.avif)

Calculate Your Crypto

Taxes in Minutes

.avif)

The complex, often confusing, aspect of dealing with cryptocurrencies is how they fit into the realm of taxes. Understanding potential transactions that are subject to tax can allow you to implement effective tax strategies and reduce your overall tax burden.

Discover whether unrealized crypto gains are subject to taxation and explore the potential tax obligations associated with unrealized gains in cryptocurrency to make informed decisions.

What Is an Unrealized Gain or Loss in Crypto?

Unrealized crypto gain or loss refers to the increase or decrease in the value of crypto assets that an investor holds but has not yet sold. For instance, if you bought Bitcoin at $5,000 and it's now worth $10,000, you have an unrealized gain of $5,000. If the price drops to $4,000, you have an unrealized loss of $1,000.

It's called 'unrealized' because the gain or loss only exists on paper – the investor has not yet made an actual profit or loss until they dispose of their asset.

Difference between Unrealized Gains and Realized Gains in Crypto

Unrealized Gain: When there’s an increase in the value of your crypto asset that has not been sold or disposed of for profit, it’s an unrealized gain. It represents the potential profit that can be realized if the asset is sold at its current value.

Realized Gain: Now, when you sell or dispose of the asset for a profit, you incur a realized gain. It is the actual profit you make from the disposal of the asset.

This distinction between unrealized and realized gains is essential because it influences your tax planning strategy.

For instance, if you're nearing the end of the tax year and have already realized significant gains (and, potential tax liability), you might decide to hold onto other investments that have appreciated in value to avoid realizing further gains that may increase your tax bill.

Calculating Unrealized Gains

The formula for calculating unrealized gains is quite straightforward:

Unrealized Gain = Current Market Value - Initial Purchase Cost

Suppose, you bought 1 Bitcoin for $20,000. If the current market value is $25,000, your unrealized gain is $5,000, i.e., ($25,000 - $20,000).

Are Unrealized Crypto Gains Taxable?

The simple answer is No!

In most jurisdictions, unrealized gains are not taxable. In the United States, for example, the IRS does not tax unrealized gains. The tax event occurs when you sell, trade, or use the cryptocurrency to purchase any goods or services – when the gains are 'realized'.

However, tax regulations vary worldwide. To ensure compliance with your regional tax guidelines, it’s advisable to consult a local tax professional or refer to our comprehensive country-specific crypto tax guides.

Why Track Unrealized Gains and Losses for Informed Tax Strategies?

Even though unrealized gains are typically not taxable, it's important to track them for strategic tax planning.

For instance, understanding your unrealized gains and losses can help you make informed decisions about when to sell a cryptocurrency, depending on your financial goals and tax implications.

Moreover, tracking unrealized gains can help you utilize tax strategies such as tax loss harvesting, where you sell a cryptocurrency at a loss to offset a realized gain.

Keeping a close eye on unrealized gains and losses can be a vital tool for minimizing your overall tax liability.

How can Kryptos help?

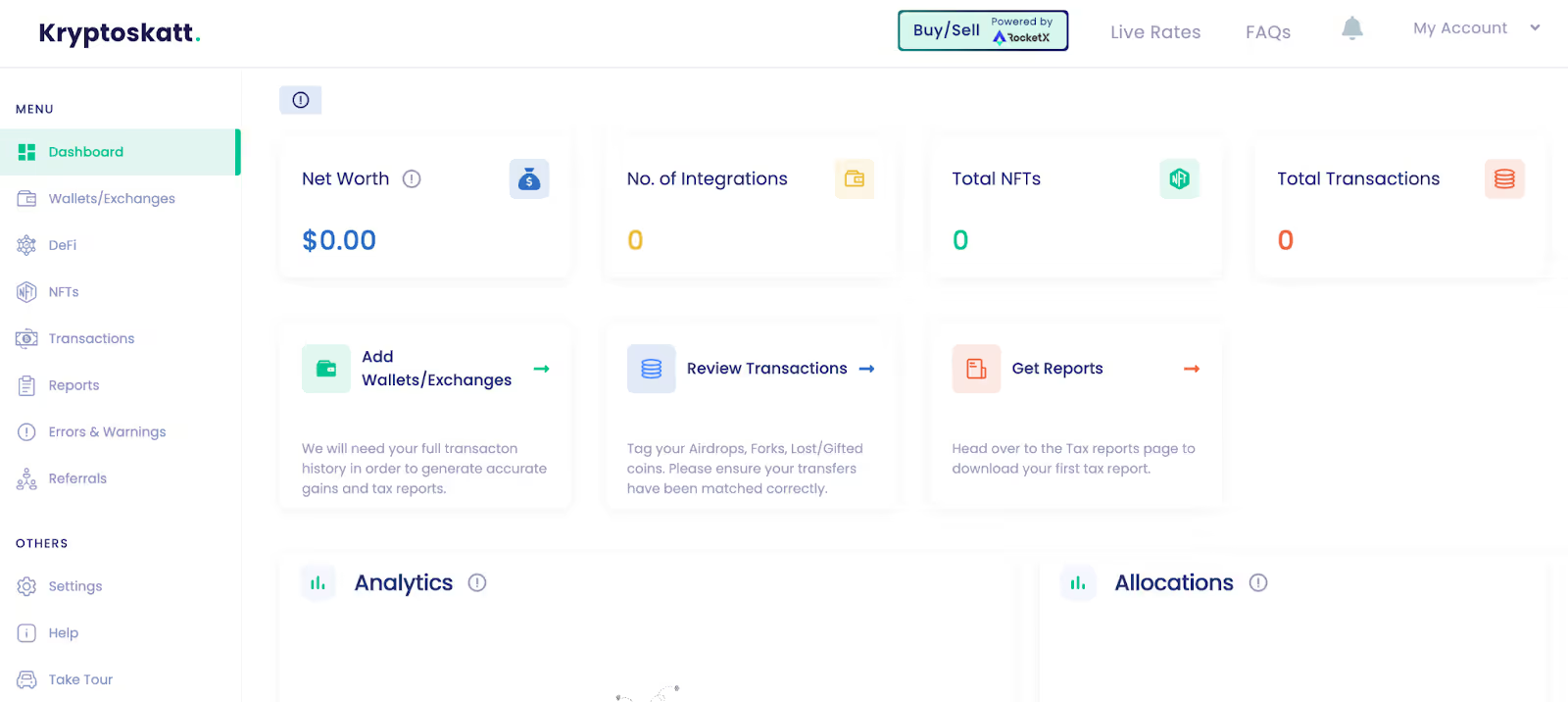

Kryptos simplifies the process of tracking your unrealized and realized crypto gains and losses. It automatically syncs with your cryptocurrency wallets and exchanges, pulling in your transaction history and calculating your gains and losses.

Beyond transaction tracking, the platform provides a comprehensive overview of your balance, cost base, and any unrealized gains or losses through its intuitive dashboard.

This information empowers you to make informed decisions about whether to realize the gains or losses and understand their impact on your overall tax obligations.

To get started, Sign Up Now.

FAQs

1. Can You Claim Unrealized Crypto Losses?

No, unrealized losses, just like unrealized gains, do not have any tax implications. You cannot claim them on your tax return. However, if these losses were to become 'realized'—meaning, you sold the cryptocurrency at a price lower than what you paid for it—then, in many jurisdictions, you could offset these realized losses against other realized gains to reduce your overall taxable income.

2. What Can You Do with Unrealized Gains?

Unrealized gains represent a potential increase in your wealth, but remember, they exist only on paper until you sell your cryptocurrency. Therefore, you can't really 'do' anything with unrealized gains. However, tracking unrealized gains is important as it can help you make informed decisions about when to sell or hold onto your investment, depending on your financial goals and potential tax implications.

3. Is Unrealised Gain a Profit?

An unrealized gain is a potential profit that exists only on paper. It does represent an increase in the value of your investment, but it isn't an actual profit until you sell the cryptocurrency and 'realize' the gain. Until such a transaction occurs, the gain remains unrealized and could increase or decrease depending on market fluctuations.

4. Where Do Unrealized Gains and Losses Go?

Unrealized gains and losses primarily live in your investment account or digital wallet. They reflect the current market value of your cryptocurrencies as compared to the purchase price. They do not appear on your tax return, as they are not taxable events.

5. Are Unrealized Gains Reported on Crypto Tax Returns?

No, unrealized gains are not reported on your crypto tax return. Only when a gain is 'realized' – when you sell, trade, or use the cryptocurrency – is it reportable on your tax return. Always consult a tax professional or a trusted tax software like Kryptos to ensure you're accurately reporting your cryptocurrency transactions.

| Step | Form | Purpose | Action |

|---|---|---|---|

| 1 | 1099-DA | Reports digital asset sales or exchanges | Use to fill out Form 8949. |

| 2 | Form 1099-MISC | Reports miscellaneous crypto income | Use to fill out Schedule 1 or C. |

| 3 | Form 8949 | Details individual transactions | List each transaction here. |

| 4 | Schedule D | Summarizes capital gains/losses | Transfer totals from Form 8949. |

| 5 | Schedule 1 | Reports miscellaneous income | Include miscellaneous income (if not self-employment). |

| 6 | Schedule C | Reports self-employment income | Include self-employment income and expenses. |

| 7 | Form W-2 | Reports wages (if paid in Bitcoin) | Include wages in total income. |

| 8 | Form 1040 | Primary tax return | Summarize all income, deductions, and tax owed. |

| Date | Event/Requirement |

|---|---|

| January 1, 2025 | Brokers begin tracking and reporting digital asset transactions. |

| February 2026 | Brokers issue Form 1099-DA for the 2025 tax year to taxpayers. |

| April 15, 2026 | Deadline for taxpayers to file their 2025 tax returns with IRS data. |

| Timeline Event | Description |

|---|---|

| Before January 1, 2025 | Taxpayers must identify wallets and accounts containing digital assets and document unused basis. |

| January 1, 2025 | Snapshot date for confirming remaining digital assets in wallets and accounts. |

| March 2025 | Brokers begin issuing Form 1099-DA, reflecting a wallet-specific basis. |

| Before Filing 2025 Tax Returns | Taxpayers must finalize their Safe Harbor Allocation to ensure compliance and avoid penalties. |

| Feature | Use Case Scenario | Technical Details |

|---|---|---|

| Automated Monitoring of Transactions | Alice uses staking on Ethereum 2.0 and yield farming on Uniswap. Kryptos automates tracking of her staking rewards and LP tokens across platforms. | Integrates with Ethereum and Uniswap APIs for real-time tracking and monitoring of transactions. |

| Comprehensive Data Collection | Bob switches between liquidity pools and staking protocols. Kryptos aggregates all transactions, including historical data. | Pulls and consolidates data from multiple sources and supports historical data imports. |

| Advanced Tax Categorization | Carol earns from staking Polkadot and yield farming on Aave. Kryptos categorizes her rewards as ordinary income and investment income. | Uses jurisdiction-specific rules to categorize rewards and guarantee compliance with local tax regulations. |

| Dynamic FMV Calculation | Dave redeems LP tokens for Ethereum and stablecoins. Kryptos calculates the fair market value (FMV) at redemption and during sales. | Updates FMV based on market data and accurately calculates capital gains for transactions. |

| Handling Complex DeFi Transactions | Eve engages in multi-step DeFi transactions. Kryptos tracks value changes and tax implications throughout these processes. | Manages multi-step transactions, including swaps and staking, for comprehensive tax reporting. |

| Real-Time Alerts and Updates | Frank receives alerts on contemporary tax regulations affecting DeFi. Kryptos keeps him updated on relevant changes in tax laws. | Observe regulatory updates and provide real-time alerts about changes in tax regulations. |

| Seamless Tax Reporting Integration | Grace files taxes using TurboTax. Kryptos integrates with TurboTax to import staking and yield farming data easily. | Direct integration with tax software like TurboTax for smooth data import and multi-jurisdictional reporting. |

| Investor Type | Impact of Crypto Tax Updates 2025 |

|---|---|

| Retail Investors | Standardized crypto reporting regulations make tax filing easier, but increased IRS visibility raises the risk of audits. |

| Traders & HFT Users | To ensure crypto tax compliance, the IRS is increasing its scrutiny and requiring precise cost-basis calculations across several exchanges. |

| Defi & Staking Participants | The regulations for reporting crypto transactions for staking rewards, lending, and governance tokens are unclear, and there is a lack of standardization for decentralized platforms. |

| NFT Creators & Buyers | Confusion over crypto capital gains tax in 2025, including the taxation of NFT flips, royalties, and transactions across several blockchains. |

| Crypto Payments & Businesses | Merchants who take Bitcoin, USDC, and other digital assets must track crypto capital gains for each transaction, which increases crypto tax compliance requirements. |

| Event | Consequences | Penalties |

|---|---|---|

| Reporting Failure | The tax authorities can mark uncontrolled revenues and further investigate. | Penalty fines, interest on unpaid taxes and potential fraud fees if they are deliberately occurring. |

| Misreporting CGT | Misreporting CGT Error reporting profits or losses can trigger the IRS audit. | 20% fine on under -ported zodiac signs, as well as tax and interest. |

| Using decentralized exchanges (DEXs) or mixers without records | The IRS can track anonymous transactions and demand documentation. | Possible tax evasion fee and significant fine. |

| Disregarding Bitcoin mining tax liabilities | Mining reward is considered taxable income, and failure of the report can be regarded as tax fraud. | Further tax obligations, punishment and potential legal steps. |

| Foreign crypto holdings: Non-disclosure | Foreign-accepted crypto FATCA may be subject to reporting rules. | Heavy fines (up to $ 10,000 per fracture) or prosecution for intentional non-transport. |

File Your Crypto Tax in Minutes

.avif)