate of 26%.

This changed after the Italian Senate formulated new tax rules for crypto taxation and passed them as part of the new budget legislation in December 2022. According to the new tax rules, any gains amounting to €2,000 or more will be taxed at a flat rate of 26%.

More importantly, the “Substitute Value Tax” concept was put into place to encourage Italian residents to report all their crypto holdings in their tax returns. According to this rule, if you declare the total value of your assets as of January 1st of every year, your gains will be taxed at a discounted tax rate of 14% instead of 26%.

The Agenzia Entrate is still not too clear on what constitutes a gain in the context of crypto transactions because they are yet to disclose the transactions that are counted as disposal. However, from the number of insights we have access to we can extrapolate that the following transactions are generally considered as disposal in Italy:

All your capital gains will be taxed at a flat rate of 26% regardless of your income level.

Now that you have an idea about how your gains will be taxed. It’s time to calculate the gains you’ve made so you can reasonably predict the amount of taxes you owe to the tax authorities. Lucky for you, calculating capital gains or losses is a fairly simple task and all you need to do is use the formulae given below:

Capital Gain/Loss = (Disposal Amount or Selling Price) - (Cost Basis)

Now this is a fairly simple equation and all you need to do is insert values and you will have your gains or losses. The only apparent complication here is the cost basis. Your cost basis is simply the amount you pay to acquire an asset including any additional fees like gas fees or transaction fees paid in the process. Once you have your cost base, simply subtract it from the disposal amount. If the resulting amount is positive it’s a gain, otherwise, it’s a loss.

Example:

Consider the following transactions:

03/02/2022 - Brian buys 2 BTC for €15,000 each

06/04/2022 - Brian buys 3 ETH for €1,400 each

05/06/2022 - Brian buys 1 BTC for €17,000 and 2 ETH for €1,600 each

13/06/2022 - Brian sells 1 BTC for €20,000

19/08/2023 - Brian sells 3 ETH for €2,000 each

As you can see, Brian made two disposals. Let’s calculate the gain for each disposal one at a time.

1st Disposal

Brian sells 1 BTC for €20,000

Please be aware that in this guide, we will be using the LIFO accounting method as recommended by Agenzia Entrate. A more comprehensive discussion of accounting methods is provided later in the guide. For now, a straightforward way to comprehend how the LIFO (First-In-First-Out) method operates is to imagine that the last asset you purchase is the first one you sell.

Now, this is the same BTC acquired on 05/06/2022 for €17,000

Cost Basis = €17,000

Disposal Amount = €20,000

Capital Gain/Loss = Disposal Amount - Cost Basis = €20,000 - €17,000 = €3,000

2nd Disposal

3 ETH sold for €2,000 each.

If we use the LIFO accounting rules, there are two types of ETH tokens involved in this transaction. 2 ETH tokens are the ones acquired on 05/06/2022 for €1,600 each and one token is from 06/04/2022 for €1,400.

Now for tokens acquired for €1,600

Cost Base = €1,600

Disposal Amount = €2,000

Capital Gain for 1 ETH = €2,000 - €1,600 = €400

So for 2 tokens, the total gain comes out to be = 2*400 = €800

And for the 1 ETH token acquired for €1,400

Cost base = €1,400

Disposal Amount = €2,000

Capital Gain = €2,000 - €1,400 = €600

Collective gain for all the 3 tokens = €1,400

Total Gain for both disposals = €3,000 + €1,400 = €4,400

The latest crypto tax rules in Italy have a specific provision that allows for the deduction of losses greater than €2,000 from crypto investments. These losses can now be offset against profits and carried forward for up to five years, which presents an excellent opportunity for taxpayers to potentially minimise their tax obligations over an extended period. By employing a crypto loss harvesting strategy, investors can take advantage of this new provision to optimize their tax planning.

The Agenzia Entrate has not provided any guidance on whether lost crypto due to scams, hacks, or misplaced private keys qualifies as a capital loss for the deduction. If you have experienced such losses, it is recommended to consult with a crypto accountant for advice on whether you are eligible to claim them as a capital loss. This will provide clarity on your tax obligations and enable you to potentially lower your tax liability through proper planning.

The only tax break offered by the new tax rules is the exemption amount of €2,000. You only pay taxes when you make gains above the exemption amount. But there are a few transactions that help you reduce your tax bill and listed below are some of them:

The LIFO accounting method is recommended by the Agenzia Entrate for cost basis calculation in Italy. LIFO accounting stands for "last in, first out" and is a method used for inventory management and accounting. It assumes that the last item purchased is the first one that is sold. The LIFO accounting method will be better understood with an example.

Let's say that on January 1st, 2022, Giuseppe purchased 1 Bitcoin for €30,000. On February 1st, he bought another Bitcoin for €35,000, and on March 1st, he bought a third Bitcoin for €40,000.

Later in the year, on October 1st, Giuseppe sold 1 Bitcoin for €45,000. At this point, he would use the LIFO method to determine which Bitcoin was sold and what the cost basis of that Bitcoin was.

According to LIFO, the last Bitcoin that Giuseppe purchased for €40,000 would be considered the first one sold since it was the newest in his inventory. Therefore, the €45,000 sale price would be matched with the €40,000 cost basis, resulting in a capital gain of €5,000.

The remaining 2 Bitcoins in Giuseppe's inventory would be valued at the purchase price of €30,000 and €35,000, respectively. If Giuseppe were to sell one of those remaining Bitcoins at a later date, he would use the same LIFO method to determine the cost basis and gain or loss on the sale.

The Imposta sui redditi delle persone fisiche (IRPEF), also known as Personal Income Tax, consists of national, regional, and municipal income taxes. While Agenzia Entrate has not provided clarity on the taxation of crypto, it is commonly accepted by tax authorities globally that mining and staking rewards should be considered as income. Therefore, it is reasonable to assume that Agenzia Entrate may adopt the same stance.

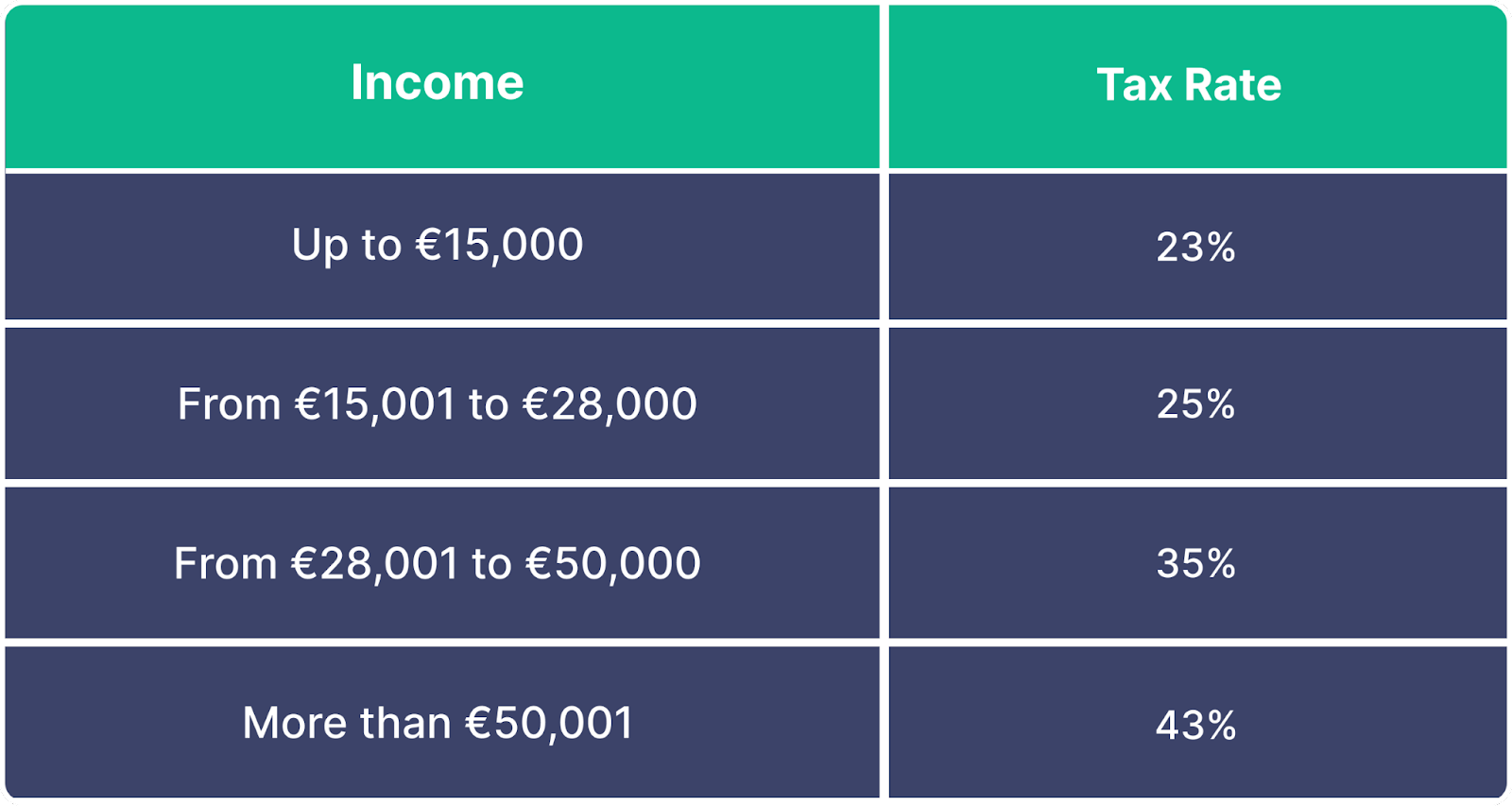

The IRPEF, being a national income tax is progressive, meaning that the more income you have, the more taxes you pay. You can refer to the table below to identify your tax bracket.

In contrast, regional and municipal income tax rates offer a considerably lower financial burden. Depending on your place of residence, regional income tax ranges from 1.23% to 3.33%, while municipal income tax can fall anywhere between 0% and 0.9%.

To calculate your crypto income, it's crucial to know the gains you’ve made over a tax year in fiat currency beforehand. This involves tracking the fair market value of the assets you acquired in EUR on the day you obtained them. This value will serve as the basis for calculating the Income Tax you owe.

Listed below are some of the tax-free crypto transactions in Italy:

Following are the crypto transactions that attract tax liabilities in Italy:

Agenzia Entrate has not officially released guidelines on how to tax mining rewards. Although two published resolutions have discussed the tax implications for businesses and individuals who deal with cryptocurrencies, they do not offer any specific guidance for mining.

However, not having guidance does not mean that mining rewards are tax-exempt. We suggest reporting your mining rewards as general income on your annual tax returns to be in a safe spot. This approach is also consistent with how mining rewards are currently taxed in most other countries.

Crypto mining and staking are two entirely different ways of adding and validating new blocks of transactions to public ledgers where PoW (proof-of-work) networks support mining, PoS networks support staking.

However, mining and staking rewards are treated the same for tax purposes. The Agenzia Entrate is yet to release new guidelines on the taxation of staking rewards, but this does not mean that mining rewards are tax-free. There’s a consensus among tax offices globally that mining and staking rewards are to be treated as general income and should be taxed at receipt. Moreover, any gains incurred from the disposal of such assets shall be subjected to a capital gains tax.

Although we suggest seeking guidance from an experienced tax advisor to better understand how these transactions are taxed.

The Italian tax authority is yet to issue any official guidelines on how to tax crypto margin trading, futures trading, and CFDs.

Nevertheless, based on our active deliberations with tax experts and their interpretation of current tax guidelines, we have discovered that any gains over €2,000 are subject to a flat tax rate of 26%. Similar tax treatment may apply to gains from crypto-related activities.

Italy has an inheritance and gift tax that applies to various types of assets, but the specific application to cryptocurrency is currently unclear, and no official guidance has been provided thus far.

If the inheritance and gift tax does apply to crypto transfers, the tax rate can range from 4% to 8%, depending on the relationship between the donor and recipient. However, it's important to note that the gift tax may not apply to certain foreign assets. Therefore, if cryptocurrency is considered a foreign asset, the gift tax may not be applicable in such cases. To obtain accurate and reliable information, it is advisable to consult with an experienced accountant who can provide guidance specific to your situation, especially if you have already gifted or are planning to gift cryptocurrency.

Although there are no dedicated guidelines on the taxation of crypto donations, if we consider crypto donations to be the same as fiat transactions, there are ways you can claim a tax deduction on donations. Individual and corporate donors can deduct contributions from their income tax, up to 10% of their declared income or a maximum of €70,000 per tax year.

Agenzia Entrate has not given specific guidance on the matter, but it is highly likely that individuals who earn more than €2,000 in profits from trading crypto assets, such as NFT tokens, must pay a flat tax rate of 26%. Remember that taxes may need to be paid when disposing of NFT tokens.

It is still being determined how NFT creation and transfer are taxed in Italy. There’s a possibility that individuals engaged in these activities may not need to pay taxes, but Agenzia Entrate must provide additional guidance to confirm this.

The Agenzia Entrate is yet to release guidance on how income from DAOs will be viewed from the tax perspective. However, receiving payment in cryptocurrency, whether as a salary or for freelance services, is subject to similar tax treatment as receiving payment in traditional fiat currencies. From a tax perspective, there is no significant difference between the two, and the income received will be taxed as regular income regardless of the currency type. Therefore, it’s safe to assume that income from DAOs will be taxed the same way.

We do suggest seeking guidance from an experienced tax professional to avoid legal complications in the future.

The Agenzia Entrate hasn’t released specific guidance on how to tax DeFi transactions yet. However, the tax treatment will likely depend on the type of DeFi transaction involved.

For instance, if you have earned interest on your cryptocurrency through a DeFi lending platform, this income may be subject to income tax in Italy. Moreover, if you have participated in a DeFi liquidity pool and earned income from fees or rewards, this income may be subject to taxation.

The Agenzia Entrate has not provided guidance on the tax treatment of income from ICOs. We recommend consulting with experienced tax professionals for guidance and staying updated on any new guidelines in this regard to ensure compliance and avoid legal issues.

We will add all relevant details here as soon as the tax authorities release new guidelines regarding the same.

Agenzia Entrate is yet to provide specific guidance on the taxation of Airdrops and Forks in Italy, similar to mining, DeFi, and Staking. However, any profits gained from airdrops and forks exceeding €2,000 may be subject to a flat tax rate of 26%. We will continue to update our information if the Italian tax authorities issue further guidance.

In Italy, the tax year runs from January 1st to December 31st, and you can submit a tax return in two different types of forms: Form 730 and the Modello Redditi form.

Both tax forms have different deadlines, as mentioned below.

Form 730 is for individuals with employment income, credits, and deductions to claim and has a deadline of September 30th of the year following the tax year.

On the other hand, you can use Form Modello Redditi for reporting employment income, tax withheld, capital gains (using Form RT), foreign income/assets (using Form RW), and other transactions, including cryptocurrency. The filing deadline for the Modello Redditi form is November 30th of the year following the tax year.

Here is a step-by-step tutorial to help you file crypto taxes in Italy using the Agenzia Entrate portal, if you’re an individual taxpayer.

Does this long tax filing procedure make you feel overwhelmed?

With the ever-changing tax laws and regulations, it can be challenging to keep up and ensure that you're complying with all the requirements.

But fret not, help is on the way. Allow me to introduce you to Kryptos, the ultimate tax filing tool that can make the process of preparing and submitting your taxes a breeze. While it's true that tax laws can change, Kryptos stays up-to-date with the latest updates and developments to ensure that you are always in compliance and helps you throughout the tax filing process.

While there is no official list of records or bookkeeping details that Agenzia Entrate may require for cryptocurrency transactions during a tax audit, it is prudent to maintain certain records as a minimum. These records include:

By keeping accurate records of your cryptocurrency transactions, you can ensure compliance with tax regulations and facilitate any potential tax audits.

Now that you’re aware of how your crypto transactions are taxed and what forms you need to fill out to complete your tax report, here’s a step-wise breakdown of how Kryptos can make this task easier for you:

If you still need clarification regarding the integrations or generating your tax reports, you refer to our video guide here.

There’s no legal way to avoid crypto taxes entirely, here are some ways you can avoid taxes in Italy:

1. Is crypto legal in Italy?

Yes, cryptocurrency is legal in Italy. The Italian government has been taking steps to regulate the use of cryptocurrency in the country. In 2019, Italy implemented a regulatory framework for cryptocurrency service providers, which requires them to register with the Italian authorities and comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. Additionally, Italy has also clarified that the purchase and sale of cryptocurrencies are exempt from Value Added Tax (VAT). However, it's worth noting that cryptocurrency regulations can vary by country and are subject to change over time.

2. How is Crypto taxed in Italy?

In Italy, cryptocurrency is subject to taxation. The Italian Revenue Agency has guided how cryptocurrencies should be taxed.

For individuals, profits from cryptocurrency transactions are considered capital gains and are subject to a flat tax rate of 26% on the net gain. The net gain is calculated by subtracting the purchase price from the sale price, or the cryptocurrency's fair market value at the time it was received if it was acquired through mining or as payment for goods or services.

In addition, if an individual holds cryptocurrency for more than 7 days, they are required to declare it on their tax return. Failure to declare cryptocurrency holdings can result in fines and penalties.

For businesses, cryptocurrency transactions are subject to corporate income tax, and profits are treated as business income.

It's important to note that cryptocurrency tax regulations are subject to change and can vary by jurisdiction, so it's always a good idea to consult with a tax professional or accountant for guidance on how to comply with tax regulations in your specific situation.

3. Is any crypto tax-free in Italy?

No, no cryptocurrency is tax-free in Italy. All profits from cryptocurrency transactions, regardless of the type of cryptocurrency, are subject to taxation.

However, it's worth noting that Italy has clarified that the purchase and sale of cryptocurrencies are exempt from Value Added Tax (VAT), which is a tax on goods and services. Meaning individuals and businesses are not required to pay VAT when buying or selling cryptocurrencies.

4. How to file crypto taxes using Kryptos?

We’ve already discussed how to file your crypto taxes in the above sections of the guide offering a stepwise breakdown of the entire process. However, we agree that it is unreasonably complicated even for someone with a fair amount of prior knowledge. Although there’s an easy way to file your crypto taxes using a crypto tax software called Kryptos.

Where all you need to do is log in on the platform, add all your trading accounts, wallets, and DeFi accounts and sip coffee while Kryptos does all the heavy lifting for you. The platform can auto-fetch all your transactions from the tax year and generate a legally compliant tax report within minutes while suggesting ways to lower your tax bill. It works like magic, you need to do is try it once.

All content on Kryptos serves general informational purposes only. It's not intended to replace any professional advice from licensed accountants, attorneys, or certified financial and tax professionals. The information is completed to the best of our knowledge and we at Kryptos do not claim either correctness or accuracy of the same. Before taking any tax position / stance, you should always consider seeking independent legal, financial, taxation or other advice from the professionals. Kryptos is not liable for any loss caused from the use of, or by placing reliance on, the information on this website. Kryptos disclaims any responsibility for the accuracy or adequacy of any positions taken by you in your tax returns. Thank you for being part of our community, and we're excited to continue guiding you on your crypto journey!